The United States administration has pledged to invest in nuclear infrastructure in order to keep California’s last nuclear power plant operational. If the investment is successful, nuclear plants such as Centrus Energy (LEU), a company that supplies nuclear fuel and services on a global scale, will benefit greatly. Today’s FA Alpha will examine if the company will enjoy sustained high profitability through Uniform Accounting if investment continues.

FA Alpha Daily:

Thursday Uniform Accounting Analysis

Powered by Valens Research

The U.S. continues to invest in its infrastructure. The Biden administration announced last week the preliminary approval to spend up to $1.1 billion to keep the last nuclear power plant in California open.

This funding is just one of the examples highlighting how we have underinvested in infrastructure in the last few years and in power infrastructure for the last few decades.

Issues like “nimbyism,” where people oppose developments in their local area just because it is close to them, prevented the limited number of proposals to be realized.

However, people have realized that we need a more resilient infrastructure with the problems raised during the last few years. The pandemic hit supply chains hard, the number of geopolitical crises surged, and energy prices jumped to levels not seen in the last decade.

As the nuclear plant example shows, this realization is now leading to investments in infrastructure coming back, especially in the energy field.

If these investments continue and we embrace investing in power infrastructure and specifically nuclear, there would be clear winners.

One of the bigger winners would be Centrus Energy (LEU). The company supplies nuclear fuel and services for the nuclear power industry internationally. It has its biggest presence in the U.S., Belgium, and Japan.

The company has a very experienced executive team to take advantage of upcoming opportunities in the nuclear energy industry. The president and chief executive officer (“CEO”) of Centrus Energy is Daniel B. Poneman.

Prior to his role at Centrus, he served as the Deputy Secretary of Energy between 2009 and 2014 and as the chief operating officer (“COO”) of the U.S. Department of Energy. His responsibilities spanned a wide range of U.S. energy policies and programs including hydrocarbons, renewables, nuclear, and efficiency.

With the vision of the highly experienced team, the company offers low-enriched uranium components and natural uranium for utilities that operate nuclear power plants and both technical and operations services to public and private sector customers.

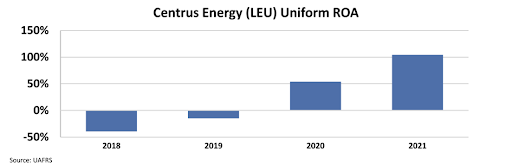

Centrus Energy has already benefited from the investments that have been growing in the industry and successfully increased its profitability. The return on assets (“ROA”) of the company rose from -40% in 2018 to 104% in 2021.

If investments continue, the company will continue to benefit and might have the chance to enjoy sustained high profitability.

However, it is crucial to understand what the market thinks and what it prices before making an investment decision. If the opportunity we see is already captured by the stock price, there might not be additional value in investing.

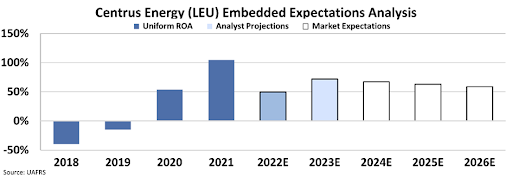

By utilizing our Embedded Expectations Analysis (“EEA”) framework, we can see what investors expect these companies to do at the current stock price.

Stock valuations are typically determined using a discounted cash flow (“DCF”) model, which makes assumptions about the future and produces the “intrinsic value” of the stock.

We know models with garbage-in assumptions based on distorted GAAP metrics only come out as garbage. Therefore, we use the current stock price with our Embedded Expectations Analysis to determine what returns the market expects.

At around $37, the market expects Centrus Energy’s Uniform return on assets to retract back to 2020 levels of 54% from the recent 104%. Analysts seem to agree with the market, forecasting a drop in Uniform ROA to 72% in two years.

Even though the market foresees a drop in profitability, expectations are still high. This could suggest that investors see the trends the company is benefiting from.

If Centrus Energy manages to grow while seeing these strong ROAs, there might be even more upside.

Our EEA framework helps investors understand public opinion and take an investment position accordingly.

SUMMARY and Centrus Energy Corp. Corporation Tearsheet

As the Uniform Accounting tearsheet for Centrus Energy Corp. (LEU: USA) highlights, the Uniform P/E trades at 22.9x, which is above the corporate average of 18.4x and its historical P/E of 19.2x.

High P/E require high EPS growth to sustain them. In the case of Centrus Energy’s, the company has recently shown a 23% increase in Uniform EPS.

Wall Street analysts provide stock and valuation recommendations that in general provide very poor guidance or insight. However, Wall Street analysts’ near-term earnings forecasts tend to have relevant information.

We take Wall Street forecasts for GAAP earnings and convert them to Uniform earnings forecasts. When we do this, Centrus Energy’s Wall Street analyst-driven forecast is a 62% shrinkage and 16% EPS growth in 2022 and 2023, respectively.

Based on the current stock market valuations, we can use earnings growth valuation metrics to back into the required growth rate to justify Centrus Energy’s $38 stock price. These are often referred to as market embedded expectations.

The company is currently being valued as if Uniform earnings were to shrink by 16% annually over the next three years. What Wall Street analysts expect for Centrus Energy’s earnings growth is below what the current stock market valuation requires in 2022 but above its requirement in 2023.

Furthermore, the company’s earning power in 2021 is 17x the long-run corporate average. Moreover, cash flows and cash on hand are 15.9x its total obligations—including debt maturities, capex maintenance, and dividends. Also, the company’s intrinsic credit risk is 310bps above the risk-free rate.

All in all, this signals average credit risk.

Lastly, Centrus Energy’s Uniform earnings growth is in line with its peer averages and above its average peer valuations.

Best regards,

Joel Litman & Rob Spivey

Chief Investment Strategist &

Director of Research

at Valens Research

The Uniform Accounting insights in today’s issue are the same ones that power some of our best stock picks and macro research, which can be found in our FA Alpha Daily newsletters.