Despite the Fed’s aggressive interest rate hikes, low unemployment rate and strong consumer spending persist due to substantial consumer liquidity. Consumers saw a dramatic increase in cash balances, along with notable growth in savings accounts, money market investments, and home and total equity since 2020. Today’s FA Alpha Daily explores how the Fed’s rate hikes may cause a modest recession and how consumers can utilize their cash reserves to weather the storm.

FA Alpha Daily:

Monday Macro

Powered by Valens Research

At the height of the pandemic, a lack of spending and multiple injections of government stimulus meant consumers saved a ton of money. Most folks understand this on some level.

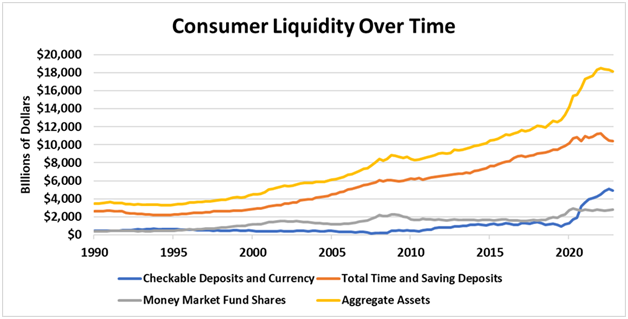

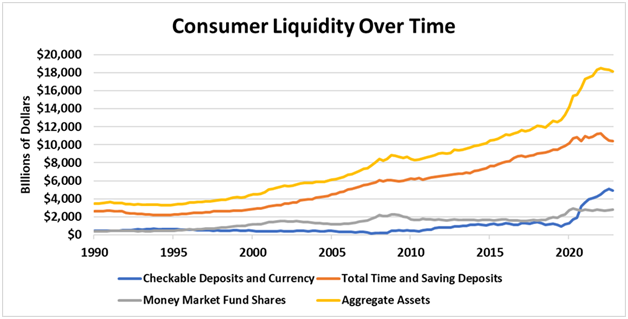

What they might not fully grasp is just how massive this cash balance is. In the past four years, consumer cash balances increased from $1 trillion to $5 trillion in checking accounts alone. That’s a 400% increase.

While savings accounts haven’t risen quite as fast, balances are still rising. Cash in savings accounts is up by $600 million in the same time frame. And money market investments have grown by more than $1.2 trillion since mid-2017.

You can see this in the following chart.

Keep in mind, this data is only available through the third quarter of 2022. Folks have probably started dipping into some of these assets recently.

Regardless, consumers are sitting on massive amounts of liquidity. They really haven’t had to draw on it yet. All this cash padding will keep the American consumer resilient, even as the economy slows down.

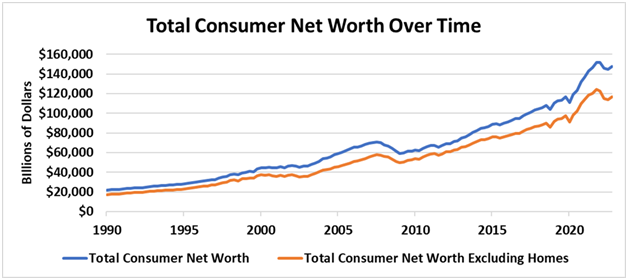

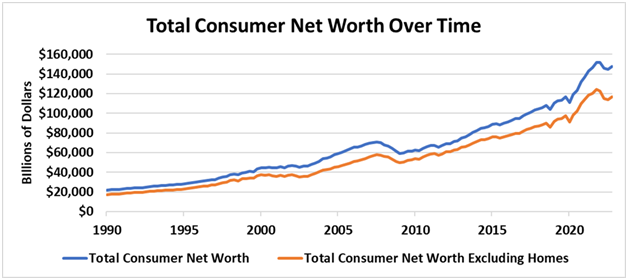

What makes this even more apparent is when you look at consumer net worth.

This metric measures all consumers assets minus liabilities like credit cards and mortgages. Looking at it with or without home equity both tell the same story.

Consumers have added $11 billion in home equity and $37 billion in total equity to their balance sheets since 2020. Said another way, net equity is up more than 30% in the past three years.

Check it out.

As you can see, total consumer net worth is still way higher than it was pre-pandemic. And even as folks draw some of that wealth down this year, we need to remember that it’s starting out from a strong place.

The Fed’s rate hikes will slow spending and cool down the economy. They’ll likely tip us into a modest recession. In short, they’re doing what they’re designed to do.

That doesn’t mean the downturn will be cataclysmic. It’s not going to collapse the economy.

Consumers are comfortable. While recession fears have many folks watching their budgets, they should be able to weather the coming storm.

Best regards,

Joel Litman & Rob Spivey

Chief Investment Strategist &

Director of Research

at Valens Research

To see our best macro insights, become an FA Alpha and get access to FA Alpha Pulse.