Given the rise of digital transformation in businesses, people commend AutoDesk as a SaaS provider but overlook PTC Inc. (PTC). Today’s FA Alpha Daily will explore PTC’s potential using Uniform Accounting to see how it differs from what investors are thinking.

FA Alpha Daily:

Thursday Uniform accounting analysis

Powered by Valens Research

One of the most impressive investing stories over the past 5 years has been AutoDesk (ADSK).

The computer-aided design (CAD) company committed to a massive transformation by moving its sales model to a Software-as-a-Service (SaaS) model, and executed it perfectly.

After moving software sales into a recurring subscription on the cloud, the company’s stock price makes just as impressive of a move, rising from $30 in the first part of the 2010s to over $300 in its peaks of 2021.

Thanks to its rampant success, AutoDesk became a favorite SaaS company for many investors.

But while people were rightfully going crazy for AutoDesk, they may have missed another golden opportunity with one of its competitors, an impressive operator in its own right.

PTC, formerly known as Parametric Technology Corporation, started as a 3D CAD business, much like AutoDesk, but has also successfully pivoted to being a SaaS business. Their new model allows others to leverage its software and technology in a way that wasn’t possible before.

The SaaS pivot was a breakthrough for companies to not just design their products, but truly go through a digital transformation of the entire manufacturing process. Through company-wide access to the cloud, engineers and developers across the globe can collaborate on projects in real-time.

These improvements combined with a SaaS model’s customer-centric focus help industrial companies and various manufacturers increase efficiency, reduce operational costs, and maximize revenue growth.

With a motto of “Power To Create,” PTC enables companies to drive profitability through their wide range of digital solutions including CAD, product lifecycle management (PLM), Industrial Internet of Things (IIoT), and Augmented Reality (AR).

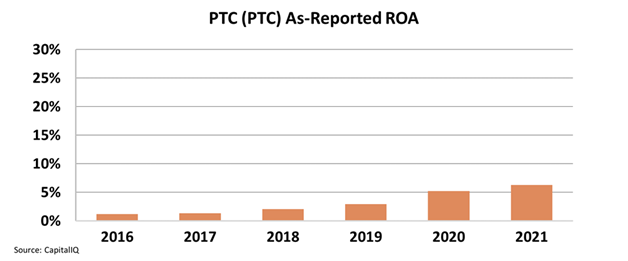

Looking at as-reported metrics, the company seems like it didn’t have enough “Power To Create” immense returns.

While this company should be riding the combination of the SaaS wave while empowering others to do the same, as-reported ROA hasn’t broken 10% in over a decade, signaling it’s far behind peers like AutoDesk or Adobe (ADBE).

However, this below average profitability is just a distortion of as-reported accounting.

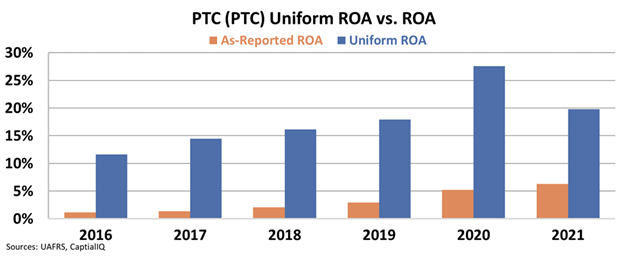

A closer look into Uniform Accounting shows that PTC has been able to ride the SaaS wave to become incredibly profitable.

Uniform ROA reached 28% in 2020, rising from 12% in 2016, and even though it took a step back in 2021, it still remains an impressive 20%.

As the platform continues to scale, PTC is in prime position to continue accelerating their profitability and its market performance along with it. Without Uniform Accounting, investors would never realize the power of this SaaS transformation for PTC.

SUMMARY and PTC Inc. Tearsheet

As the Uniform Accounting tearsheet for PTC Inc. (PTC:USA) highlights, the Uniform P/E trades at 32.7x, which is above the global corporate average of 24.0x and its own historical P/E of 30.2x.

High P/Es require high EPS growth to sustain them. In the case of PTC, the company has recently shown a 10% Uniform EPS growth in 2021.

Wall Street analysts provide stock and valuation recommendations that in general provide very poor guidance or insight. However, Wall Street analysts’ near-term earnings forecasts tend to have relevant information.

We take Wall Street forecasts for GAAP earnings and convert them to Uniform earnings forecasts. When we do this, PTC’s Wall Street analyst-driven forecast is 12% and 16% EPS growth in 2022 and 2023, respectively.

Based on the current stock market valuations, we can use earnings growth valuation metrics to back into the required growth rate to justify PTC’s $107 stock price. These are often referred to as market embedded expectations.

The company is currently being valued as if Uniform earnings were to grow by 21% annually over the next three years. What Wall Street analysts expect for PTC’s earnings growth is below what the current stock market valuation requires through 2023.

Furthermore, the company’s earning power in 2021 is 3x the long-run corporate average. Also, cash flows and cash on hand are 3x its total obligations—including debt maturities and capex maintenance. Additionally, intrinsic credit risk is 230bps above the risk-free rate. All in all, this signals average credit risk.

Lastly, PTC’s Uniform earnings growth is below peer averages but the company is trading above its peers’ average valuations.

Best regards,

Joel Litman & Rob Spivey

Chief Investment Strategist &

Director of Research

at Valens Research

The Uniform Accounting insights in today’s issue are the same ones that power some of our best stock picks and macro research, which can be found in our FA Alpha Daily newsletters.