Today’s FA Alpha Daily will feature game-making company Playtika (PLTK), and its strong cash flows and tailwinds credit agencies are missing.

FA Alpha Daily:

Wednesday Credit

Powered by Valens Research

Over a month ago, we highlighted Playtika (PLTK), an impressively profitable company on our FA Alpha 50 the market doesn’t understand.

The company has done an incredible job of riding one of the most powerful technology trends of all time.

With the advent of the smartphone bringing computing to everyone’s fingertips, Playtika has used that computing power to bring gaming and entertainment mobile.

Playtika has often been overshadowed in equity markets by its larger and better-known game-making competitor Zynga (ZNGA). However, just because Zynga is better known, that doesn’t mean it’s more profitable or at more attractive valuations.

Furthermore, it’s not just the equity markets that are misunderstanding just how impressively profitable Playtika is.

Ratings agencies are making the same mistake. While you may assume credit analysts only care about cold hard cash and not future valuations that equity analysts are often tied up in, that simply isn’t the case here.

S&P rates the company as a BB- credit, which implies they are poised for a downfall.

However, we can figure out if there is a real risk for this cash-rich company by examining it through the lens of the Credit Cash Flow Prime.

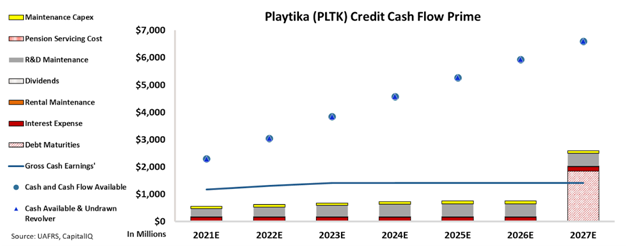

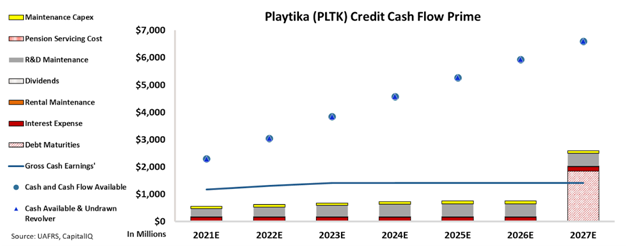

In the chart below, the stacked bars represent the firm’s obligations each year for the next seven years. These obligations are then compared to the firm’s cash flow (blue line) as well as the cash on hand available at the beginning of each period (blue dots) and available cash and undrawn revolver (blue triangles).

Even if we were to exclude the massive industry tailwinds making this default unlikely, a look at the CCFP shows why such a low rating makes no sense.

Not only does Playtika have over $1 billion in cash on its books and a surplus of over $500 million a year in cash flows over operating obligations, but it also has no debt maturities until its debt headwall in 2028.

This headwall shouldn’t be a concern though as high cash flow and cash on hand levels will have no trouble playing. Combined, we are left with a company that is facing a very low risk of bankruptcy and has a significant buffer even if there were a minor disruption at any time.

See for yourself:

S&P’s BB- credit rating isn’t reflective of Playtika’s creditworthiness, but rather a sign of the ratings agencies missing the company’s tailwinds and strong cash position.

That’s why we rate Playtika as a much safer IG3- investment-grade credit, and with the continued fundamental tailwinds, could be even stronger.

Playtika is yet another company where the credit rating agencies don’t capture the complete story. While we at Valens recognize the flaws with traditional credit ratings, many creditors do not. The BB- credit rating is pessimistic and paints a picture of a company that is much riskier than it is in reality.

It is our goal to bring forward the real creditworthiness of companies, built on the back of better Uniform Accounting.

To see Credit Cash Flow Prime ratings for thousands of companies, click here to learn more about the various subscription options now available for the full Valens Database.

SUMMARY and Playtika Holding Corp. Tearsheet

As the Uniform Accounting tearsheet for Playtika Holding Corp.(PLTK:USA) highlights, the Uniform P/E trades at 12.9x, which is below the global corporate average of 24.0x, but above its historical P/E of 8.1x.

Low P/Es require low EPS growth to sustain them. That said, in the case of Playtika, the company has recently shown a 45% Uniform EPS growth.

Wall Street analysts provide stock and valuation recommendations that in general provide very poor guidance or insight. However, Wall Street analysts’ near-term earnings forecasts tend to have relevant information.

We take Wall Street forecasts for GAAP earnings and convert them to Uniform earnings forecasts. When we do this, Playtika’s Wall Street analyst-driven forecast is for a 6% and 5% growth in 2022 and 2023, respectively.

Based on the current stock market valuations, we can use earnings growth valuation metrics to back into the required growth rate to justify Playtika’s $18 stock price. These are often referred to as market embedded expectations.

The company is currently being valued as if Uniform earnings were to shrink by 7% over the next three years. What Wall Street analysts expect for Playtika’s earnings growth is above what the current stock market valuation requires through 2023.

Furthermore, the company’s earning power in 2021 is 10x above the long-run corporate average. Moreover, cash flows and cash on hand are 4x its total obligations—including debt maturities and capex maintenance. All in all, this signals a low credit risk.

Lastly, Playtika’s Uniform earnings growth is well above its peer averages, and the company is trading below its average peer valuations.

Best regards,

Joel Litman & Rob Spivey

Chief Investment Strategist &

Director of Research

at Valens Research

This analysis of Playtika (PLTK) credit outlook is the same type of analysis that powers our macro research detailed in the FA Alpha Pulse.