The merger between Smurfit Kappa and Westrock has created Smurfit Westrock (SW), now the world’s largest packaging company. Despite Westrock’s previous financial struggles and industry challenges, the merger has bolstered the company’s financial health and market position. In today’s FA Alpha Daily, we examine how Smurfit Westrock’s solid financials and emphasis on sustainability set the stage for future growth amid economic recovery.

FA Alpha Daily:

Friday Portfolio Analysis

Powered by Valens Research

Smurfit Westrock (SW) has officially started trading following the merger of two packaging giants, Smurfit Kappa and Westrock.

This merger has resulted in the creation of the biggest packaging company out there, with shares now trading on the New York and London stock exchanges.

Before the merger, Westrock faced substantial market concerns due to its rising debt and weakening financials, including dropping sales and gross margins.

These issues were compounded by broader challenges in the packaging industry, which relies heavily on consumer demand.

When the economy takes a downturn, consumer spending drops, directly impacting the demand for packaging products. Additionally, the industry has been dealing with increasing costs of raw materials, which puts pressure on profit margins.

On top of that, there’s a growing push for sustainable packaging solutions, driven by consumer preferences and regulatory requirements. Meeting these demands requires significant investment, adding another layer of financial strain.

However, the merger has significantly improved Westrock’s financial health. Smurfit Kappa’s strong cash reserves and recent bond offerings have provided the capital needed to address Westrock’s debt issues.

Smurfit Westrock now proudly calls itself the “partner of choice in sustainable packaging.”

The merger has also given the company an impressive global footprint, covering key markets in North America, Europe, and beyond. This broad reach not only spreads risk but also positions the company to seize growth opportunities in emerging markets.

Despite these improvements coming from the merger, the market still has concerns about the packaging industry’s challenges and Westrock’s previous financial troubles.

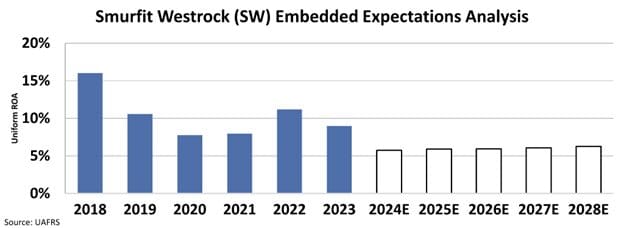

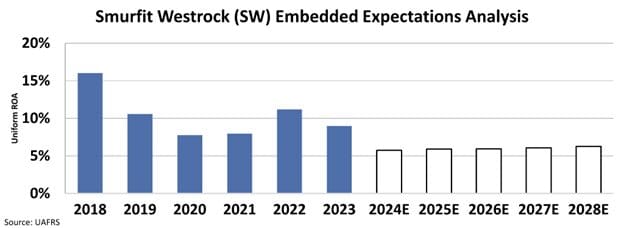

We can see what the market thinks through our Embedded Expectations Analysis (“EEA”) framework.

The EEA starts by looking at a company’s current stock price. From there, we can calculate what the market expects from the company’s future cash flows. We then compare that with our own cash-flow projections.

In short, it tells us how well a company has to perform in the future to be worth what the market is paying for it today.

At the current stock price, the market expects the company’s Uniform return on assets ”ROA” to fall to around 6%.

According to the Financial Times, the merger is expected to bring substantial cost savings and operational efficiencies, giving Smurfit Westrock a competitive edge.

As the market starts to recover and consumer spending increases, Smurfit Westrock is in a prime position to reap the benefits.

The company’s solid financial footing, diverse product range, and commitment to sustainability are key strengths that will drive growth.

The merger has not only resolved immediate financial issues but has also set the stage for future expansion.

IN CASE YOU MISSED IT:

AI has ushered in the biggest tech mania since the 1990s and has created 500,000 new millionaires—roughly 587 per day—since the launch of ChatGPT in late 2022.

In fact, Nvidia is already up more than 783% in the past two years and recently, the S&P 500 made a new all-time high, driven mostly by AI stocks.

While this may sound like good news, the world elite are already preparing for an AI crisis that could trigger a major catastrophe in the stock market.

When this crisis happens, it could impact your money—whether you own AI stocks or not.

If you want to protect yourself from this impending crisis, watch the replay of Professor Joel Litman’s most recent AI Panic Summit.

During the summit, Professor Litman discussed everything you need to know about the impending turmoil on AI stocks and what you can do to avoid massive losses and seize huge gains.

Click this link to watch the replay. This is completely free of charge.

Hope you’ll take the time to check it out!

Best regards,

Joel Litman & Rob Spivey

Chief Investment Strategist &

Director of Research

at Valens Research

This portfolio analysis highlights the same insights we share with our FA Alpha Members. To find out more, visit our website.