Mergers and acquisitions (M&A) are crucial for businesses seeking to expand their scale, enter new markets, explore growth opportunities, and gain efficiencies and cost savings through operational consolidation. However, large-scale M&A transactions often result in a substantial amount of debt, burdening the newly formed company with significant leverage and obligations. For instance, the merger between Kraft Foods and Heinz created one of the world’s largest food and beverage companies, but it also resulted in a huge debt burden for the new entity, the Kraft Heinz Company (KHC). In today’s FA Alpha Daily, using Uniform Accounting, we will evaluate KHC’s true profitability in light of its debt obligations and determine the actual credit risk of this enterprise.

FA Alpha Daily:

Wednesday Credit

Powered by Valens Research

Consumer staples companies are often considered to be among the most stable companies globally.

They provide everyday goods that consumers need, such as food, beverages, household products, and personal care items. To add, they’re some of the largest conglomerates on earth.

Those factors lead to strong and stable returns on assets (ROA) among the best and biggest staples. That said, you really need to be among the biggest to get the benefit.

This is just what Kraft Foods and Heinz did when they merged in a deal orchestrated by Berkshire Hathaway (BRK.A) and 3G Capital, a private equity firm.

These two investment management companies saw an opportunity to make Kraft Foods and Heinz more efficient by taking them private, combining them to achieve significant efficiencies by leveraging the scale of the two businesses, and slashing costs.

Taking them private was important because it let them act as fast and efficiently as possible. First, they acquired Heinz in 2013 and merged it with Kraft Foods over the next two years.

The merger resulted in the creation of Kraft Heinz (KHC), which owns some of the most well-known brands in the food and beverage industry, including Kraft, Heinz, Oscar Mayer, and Philadelphia.

This was one of the most important deals of the last decade but it was expensive though…

The company had to go public in 2015 in order to get liquidity support from investors to deal with its huge debt obligations.

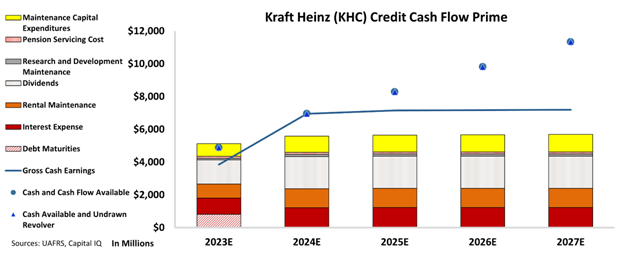

Additionally, Kraft Heinz has been paying more than $55 billion in debt obligations since the merger and still has debt-related issues. Just take a look at the company’s Credit Cash Flow Prime (“CCFP”).

The CCFP chart clearly shows that Kraft Heinz’s cash flows are not sufficient to cover all its obligations in the near future.

The chart shows the company has a debt maturity this year and its cash available is not enough to serve all of its obligations in 2023.

Also, it is important to note that Kraft Heinz company paid almost $8 billion of debt in the last two years. Still, it has to pay significant amounts of interest expenses going forward.

The massive deal created one of the biggest food and beverage companies in the world, but it brought many debt-related problems.

The only reason the company has been able to get this far is that it was taken public again back in 2015, giving it access to the most liquid market in the world.

Without the liquidity of the public markets, Kraft Heinz could have easily succumbed to its massive debt load.

And that’s true for a lot of other companies, not just the largest companies in the world.

Companies are always vying for investor attention. And frequently, having that attention can be life or death for smaller public companies. Through our research at our consumer brand Altimetry, we’ve identified several companies that we think are close to cracking into the public eye, and several others that may be in trouble.

Tonight, we’ll be revealing what could be the most important investing day of the year, and which companies could succeed and fail as a result. If you are interested to learn more, click here to sign up.

SUMMARY and Kraft Heinz (KHC:USA) Tearsheet

As the Uniform Accounting tearsheet for Kraft Heinz (KHC:USA) highlights, the Uniform P/E trades at 20.7x, which is above the global corporate average of 18.4x and its historical P/E of 20.0x.

High P/Es require high EPS growth to sustain them. In the case of Kraft Heinz, the company has recently shown a 195% Uniform EPS growth.

Wall Street analysts provide stock and valuation recommendations, that in general, provide very poor guidance or insight. However, Wall Street analysts’ near-term earnings forecasts tend to have relevant information.

We take Wall Street forecasts for GAAP earnings and convert them to Uniform earnings forecasts. When we do this, Kraft Heinz’s Wall Street analyst-driven forecast is for a -8% and 1% EPS growth in 2023 and 2024, respectively.

Based on the current stock market valuations, we can use earnings growth valuation metrics to back into the required growth rate to justify Kraft Heinz’s $41 stock price. These are often referred to as market-embedded expectations.

Furthermore, the company’s earning power in 2022 was 4x the long-run corporate average. Moreover, cash flows and cash on hand are below its total obligations—including debt maturities and capex maintenance. The company also has an intrinsic credit risk that is 120bps above the risk-free rate.

Overall, this signals a moderate credit risk and a high dividend risk.

Lastly, Kraft Heinz’s Uniform earnings growth is below its peer averages and is trading below its average peer valuations.

Best regards,

Joel Litman & Rob Spivey

Chief Investment Strategist &

Director of Research

at Valens Research

This analysis of Kraft Heinz Company (KHC)’s credit outlook is the same type of analysis that powers our macro research detailed in the member-exclusive FA Alpha Pulse.