Unemployment holds a pivotal role in the economy. As it trends upward, layoffs become more pronounced, leading to reduced consumer spending, perpetuating a cycle that can ultimately plunge us into a recession. In today’s FA Alpha Daily, we explore the “Sahm Rule”, a cyclical loop highlighting unemployment’s impact on the forthcoming economic landscape.

FA Alpha Daily:

Monday Macro

Powered by Valens Research

Continuing claims, or the number of people unemployed for at least five weeks, was up almost 12% year over year in October.

Hiring rates have fallen from post-pandemic highs. They’re now more in line with 2015 to 2017 levels.

And the employment rate for people between ages 25 and 54 – the heart of the workforce – is starting to roll over. It fell from 80.9% in August to 80.6% in October.

Unemployment is still fairly low, at only 3.9%.

But job prospects are getting harder to come by. Corporate hiring rates are at a post-pandemic low. As folks get laid off, it’s getting harder for them to find new jobs.

No matter what metric you look at, it all says Sahm’s dreaded “feedback loop” may be starting, and the Sahm Rule reveals why we should be worried.

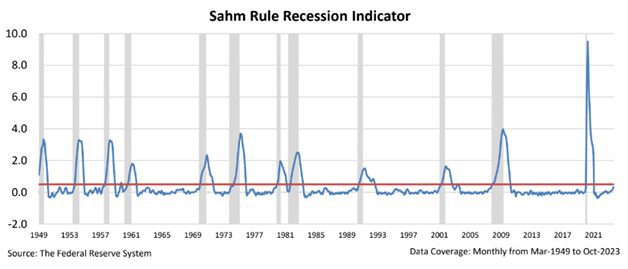

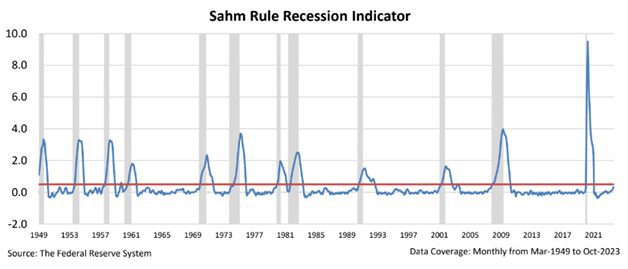

The rule tracks the three-month rolling average unemployment rate. If that rolling average climbs 0.5 percentage points above its one-year low, it’s a sign that a downturn has started.

For example, this average was 3.5% in April 2023. If it surpasses 4% before April 2024, the Sahm Rule would say we’re in a recession.

We’re not there yet.

But the indicator is rising fast. The unemployment rate was 3.8%, 3.8% again, and 3.9% in the past three months.

Right now, it sits at about 3.83%. That’s 0.33 percentage points higher than the April low.

The trend is not the economy’s friend right now. Take a look.

In the past 70-plus years, the Sahm indicator only got this high without surpassing 0.5 percentage points once in 2003.

Every other time the indicator reached 0.33 percentage points, we went on to recession territory.

We’ll be keeping a close eye on these metrics.

As the consumer feedback loop gets underway, unemployment will continue rising.

We could surpass the Sahm Rule’s threshold within a few months.

Best regards,

Joel Litman & Rob Spivey

Chief Investment Strategist &

Director of Research

at Valens Research

The battle between fundamental investors and technical investors rages on. Each camp swears on its methodology, and each has attributes that appeal to investors. What if we combined these methods and track performance? We did just that, and you need to see the results…

We are inviting you to attend our upcoming event this Wednesday, December 6, 2023 at 8:00 PM EST to help you succeed with your financial decisions.

To see our best macro insights, become an FA Alpha and get access to FA Alpha Pulse.