As the global energy industry rapidly transforms to address climate change, traditional oil and gas sectors are experiencing significant disruptions. Chart Industries (GTLS), a leader in equipment manufacturing for energy and industrial gas markets, is tackling these challenges head-on by investing in new technologies and making strategic acquisitions. In today’s FA Alpha, we delve into how Chart Industries positions itself for long-term sustainable growth.

FA Alpha Daily:

Wednesday Credit

Powered by Valens Research

The global energy industry is undergoing rapid transformation as countries work to decarbonize their economies and mitigate the worst impacts of climate change.

With mounting pressure to transition away from fossil fuels, industries that have traditionally served oil and gas are facing disruptive change.

Equipment manufacturers must now pivot to support emerging clean technologies if they want to remain relevant in a carbon-constrained future.

Chart Industries (GTLS) has established itself as a global leader in equipment manufacturing for the energy and industrial gas markets.

However, the company recognizes that these markets face challenges from cyclicality and increasing concerns over climate change.

With strategic acquisitions and investments in clean energy, Chart Industries aims to strengthen its positioning for long-term sustainable growth.

The company has a long history of serving the hydrocarbon fuel industry. However, in recent years, the firm has proactively expanded into emerging clean energy sectors that are expected to see significant growth this decade and beyond.

A great example of this is the recent acquisition of Howden Group…

In 2023, Chart completed the acquisition of Howden Group, a leading gas handling company, in a transformative $4.4 billion deal.

This strengthened the company’s portfolio with complementary products for applications in traditional markets as well as new clean energy industries like hydrogen and carbon capture.

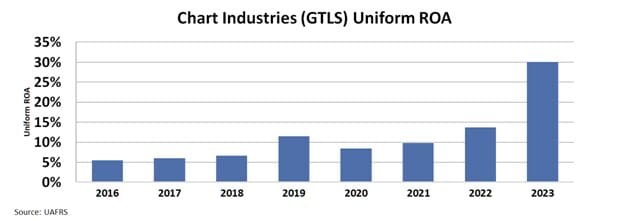

The Howden acquisition has paid dividends, with Chart achieving record financial results since the acquisition with the company reaching a 30% Uniform return on assets ”ROA” and 41% asset growth.

The stock is currently priced at an 18x Uniform P/E, reflecting the market’s concerns.

While energy markets tend to be cyclical in nature, Chart’s expansion into clean energy helps diversify end markets.

Hydrogen production and carbon capture technologies in particular are expected to see strong growth this decade driven by climate policies around the world.

Chart Industries is well-positioned to capture opportunities emerging from the clean energy transition through its expanded portfolio and engineering expertise.

Best regards,

Joel Litman & Rob Spivey

Chief Investment Strategist &

Director of Research

at Valens Research

This analysis of Chart Industries (GTLS)’s credit outlook is the same type of analysis that powers our macro research detailed in the member-exclusive FA Alpha Pulse.