In the high-stakes pharmaceutical industry, Jazz Pharmaceuticals strikes a different chord. Dominating the narcolepsy market with unparalleled patents, Jazz has not only revolutionized sleep medicine but also masterfully reinvested its returns, transforming itself into a portfolio powerhouse. With a diverse drug pipeline that promises future growth, Jazz is harmonizing innovation with profitability, offering investors a potential symphony of success.

FA Alpha Daily:

Tuesday Company Specific

Powered by Valens Research

The pharmaceutical industry is notorious for leaving investors with hopeful investments with pennies on the dollar.

It’s a complex industry seemingly not meant for the average investor.

For instance…

Pharmaceutical stocks can be highly volatile, especially smaller biotech firms that are often dependent on the success of a single drug. News of trial results, either positive or negative, can result in significant stock price swings.

Likewise, the science behind drug development is complicated, requiring specialized knowledge to truly understand a company’s prospects. This makes it difficult for the average investor to make informed decisions.

So clearly, it seems like every pharmaceutical company would be a very risky investment.

But Jazz Pharmaceuticals (JAZZ) puts this statement to the test.

Jazz Pharmaceuticals is a global biopharmaceutical company focused on developing and commercializing innovative medicines to address unmet medical needs.

The unmet medical needs segment of pharmaceuticals is highly profitable. There is a desperate need for effective treatments in these areas, creating a high level of demand almost immediately upon release.

Likewise, due to the limited options available, pharmaceutical companies have substantial pricing power, allowing them to set high prices for genuinely innovative therapies.

For example, Jazz has been dominating the sleep medicine market. In fact, its medications are the sole treatment options for minimizing nighttime sleep issues in those with narcolepsy, a serious sleep disorder.

Taking this a step further, Jazz has made it nearly impossible for competitors to enter the narcolepsy drug market. This class of drug has a controversial history for its unfortunate side effect that it can be used to force people to fall asleep.

As a result, Jazz was forced to ensure the drug was only distributed to the intended customers… and it was able to patent that distribution process as well.

As a result, this narcolepsy drug has an even stronger moat than most drugs do, which is why it has had such strong and stable returns for years.

Adding to that, Jazz has taken its profits from its cash cow drug to start investing in its future pipeline. Since 2016, the company has spent nearly $10 billion buying new drugs and entire pharmaceutical companies, including its landmark GW acquisition in 2021.

As a result, today, the company operates more like a portfolio management company than a true drug developer.

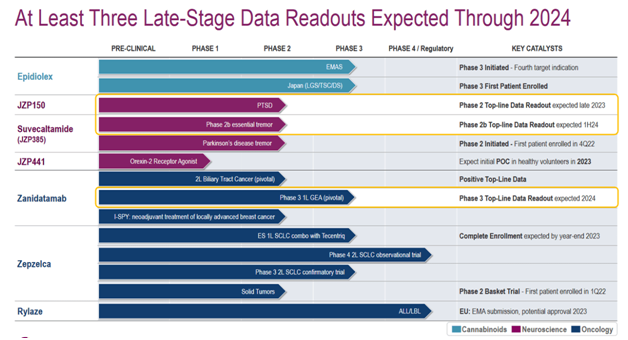

As a result, its pipeline spans neuroscience, oncology, and cannabinoids, which should help it diversify in the future.

Take a look…

With several drugs in Phase 3 and some even pushing into Phase 4, Jazz is continuing to grow its drug offerings.

The company’s continued dominance in the narcolepsy market, its commitment to continued pipeline development, and its strong demand have resulted in high profitability.

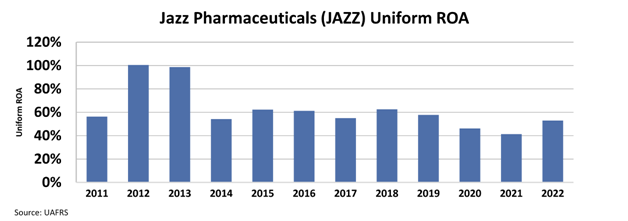

Jazz’s Uniform return on assets (“ROA”) has averaged 62% in the last 12 years.

The chart shows that the company has performed incredibly well for over a decade. Clearly, as the company continues to grow its pipeline, see strong demand, and improve its control over the narcolepsy market, it will continue to show profitability.

And yet, the market fails to recognize this opportunity.

The stock trades at a 2.1x Uniform price-to-book (“P/B”), which is the lowest level since 2010 and way below the 15.8x P/B the stock traded at in 2013.

The market is lumping Jazz in with the high-risk pharmaceutical industry, which is leading to this mispricing.

Given the growth of the company in the past and its continued positive developments, this ratio seems overly pessimistic.

Jazz has substantial potential to scale its operations and continue to grow its demand within the pharmaceutical industry.

That is why Jazz Pharmaceuticals showed up on our screen. The company makes a great FA Alpha 50 name due to its potential for high returns and low expectations from the market.

Throughout financial market history, many of the world’s most successful investors have been candid in their belief that Generally Accepted Accounting Principles (“GAAP”) distort economic reality.

Warren Buffett, for example, once said investors should “concentrate on the world of companies, not arcane accounting mathematics.”

Investors who neglect the very real issues with as-reported accounting can find themselves caught up in investing with the crowd, blindly following hot “themes” without a thorough grasp of how to understand the businesses in question.

The only true way to focus on the “world of companies,” as Buffett suggests investors do, is to present a clear picture of how a business operates, something that can only be done by adjusting financial statements to reflect the arbitrary nature of certain accounting rules that leave much to discretion.

The world’s best investors understand the need to make these adjustments, which allows them to focus not on picking out the most popular companies but rather on looking for great names in sleepy areas that the market isn’t paying much attention to. From there, the goal is to then identify quality companies with significant growth potential at reasonable prices.

That’s exactly what we’ve set out to do with the FA Alpha, our monthly list of 50 companies that rank at the top for quality, high growth, and low valuations.

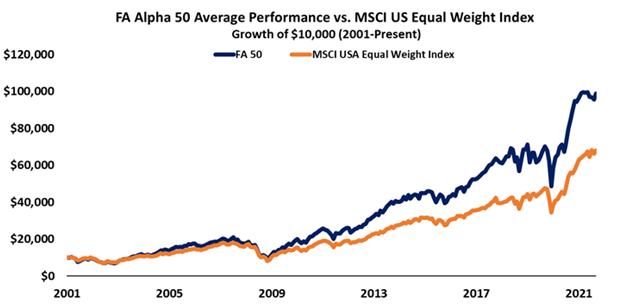

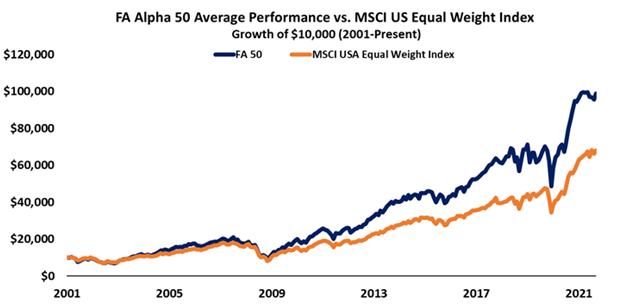

This list has outperformed the market by 300 basis points per year for over 20 years now, effectively doubling the performance of the market by focusing on the real fundamentals and valuations of companies with our proprietary Uniform Accounting framework.

See for yourself below.

To see the other 49 names on the list, click here.

Best regards,

Joel Litman & Rob Spivey

Chief Investment Strategist &

Director of Research

at Valens Research

Today’s highlight, Jazz Pharmaceuticals (JAZZ) is one of the top stock picks from FA Alpha 50 this month. To see more stock picks like this, become an FA Alpha and get access to FA Alpha 50.