As consumer debt reaches unprecedented levels and spending habits evolve, concerns over financial strain intensifies. Credit card issuers stand to benefit from rising balances and higher interest rates, yet they face significant potential risks ahead. In today’s FA Alpha Daily, we examine how escalating debt levels and the return of student loan payments could affect consumer spending and the overall economy.

FA Alpha Daily

Powered by Valens Research

Last month, consumers passed $1.14 trillion in credit-card debt.

Higher interest rates are one reason for this. The average credit card interest rate was around 16% pre-pandemic. Today, that number is around 25%.

That’s tied for the highest rate in the 30 years since the Federal Reserve started tracking rates.

… and it’s not just higher interest rates, but also years of rampant consumer spending.

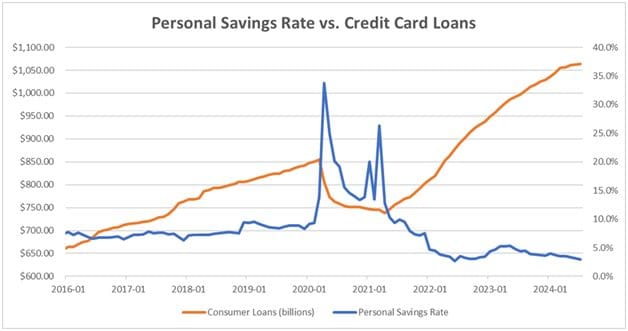

Credit card debt has been on a roller-coaster ride since the pandemic started. It sat at about $850 billion in February 2020.

By April 2021—after three rounds of stimulus checks and consumers spending far less money while staying home—balances fell below $750 billion.

Three and a half years later, spending has surged back with a passion. Credit-card debt is up more than 52% since the 2021 low.

America’s new record is a sign that the consumer is finally losing steam.

The U.S. government provided $4.6 trillion in stimulus during the pandemic to help people keep money in their accounts. As a result, the personal savings rate shot up like a rocket ship.

Then, the world reopened. People returned to their old habits and spending ramped up with a vengeance. They turned their lockdown-induced energy toward industries like travel, restaurants, and retail.

Ed Bastian, CEO of air carrier Delta Air Lines (DAL), noticed this trend. In 2023, he asked his team to measure pent-up spending in areas like food, travel, and hotels over the previous three years. They estimated it was about $300 billion.

The economy benefited from all that “revenge spending”… for a time. However, a spending spree of that magnitude can only last for so long.

Since the start of 2022, personal savings rates have been low. They’re close to levels we saw from 2005 to 2007, before the Great Recession.

… and credit-card debt is back with balances now at all-time highs.

Take a look…

When people have less money saved up, they’re not able to spend as much on non-necessities.

We’re entering the biggest shopping period of the year and this upcoming quarter will tell us a lot about the state of the consumer.

Consumers are expected to slow down spending across almost every spending category this quarter. With the student-loan “on-ramp” period wrapping up, consumer balance sheets could take an even bigger hit soon.

The Federal Reserve cut rates two weeks ago but these cuts take time to work their way through the economy. In any event, it’s a sign that the Fed is starting to worry about an economic slowdown.

… and considering consumer spending is the engine of the U.S. economy, all of this is a huge warning sign.

You wouldn’t know it if you just followed the stock market. The S&P 500 is up 20% this year. Such strong returns make it seem like nothing’s going wrong.

The U.S. consumer can’t spend like this for much longer. This is a time to exercise caution.

A fall in consumer spending could mean serious problems for the U.S. economy… and it could bring fear right back into the stock market.

Best regards,

Joel Litman & Rob Spivey

Chief Investment Strategist &

Director of Research

at Valens Research

To see our best macro insights, become an FA Alpha and get access to FA Alpha Pulse.