Cracker Barrel has long been known for its country-inspired identity, from vintage décor to its iconic logo. But recent attempts to modernize the brand have sparked controversy and rattled investors. In today’s FA Alpha Daily, we’ll explore Cracker Barrel’s transformation efforts and what they mean for its future profitability.

FA Alpha Daily

Powered by Valens Research

The U.S. is home to a highly lucrative and competitive food service industry which generated over $2.6 trillion in sales in 2024.

That said, restaurants often operate on razor-thin margins, and have little room to maneuver when food costs rise due to inflation. Restaurant operations also require substantial labor, creating additional pressures that further squeeze profitability.

More importantly, restaurant profitability is highly dependent on attendance. When consumers eat less, margins get squeezed further. In fact, U.S. restaurants experienced one of their weakest six-month sales growth periods in a decade during the first half of 2025.

As a result of this, some restaurants, including Cracker Barrel (CBRL), have resorted to menu changes, rebrands, and a slew of other operational changes to retain customers, attract new ones, and to improve returns..

Last week, the Tennessee-based restaurant chain made headlines for all the wrong reasons as it lost nearly $100 million in market value after the release of its redesigned logo stirred controversy among political commentators, long-time patrons, and investors.

Cracker Barrel carved out a unique brand image by adopting an old country-inspired identity, which was reflected in vintage decor, home cooking-inspired dishes, and a logo depicting a sitting gentleman leaning against a barrel.

Recently, the company has undergone efforts to shed its rustic brand image to attract a younger audience. Vintage decors have given way to a more modern atmosphere and the menu has been simplified and altered to accommodate seasonal offerings.

The most recent move in Cracker Barrel’s ongoing brand refresh came in the form of a logo change that replaced the iconic barrel design with a cleaner, text-only design featuring its name.

In response, long-time customers complained that the redesigned logo veered away from the legacy chain’s “country roots,” while experts pointed out that a rebrand can damage brand identity and turn off long-time customers. Meanwhile, conservative pundits accused the company of turning its back on American values.

The negative response immediately resulted in a nearly $94 million dollar drop in market value and a company-issued apology for the logo change, emphasizing that this change was part of a broader plan that’s expected to pay off by 2027.

And yesterday, the chain reverted its logo change completely, deciding to stick with its classic brand image.

While Cracker Barrel’s recent rebranding efforts seem drastic to some, Uniform Accounting highlights the necessity for this business to change its current course.

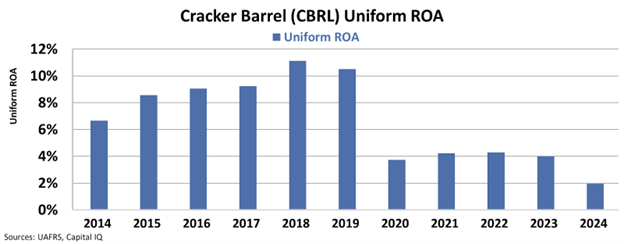

The chain once generated reliable returns ranging from 9% to 10% prior to the pandemic. Since 2020, the company has struggled to deliver returns similar to its historical performance.

Its Uniform return on assets (“ROA”) hovered around 4% levels from 2020 to 2023, before declining to just 2% last year.

Since 2023, Cracker Barrel’s leadership has been pursuing a transformation of its business which also involves the remodeling of its roughly 660 locations and attempts to attract a younger, and higher-income demographic.

So far its efforts to reinvent its brand and give its business a kickstart have grabbed the headlines for the wrong reasons. And while its classic logo is here to stay for the time being, it remains to be seen what else the restaurant will do to recapture its former glory and restore its profitability levels.

For now, investors will have to wait and see if Cracker Barrel’s strategy will pay off for the restaurant chain.

Best regards,

Joel Litman & Rob Spivey

Chief Investment Officer &

Director of Research

at Valens Research

Today’s analysis highlights the same insights we share with our FA Alpha Members. If you want to an get in-depth analysis of market trends and uncover undervalued stocks, become an FA Alpha Member today.