Having a rough year shows that even technology companies are affected by economic uncertainties. But, the improvement and modernization of communication equipment spells good news for the industry. In today’s FA Alpha, we’ll see the financial position of Ciena Corporation and determine if there’s a significant risk of default for the company using Uniform Accounting.

FA Alpha Daily:

Wednesday Credit

Powered by Valens Research

The last year has been tough for many companies but technology firms were one of the most affected ones.

The uncertainties caused by the Ukraine-Russia war, global supply chain problems, rising interest rates, and inflation made it difficult for them to have a strong and profitable year.

On top of that, people started to spend less, and tech spending for software and hardware fell significantly all around the country.

Even semiconductor giants like Taiwan Semiconductor (TSM) and Intel (INTC) lost more than 30% of their value in the last 12 months.

But things are not all just bad. There is some good news to come for tech companies, especially for communication equipment firms.

As the U.S. is moving on its way to improving and modernizing its infrastructure and nearshoring becomes much more important, communication equipment firms will massively benefit from these trends.

One great example of this is Ciena Corporation (CIEN). The company provides networking platforms and routers, which make the delivery of video, data, and voice seamless all around the world.

As the IoT infrastructure investments gain momentum, the company’s platforms and routers could see incredibly high demand.

However, rating agencies do not think the same way and they expect the company to see a negative cycle.

In addition, they see a very high credit risk for the company and rate it with a 10% chance of bankruptcy.

We can figure out if there is a real risk for this company by leveraging the Credit Cash Flow Prime (“CCFP”) to understand the company’s obligations matched against its cash and cash flows.

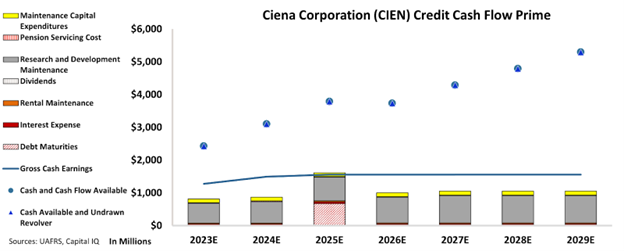

In the chart below, the stacked bars represent the firm’s obligations each year for the next five years. These obligations are then compared to the firm’s cash flow (blue line) as well as the cash on hand available at the beginning of each period (blue dots) and available cash and undrawn revolver (blue triangles).

The CCFP chart shows that Ciena’s cash flows are much higher than its obligations going forward. In fact, its cash and cash flows together are more than double of its obligations.

CCFP chart indicates that the company does not have debt headwalls that will stress its balance sheet.

The only debt maturity in the next 7 years is in 2025 and the company could easily refinance or pay it with its cash available without any difficulties.

Considering the tailwinds mentioned and its strong financial standpoint, the company does not have a significant credit risk.

That is why we are giving an IG3+ rating to the company. This rating implies around just a 1% chance of default as opposed to 10% by rating agencies.

It is our goal to bring forward the real creditworthiness of companies, built on the back of better Uniform Accounting.

To see Credit Cash Flow Prime ratings for thousands of companies, click here to learn more about the various subscription options now available for the full Valens Database.

SUMMARY and Ciena Corporation (CIEN:USA) Tearsheet

As the Uniform Accounting tearsheet for Ciena Corporation (CIEN:USA) highlights, the Uniform P/E trades at 14.4x, which is below the global corporate average of 18.4x, and its historical P/E of 15.1x.

Low P/Es require low EPS growth to sustain them. In the case of Ciena, the company has recently shown a 37% Uniform EPS shrinkage.

Wall Street analysts provide stock and valuation recommendations that in general provide very poor guidance or insight. However, Wall Street analysts’ near-term earnings forecasts tend to have relevant information.

We take Wall Street forecasts for GAAP earnings and convert them to Uniform earnings forecasts. When we do this, Ciena’s Wall Street analyst-driven forecast is for a 43% and 35% EPS growth in 2023 and 2024, respectively.

Based on the current stock market valuations, we can use earnings growth valuation metrics to back into the required growth rate to justify Ciena’s $51 stock price. These are often referred to as market embedded expectations.

Furthermore, the company’s earning power in 2022 was above the long-run corporate average. Moreover, cash flows and cash on hand are 4x its total obligations—including debt maturities and capex maintenance. The company also has an intrinsic credit risk that is 70bps above the risk-free rate.

Overall, this signals a low credit risk.

Lastly, Ciena’s Uniform earnings growth is above its peer averages and is trading below its average peer valuations.

Best regards,

Joel Litman & Rob Spivey

Chief Investment Strategist &

Director of Research

at Valens Research

This analysis of Ciena Corporation (CIEN) credit outlook is the same type of analysis that powers our macro research detailed in the member-exclusive FA Alpha Pulse.