In good times, companies can be reckless, taking on massive debt to finance investments and growth. However, in bad times, as companies face debt maturities amidst rising interest rates, they shifted to dismantling their businesses to raise cash. In today’s FA Alpha Daily, we will analyze when companies are divesting and when to expect a sell-off.

FA Alpha Daily:

Monday Macro

Powered by Valens Research

U.S. debt maturities signal many are going to be running for the exit in 2024 and into 2025.

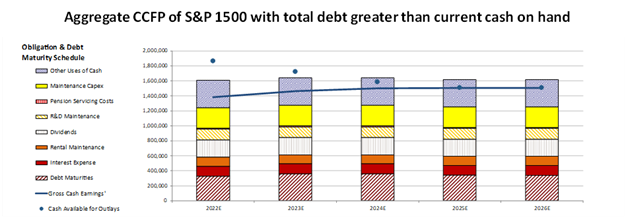

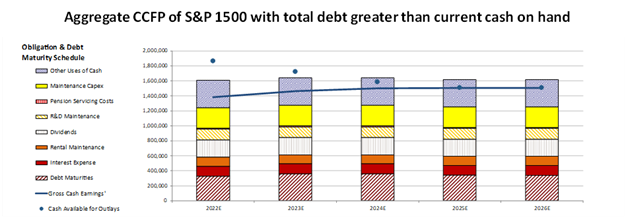

Our aggregate Credit Cash Flow Prime (“CCFP”) shows when U.S. companies as a whole have debt coming due.

We use the CCFP to figure out if there is a real credit risk for companies. It compares the company’s financial obligations against its cash position and expected cash earnings.

When we do this analysis for the whole U.S. market, or in this case, for the companies in the S&P 1500 that have more debt outstanding than cash on hand, we see the following picture.

The stacked bars represent the U.S. firms’ obligations each year for the next five years. These obligations are then compared to these firms’ cash flow (blue line) as well as the cash on hand available at the beginning of each period (blue dots).

The CCFP shows that the companies who most need cash flow to handle obligations are going to run into tough decisions by 2024.

Cash flows can cover all other obligations than “other uses of case” which represents a normal level of share buybacks. Companies will have to start thinking about ways to raise cash though if they want to keep shareholders happy by buying back shares, or if they want to be able to manage their debt maturities that are coming due.

While companies do have cash on hand to help manage this until 2024 and 2025, there is one strong conclusion here.

Companies need more capital, and they need it soon.

This is exactly what CEOs are looking at when 44% of them say they’re looking to raise capital to pay down their debts. This view isn’t just a whim of the C-suite, it’s a necessity.

That is why next year may be the year of divestitures in a big way.

This might create opportunities for smart investors.

When a company spins off a business unit, data shows that divestiture regularly outperforms the market. Research by Credit Suisse and JPMorgan shows spin-offs beat the market by upwards of 13% in the first year after standing up on their own.

That is why there is even a report people specifically dedicated to these opportunities called The Spin-Off Report.

When companies decide to sell assets to raise capital, they regularly choose to sell underperformers at the lowest point.

In the coming quarters, companies that are facing a cash crunch because of looming debt maturities are likely to be looking to sell a lot of businesses that sound like that.

Smart investors who can take advantage of management teams who overspent in boom times are going to reap dividends by being patient now. Keep your eyes peeled.

Best regards,

Joel Litman & Rob Spivey

Chief Investment Strategist &

Director of Research

at Valens Research

To see our best macro insights, become an FA Alpha and get access to FA Alpha Pulse.