As a consequence of soaring mortgage rates, borrowing and financing costs have surged, discouraging both homebuyers and homebuilders from participating in the housing market. This has led rating agencies to hold a negative perspective on the sector. Nevertheless, Louisiana-Pacific Corporation (LPX) remains resolute in the industry, diversifying its services and adapting to the ever-evolving demands of the construction sector. In today’s FA Alpha Daily, we thoroughly examine LPX’s true credit risk utilizing the Credit Cash Flow Prime™.

FA Alpha Daily:

Wednesday Credit

Powered by Valens Research

The real estate market is facing challenges due to high mortgage rates. With rates now above 7%, this resembles peak levels since March 2002. As a result, the homebuilding sector is getting hit hard.

Rising mortgage rates have worsened the usual end-of-year slump in the real estate sector, historically causing new home sales to dip. Specifically, homebuilder shares fell by 4% in September, while the S&P 500 Index only dipped by 0.2%.

This has raised concerns among credit rating agencies, which are now cautious about real estate and homebuilding companies.

However, some homebuilding firms are holding strong amidst these adversities. Their solid business models and promising outlooks set them apart.

Louisiana-Pacific Corporation (LPX) stands out in this regard. They provide top-notch construction materials and solutions for both new and ongoing projects.

They are a major producer of oriented strand board (OSB) panels, crucial in construction, holding a 24% market share in North America. Also, they manufacture wood siding and engineered wood products, showcasing a diverse portfolio.

The company’s products cater to both new constructions and remodeling projects. This strategic stance helps maintain steady demand for their products, even in economic downturns.

Moreover, it has a rich tradition of innovation. They consistently develop new products to meet the construction industry’s evolving needs. This innovative approach not only sets Louisiana-Pacific apart, but also provides a competitive edge to weather the cyclical nature of the real estate market.

Currently, the company is extending its market reach, launching new products, and targeting the less volatile Siding market segment. This will help reduce the impact of seasonal trends on the firm, as it continues to invest in these less cyclical and seasonal segments.

Early this year, Louisiana-Pacific successfully initiated Sagola’s conversion to a siding mill, a big step to expanding its capacity. Soon after, they acquired Forex’s Wawa OSB facility to meet North America’s rising demand, adding significant capacity.

This boosts the company’s siding capacity to 2.7 billion square feet annually. By increasing production in a less cyclical industry segment, it aims to improve its financial position amidst a wide range of target markets.

However, it appears that rating agencies are not taking these developments into account, merely categorizing the company as a homebuilder vulnerable to the cyclical real estate sector.

That’s why, S&P gives Louisiana-Pacific a “BB+” rating. This rating suggests a risk of default around 11% over the next five years. It also places the company in the risky high-yield basket.

Its clean balance sheet and diverse portfolio make us think it deserves a much safer credit rating.

We can figure out if there is a real risk for this company by leveraging the Credit Cash Flow Prime (“CCFP”) to understand how the company’s obligations match against its cash and cash flows.

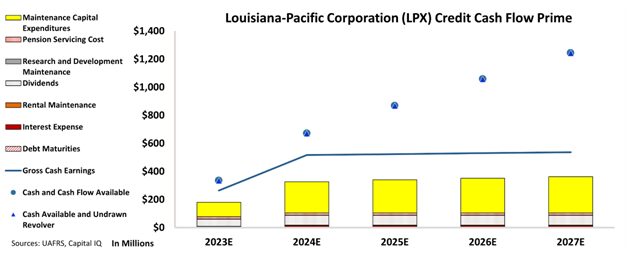

In the chart below, the stacked bars represent the firm’s obligations each year for the next five years. These obligations are then compared to the firm’s cash flow (blue line) as well as the cash on hand available at the beginning of each period (blue dots) and available cash and undrawn revolver (blue triangles).

The CCFP chart shows that Louisiana-Pacific’s cash flows are more than enough to serve all its obligations going forward.

The chart indicates that the business is in a healthy financial position and will have no trouble meeting its obligations in the near future.

Remarkably, it has no debt maturing in the next five years. The company generates substantial cash flows, which would allow it to manage any debt effortlessly, should it have any.

Furthermore, the company stands to boost its earnings through the expansion of its siding segment.

Therefore, contrary to the rating agencies’ assessment, we believe Louisiana-Pacific presents a minimal default risk.

Considering these factors, we are giving an “IG3+” rating to the company. This rating ensures it is in the safer investment-grade basket and implies a risk of default of around just 1%.

It is our goal to bring forward the real creditworthiness of companies, built on the back of better Uniform Accounting.

To see Credit Cash Flow Prime ratings for thousands of companies, click here to learn more about the various subscription options now available for the full Valens Database.

SUMMARY and Louisiana-Pacific Corporation (LPX:USA) Tearsheet

As the Uniform Accounting tearsheet for Louisiana-Pacific Corporation (LPX:USA) highlights, the Uniform P/E trades at 18.0x, which is around the global corporate average of 18.4x and above its historical P/E of 13.7x.

Low P/Es require low EPS growth to sustain them. In the case of Louisiana-Pacific, the company has recently shown a 4% Uniform EPS shrinkage.

Wall Street analysts provide stock and valuation recommendations, that in general, provide very poor guidance or insight. However, Wall Street analysts’ near-term earnings forecasts tend to have relevant information.

We take Wall Street forecasts for GAAP earnings and convert them to Uniform earnings forecasts. When we do this, Louisiana-Pacific’s Wall Street analyst-driven forecast is for a 83% EPS shrinkage and a 94% EPS growth in 2023 and 2024, respectively.

Based on the current stock market valuations, we can use earnings growth valuation metrics to back into the required growth rate to justify Louisiana-Pacific’s $52 stock price. These are often referred to as market-embedded expectations.

Furthermore, the company’s earning power in 2022 was 6x the long-run corporate average. Moreover, cash flows and cash on hand are above its total obligations—including debt maturities and capex maintenance. The company also has an intrinsic credit risk that is 170bps above the risk-free rate.

Overall, this signals a moderate credit risk and a low dividend risk.

Lastly, Louisiana-Pacific’s Uniform earnings growth is below its peer averages and is trading above its average peer valuations.

Best regards,

Joel Litman & Rob Spivey

Chief Investment Strategist &

Director of Research

at Valens Research

We are inviting you to attend FA Alpha’s upcoming CAIA Hong Kong event on Wednesday, 11/1, at 6:30 PM HKT to learn about the latest macroeconomic trends affecting the global economy.

This analysis of Louisiana-Pacific Corporation (LPX)’s credit outlook is the same type of analysis that powers our macro research detailed in the member-exclusive FA Alpha Pulse.