Prospect Capital’s early success as a Business Development Company (BDC) in the private credit market has turned precarious amid rising interest rates and increasing borrower struggles. To navigate these pressures, Prospect has adopted high-risk strategies that could further destabilize its financial standing. In today’s FA Alpha Daily, we examine the growing concerns surrounding Prospect Capital and why it might be wise for investors to steer clear.

FA Alpha Daily

Powered by Valens Research

When Prospect Capital (PSEC) launched its first Business Development Company (“BDC”) two decades ago, it unwittingly laid the groundwork for what would become the $2 trillion private credit market today.

Initially, it was a low-key business, simply lending money to small and financially distressed firms and getting a steady stream of payments in return.

Yet the real catch is, as a BDC it can do this tax-free as long as it distributed 90% of its income as dividends.

Prospect bagged consistent but modest returns in silence for a while. Yet, things really ramped up when the Federal Reserve started rate hikes after the pandemic.

Big private equity players like Blackstone, Ares, and Golub smelled this opportunity and didn’t want to miss out.

Private credit has become a huge business but at the same time has started to lose its charm in the last few years, as we discussed in early August.

After years of success, Prospect’s fund reached a value of $8 billion, but now it cannot generate enough cash flow to pay the required dividends.

Last year, Prospect’s cash flow from investments fell $200 million short of the amount it paid in dividends, marking its largest shortfall in seven years.

The reason lies in the high rates. As we are having decades-high rates of around 5%, most loans have reached double-digit rates, making them pretty expensive for borrowers.

Therefore, borrowing firms are beginning to struggle with paying their interest, resulting in less cash generated by Prospect’s loans.

This is not likely to come to an end, as some borrowers are defaulting and others are facing bankruptcy.

To find salvation in this near-collapse circumstance, Prospect resorted to risky strategies.

One approach is accepting interest payments as pay-in-kind (“PIK”) debt, where borrowers are forced to take on additional loans from their lender instead of paying cash.

This way, Prospect can write the payments from additional loans as PIK income, so its returns seem fine on paper.

This sly strategy does not solve the underlying issue but only postpones it and makes the problem bigger.

Prospect has abused this method so much that one-third of its net investment income in 2023 was generated by PIK, which is twice the industry average.

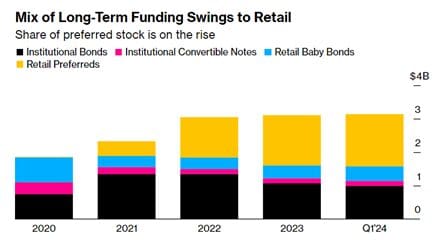

To cover the shortfall, Prospect has turned to individual investors. It has resorted to selling bonds and equity for financing. This is the usual practice for BDCs, but the concerning part is Prospect has begun raising funds by heavily selling preferred stock.

At first glance, it seems like a good opportunity for individual investors to get access to the private credit market.

That’s why people rushed to buy preferred stocks as Prospect has sold over $1.6 billion of them in less than four years.

Currently, cash from selling preferred stock represents more than half of Prospect’s long-term funding. It was less than one percent in 2020.

Take a look…

Ordinary investors are actually funding payouts to other investors rather than getting a slice of the profits generated in the private credit industry.

Prospect has used funding from preferred stock to jump its assets from $5.3 billion to $8 billion in the last four years.

In this setting, investing in Prospect seems to be relying on other new investors to pay your dividends.

So, it is wise to keep this in mind and avoid investing in Prospect.

Best regards,

Joel Litman & Rob Spivey

Chief Investment Strategist &

Director of Research

at Valens Research

To see our best macro insights, become an FA Alpha and get access to FA Alpha Pulse.