The United States is widely regarded as a premier IPO location due to the significant visibility and liquidity the U.S. market offers. As a result, it’s not surprising that the proportion of foreign companies choosing to list in the U.S. has risen dramatically over the past decades. One such foreign company that went public and listed on the NYSE is PagSeguro Digital (PAGS), a Brazilian payment processor. The company has benefitted not only from Brazil’s digitization of payments but also from the increased coverage and interest it garnered from the U.S. markets. In this edition of FA Alpha Daily, we’ll take a closer look at PagSeguro’s true profitability and valuation and see what the market is missing.

FA Alpha Daily:

Tuesday Company Specific

Powered by Valens Research

Companies have a lot to consider when they decide to go public.

They need to be able to have an investor relations department and be ready to share the details of their business with the public.

In return, companies access public funding, get exit opportunities for the owners, and enhance their brand visibility and credibility.

It seems that the best place to get these advantages has been the U.S. exchanges as more and more companies list their stocks in the U.S.

The percentage of foreign company listings in the U.S. has jumped from 1.4% in 1980 to 37.2% in 2022. The long-term trend is obvious.

The reason is that this gives them more liquidity than if they were on their local exchanges since the U.S. markets are the most liquid in the world.

Additionally, companies get higher coverage and interest in the U.S. markets than they would anywhere else.

A great example is PagSeguro Digital (PAGS). It is a Brazilian payment processor that is listed on the New York Stock Exchange (“NYSE”).

It has seen big growth thanks to Brazil’s digitization of payments and long-term economic tailwinds. However, this is not the only story here.

PagSeguro is not only growing with the market but also in the market. Its market share of volume transactions in Brazil surged from 3.5% in 2017 to above 7% in 2022.

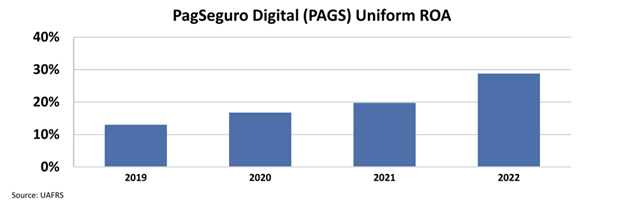

This growth led to high profitability. The company’s return on assets (“ROA”) surged from 13% in 2019 to 29% in 2022.

The move to a cashless society is only beginning. As the digital transaction volume increases, PagSeguro will see more demand for its services.

Additionally, the company has shown that it can attract more customers as it grows, gaining market share in an immensely growing market.

The company is also benefiting from being listed in the U.S. as it is getting more attention than some of its competitors, helping it to grow.

However, the market doesn’t seem to understand its story.

PagSeguro’s stock trades at only 1x price-to-book (“P/B”) and 4.1x price-to-earnings (“P/E”) ratios. Not only are these incredibly lower than the market average, but they are also very low compared to the company’s own history.

The stock traded at 12.2x P/B and 48.9x P/E in 2020, when the pandemic boosted global digital payments.

Considering strong market tailwinds, and the company’s ability to grow faster than its competitors, the valuation seems low.

PagSeguro is a great example of companies benefiting from being listed in the U.S., but this is not only true for international companies.

Our research has identified a massive opportunity coming for a new wave of U.S. listed companies, and we are publishing a report on May 10th under our consumer brand, Altimetry.

If you are interested to learn more, click the link to sign up for our event, where we’ll explain why one of the biggest investing days of the year is coming soon.

Best regards,

Joel Litman & Rob Spivey

Chief Investment Strategist &

Director of Research

at Valens Research

Today’s highlight, PagSeguro Digital (PAGS) is one of the top stock picks from FA Alpha 50 this month. To see more stock picks like this, become an FA Alpha get access to FA Alpha 50.