Today’s FA Alpha Daily will feature multinational toy company Mattel (MAT), and if it still has upside potential pricing in its expected recovery after the Toys R Us bankruptcy.

FA Alpha Daily:

Thursday Uniform accounting analysis

Powered by Valens Research

Mattel’s (MAT) past eight years have proven to be tough.

At the beginning of 2014, its stock was $45. Today, it’s trading about 50% lower, and during the worst of the pandemic, it had fallen more than 75%.

As a multinational toy company with a number of iconic brands, including American Girl, Barbie, and Hot Wheels, Mattel should be set up to earn a sustainable premium return.

However, the company has had several issues pop up since 2014.

To start, its largest customer, Toys ‘R’ Us, went bankrupt back in 2017. That caused Mattel to lose 10% of its sales.

It also had a number of self-inflicted wounds. Over a multi-year period, it saw major anchors like American Girl dolls, Thomas & Friends, and Fisher Price underperform. Mattel’s licensed toys for franchises like Jurassic World and WWE also underperformed competitor Hasbro’s (HAS) Star Wars and Marvel partnerships.

This caused Mattel to see profitability drop from 22% in 2014 to negative levels, with a -7% return on assets (“ROA”) in 2017 and -4% in 2018.

But with everyone stuck at home during the pandemic, parents and kids both looked for new toys to keep kids occupied.

Since then, a combination of better execution, getting out from under the rubble of Toys ‘R’ Us, and the recovery of spending on “things,” thanks to kids looking to play at home as part of the At-Home Revolution, ROA has started to recover.

It is now forecast to reach 15% in 2022, up from 9% in 2021.

Considering the stock is still at just 50% of historical highs and the company’s returns are on their way to recovering, investors might think Mattel looks like an interesting buy.

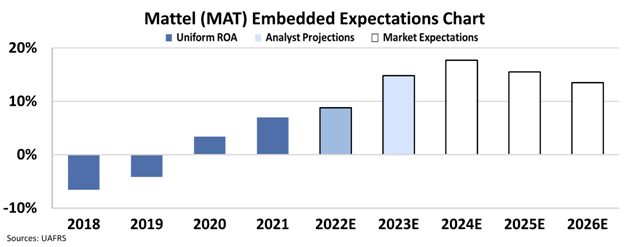

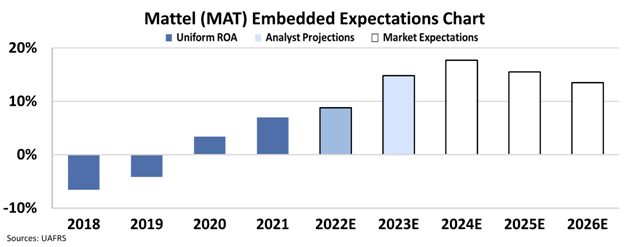

By using our Embedded Expectations Analysis (“EEA”) framework, we can see what the market expects Mattel to do at its current stock price in relation to these new returns.

Analysts are forecasting for returns to continue to improve. The market is also clued in, as Uniform metrics show us the market is already pricing in Mattel to sustain mid-double-digit returns going forward. While still below highs, the market is already pricing in a recovery in its expectations.

While Mattel is expected to continue to recover and see more robust profitability, our EEA chart shows us the market is already ahead of the curve.

While investors may think Mattel could have some upside, with our EEA analysis most value investors should know to look elsewhere. By subscribing to our Valens Research database, you can look for companies that the market hasn’t yet priced in for upside.

SUMMARY and Mattel, Inc. Tearsheet

As the Uniform Accounting tearsheet for Mattel, Inc. (MAT:USA) highlights, the Uniform P/E trades at 17.0x, which is below the global corporate average of 24.0x and its own historical P/E of 21.5x.

Low P/Es require low EPS growth to sustain them. In the case of Mattel, the company has recently shown a 44% Uniform EPS growth.

Wall Street analysts provide stock and valuation recommendations that in general provide very poor guidance or insight. However, Wall Street analysts’ near-term earnings forecasts tend to have relevant information.

We take Wall Street forecasts for GAAP earnings and convert them to Uniform earnings forecasts. When we do this, Mattel’s Wall Street analyst-driven forecast is a 212% and 40% EPS growth in 2022 and 2023.

Based on the current stock market valuations, we can use earnings growth valuation metrics to back into the required growth rate to justify Mattel’s $24 stock price. These are often referred to as market embedded expectations.

The company is currently being valued as if Uniform earnings were to grow by 7% annually over the next three years. What Wall Street analysts expect for Mattel’s earnings growth is above what the current stock market valuation requires in 2022 and 2023.

Furthermore, the company’s earning power in 2021 is slightly above the long-run corporate average. Moreover, cash flows and cash on hand are almost twice its total obligations—including debt maturities and capex maintenance. However, intrinsic credit risk is 220bps above the risk-free rate.

All in all, this signals an average credit risk.

Lastly, Mattel’s Uniform earnings growth is above its peer averages and the company is trading above its average peer valuations.

Best regards,

Joel Litman & Rob Spivey

Chief Investment Strategist &

Director of Research

at Valens Research

The Uniform Accounting insights in today’s issue are the same ones that power some of our best stock picks and macro research, which can be found in our FA Alpha Daily newsletters.