In the midst of the COVID-19 pandemic, social media and dating apps, such as Bumble, became crucial for staying connected during lockdowns. Bumble, not only experiencing substantial user growth but also strategically diversifying its subscriptions, is defying market expectations. Despite its impressive performance, the market seems to undervalue Bumble, presenting an enticing investment prospect. In today’s FA Alpha Daily, we will explore this market discrepancy and uncover the untapped potential within Bumble’s trajectory.

FA Alpha Daily:

Tuesday Company Specific

Powered by Valens Research

Social media companies experienced significant growth during the pandemic as people turned to these platforms for connection and entertainment while facing lockdowns and social distancing measures.

This increased usage provided social media companies with heightened user engagement and more opportunities for advertising revenue. The pandemic was a boon for one segment of social media in particular: dating apps.

Dating app companies experienced significant growth during the pandemic as they provided a safe, virtual alternative for people to connect and date while physical distancing measures were in place.

This shift to online interactions, compounded by the increased need for social connection during the isolating times of lockdowns, led to a surge in user engagement and new sign-ups on these platforms.

And one of the apps that benefited the most was Bumble (BMBL).

Bumble is a dating app that empowers women to make the first move in initiating conversations with potential matches. It also extends its platform for finding friends and professional connections, making it a versatile social networking tool beyond just dating.

Bumble experienced significant growth during the pandemic. The fourth quarter of 2022 alone saw Bumble’s paying users grow by 35% to 2.2 million, adding 133,000 users quarter over quarter.

On top of this, Bumble is introducing new subscription tiers to better cater to the varied demands of its customer segments, particularly focusing on Generation Z users.

The company is rolling out shorter-term, more personalized subscription plans, including two main tiers: Premium Plus and a base tier.

The Premium Plus plan offers a range of expanded benefits, including offline experiences, targeting high-intent, serious dating customers.

On the other hand, the base tier is designed to allow younger members to express their personalities and find connections in fun, social ways.

These new subscription plans could mean extensive growth for Bumble’s customer base leading to further strong performance.

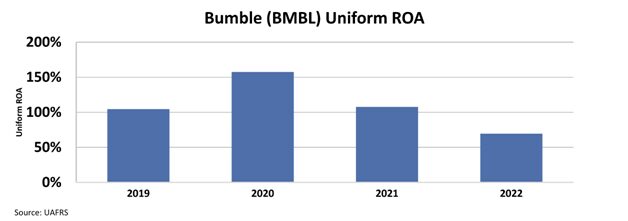

Bumble is already seeing strong profitability from its growing customer base. Bumble’s ROA averaged 112% between 2020 and 2022 during the height of the pandemic.

The chart shows that the company performed incredibly well during the pandemic. Clearly, as the company ramps up its subscription platform, such performance should continue.

And yet, the market fails to recognize this opportunity.

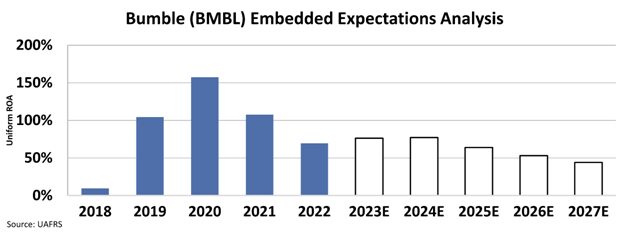

We can see this through our Embedded Expectations Analysis (“EEA”) framework.

The EEA starts by looking at a company’s current stock price. From there, we can calculate what the market expects from the company’s future cash flows. We then compare that with our own cash-flow projections.

In short, it tells us how well a company has to perform in the future to be worth what the market is paying for it today.

At the current stock price, the market expects the company’s ROA to fall below 50%, assuming the demand will collapse.

Given the company’s growing customer base and strategic expansion of its subscription platform to add more users, these expectations seem overly pessimistic.

Bumble has substantial potential to scale its platform and continue growing its user base.

That is why Bumble showed up on our screen. The company makes a great FA Alpha 50 name due to its potential for high returns and low expectations from the market.

Throughout financial market history, many of the world’s most successful investors have been candid in their belief that Generally Accepted Accounting Principles (“GAAP”) distort economic reality.

Warren Buffett, for example, once said investors should “concentrate on the world of companies, not arcane accounting mathematics.”

Investors who neglect the very real issues with as-reported accounting can find themselves caught up in investing with the crowd, blindly following hot “themes” without a thorough grasp of how to understand the businesses in question.

The only true way to focus on the “world of companies,” as Buffett suggests investors do, is to present a clear picture of how a business operates, something that can only be done by adjusting financial statements to reflect the arbitrary nature of certain accounting rules that leave much to discretion.

The world’s best investors understand the need to make these adjustments, which allows them to focus not on picking out the most popular companies but rather on looking for great names in sleepy areas that the market isn’t paying much attention to. From there, the goal is to then identify quality companies with significant growth potential at reasonable prices.

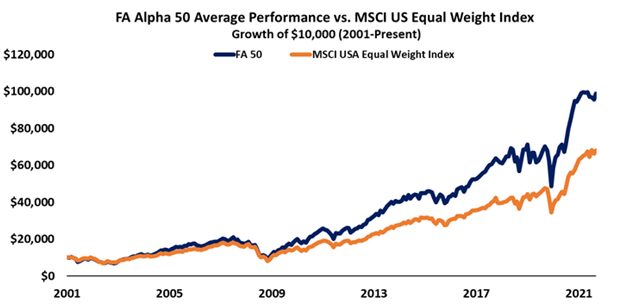

That’s exactly what we’ve set out to do with the FA Alpha, our monthly list of 50 companies that rank at the top for quality, high growth, and low valuations.

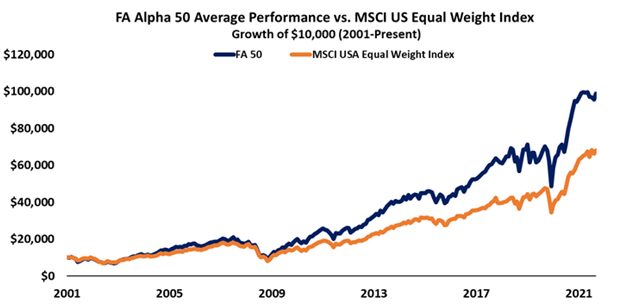

This list has outperformed the market by 300 basis points per year for over 20 years now, effectively doubling the performance of the market by focusing on the real fundamentals and valuations of companies with our proprietary Uniform Accounting framework.

See for yourself below.

To see the other 49 names on the list, click here.

Best regards,

Joel Litman & Rob Spivey

Chief Investment Strategist &

Director of Research

at Valens Research

The battle between fundamental investors and technical investors rages on. Each camp swears on its methodology, and each has attributes that appeal to investors. What if we combined these methods and track performance? We did just that, and you need to see the results…

We are inviting you to attend our upcoming event this Wednesday, December 6, 2023 at 8:00 PM EST to help you succeed with your financial decisions.

Today’s highlight, Bumble Inc. (BMBL) is one of the top stock picks from FA Alpha 50 this month. To see more stock picks like this, become an FA Alpha and get access to FA Alpha 50.