Given its cyclical nature and volatile cash flows, the energy sector was often overlooked by rating agencies of its company-specific factors when assessing its credit risk. For example, a Uniform Accounting analysis of Matador Resources (MTDR) shows higher profitability than reported under GAAP. It had record profitability last year, but rating agencies still seem concerned about its ability to meet its obligations soon. In today’s FA Alpha Daily, let’s look at Matador Resources using Uniform Accounting and see why rating agencies may exaggerate credit risk concerns.

FA Alpha Daily:

Wednesday Credit

Powered by Valens Research

Oil and gas businesses have a reputation as a boom or bust industry.

This applies especially to the prospectors, the ones going out and exploring new potential areas of oil production. These businesses could invest a lot and end up with nothing to show for it.

While that may be true in most cases, the technology behind oil exploration has gotten a lot better, and the industry has gotten more stable and mature.

Matador Resources is a great example of this.

The company engages in the exploration, development, production, and acquisition of oil and gas.

Its exploration and production activities are focused in the U.S. around Texas, New Mexico, and Louisiana.

Additionally, the company owns some pipeline assets, which tend to be more stable than being a pure-play exploration and production (E&P) business because people pay to use it no matter where oil prices are heading.

The company had record profitability last year as oil and gas prices skyrocketed, especially in the first half of the year.

But even prior to 2022, Matador had pretty stable returns.

However, the rating agencies are worried that won’t last. They see that Matador has a pretty big debt maturity coming in a few years, and they’re worried that with energy prices falling recently, it’ll struggle to pay that off.

Because of these concerns, S&P treats it like a high-yield name and rates it “BB-”, which implies a probability of default around 10%.

We think the company should have no problems meeting its obligations and that S&P is just overly concerned because of an industry bias.

We can figure out if there is a real risk for this company by leveraging the Credit Cash Flow Prime (“CCFP”) to understand how the company’s obligations match against its cash and cash flows.

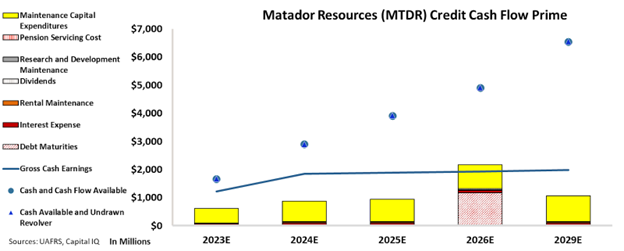

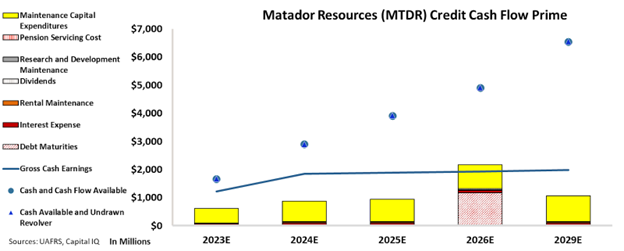

In the chart below, the stacked bars represent the firm’s obligations each year for the next five years. These obligations are then compared to the firm’s cash flow (blue line) as well as the cash on hand available at the beginning of each period (blue dots) and available cash and undrawn revolver (blue triangles).

The CCFP chart shows that Matador Resources’ cash flows are more than enough to serve all its obligations going forward.

The chart shows that the company has a debt maturity in 2026 and has limited operating obligations besides it going forward.

On the other hand, it has huge cash flows that could easily pay down that debt and cover all operating obligations.

Additionally, the significant spread between its massive cash and obligations provides flexibility to comfortably handle an economic downturn or a bad commodity cycle.

Due to these factors, we think that Matador shouldn’t be treated like a high-yield name and should be placed within the investment-grade basket.

Hence, at Valens, we are giving an IG4+ rating to this company. As opposed to rating agencies’ unreasonable 10% probability of default, this rating only implies a probability of default of around 2%.

It is our goal to bring forward the real creditworthiness of companies, built on the back of better Uniform Accounting.

To see Credit Cash Flow Prime ratings for thousands of companies, click here to learn more about the various subscription options now available for the full Valens Database.

SUMMARY and Matador Resources (MTDR:USA) Tearsheet

As the Uniform Accounting tearsheet for Matador Resources (MTDR:USA) highlights, the Uniform P/E trades at 7.7x, which is below the global corporate average of 18.4x but above its historical P/E of 6.2x.

Low P/Es require low EPS growth to sustain them. In the case of Matador, the company has recently shown a 185% Uniform EPS growth.

Wall Street analysts provide stock and valuation recommendations, that in general, provide very poor guidance or insight. However, Wall Street analysts’ near-term earnings forecasts tend to have relevant information.

We take Wall Street forecasts for GAAP earnings and convert them to Uniform earnings forecasts. When we do this, Matador’s Wall Street analyst-driven forecast is for a -35% and 28% EPS growth in 2023 and 2024, respectively.

Based on the current stock market valuations, we can use earnings growth valuation metrics to back into the required growth rate to justify Matador’s $50 stock price. These are often referred to as market-embedded expectations.

Furthermore, the company’s earning power in 2022 was 3x the long-run corporate average. Moreover, cash flows and cash on hand are below its total obligations—including debt maturities and capex maintenance. The company also has an intrinsic credit risk that is 250bps above the risk-free rate.

Overall, this signals a moderate credit risk and a high dividend risk.

Lastly, Matador’s Uniform earnings growth is in line with its peer averages and is trading below its average peer valuations.

Best regards,

Joel Litman & Rob Spivey

Chief Investment Strategist &

Director of Research

at Valens Research

This analysis of Matador Resource’s (MTDR) credit outlook is the same type of analysis that powers our macro research detailed in the member-exclusive FA Alpha Pulse.