The global energy transition is forcing traditional oil majors to make difficult choices as they balance fossil fuel demand with pressure to decarbonize. Some are doubling down on renewables, while others are rethinking portfolios and streamlining operations to stay competitive. In today’s FA Alpha Daily, we explore how BP (BP) is accelerating asset sales and restructuring in a bid to catch up with rivals and improve profitability.

FA Alpha Daily

Powered by Valens Research

The oil and gas industry is navigating a complex environment as ongoing geopolitical tensions in Europe, the Middle East, and Russia have led to volatility in both supply and prices. As a result, achieving energy security has become crucial for the U.S. and other nations across the globe.

Moreover, the industry as a whole has to contend with climate policies pushing towards the further development and adoption of clean and renewable energy as demands for decarbonization mounts.

Despite the push towards renewables and clean sources of energy, oil is still forecast to remain as the world’s largest source of energy for the next couple of decades. It’s expected that it will supply 30% of the world’s energy by 2035.

To keep up with growing demand, the International Energy Agency said that the world will need to spend $540 billion annually on oil and gas exploration to maintain current output by 2050 as existing fields decline in part due to dependency on U.S. shale.

Specifically, British oil major BP (LSE:BP) estimates that oil usage will hit 83 million barrels per day in 2050, an 8% rise compared to previous estimates of 77 million.

Yet despite this, British oil giant BP remains in trouble.

After reaching its peak nearly 20 years ago, the company has spent the past few years lagging behind competitors like Shell (LSE:SHEL), Exxon Mobile (XOM), and Chevron (CVX).

When its pivot towards green energy failed to pay off, BP changed course earlier this year, announcing it would ramp up fossil fuel production and increase oil and gas investment to $10 billion annually while slashing green investment funding by more than $5 billion.

And instead of being rewarded for this pivot, the company’s share price has continued to fall, as investors remained skeptical. Moreover, activist investor Elliott Management has acquired a significant stake in the firm.

All this signals that BP has to do more to right the ship.

BP’s new chair, Albert Manifold, indicated as much earlier this week when he said that the firm has to carefully review its portfolio and take urgent action in simplifying its “overly complex” business so it can focus on key areas.

Prior to Manifold’s ascension as chair on October 1, BP had already set in motion a plan to raise $20 billion by 2027 through asset sales and divestments in Castrol, its lubricants business, and shares of its solar firm Lightsource.

A look at BP through the lens of Uniform accounting sheds light on the reasoning behind Manifold’s statements and why the oil major is in desperate need of a turnaround.

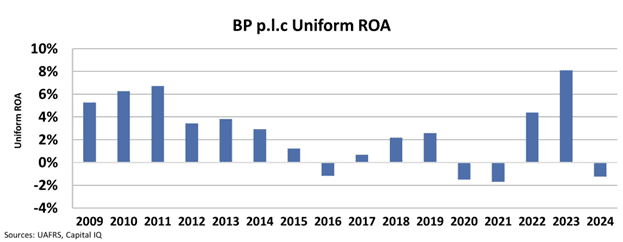

After maintaining its Uniform return on assets (“ROA”) at 5%+ levels from 2009 to 2011, the company’s returns have steadily declined until it reached negative levels in 2020 and 2021.

Even though BP saw its returns trend positively in 2022 and 2023, its returns dipped back to negative levels yet again in 2024.

It’s clear BP is facing problems generating reliable returns despite being one of the biggest oil and gas players in the world.

While its leadership has acknowledged this problem and has endeavored to take steps to resolve this challenge, it remains to be seen whether Manifold and BP CEO Murray Auchincloss can right the ship and steer the company towards profitability.

Best regards,

Joel Litman & Rob Spivey

Chief Investment Officer &

Director of Research

at Valens Research

Today’s analysis highlights the same insights we share with our FA Alpha Members. If you want to an get in-depth analysis of market trends and uncover undervalued stocks, become an FA Alpha Member today.