Despite the recent decline in LNG prices, American producers are well-positioned to benefit from the inevitable market recovery. Comstock Resources (CRK), a producer with significant acreage in the Haynesville Shale, stands out from the rest due to its ability to operate at a lower cost and transport LNG more affordably. Despite surging returns due to increasing demand for LNG from Europe, Comstock’s stock is undervalued due to the market overestimating the impact of falling prices. In today’s FA Alpha Daily, we’ll use Uniform Accounting to assess the sustainability of Comstock’s returns, even in the face of a potential recession.

FA Alpha Daily:

Tuesday Company Specific

Powered by Valens Research

The natural gas story is not over.

In August of 2022, liquid natural gas (“LNG”) prices were at their highest levels in over a decade.

The Russian invasion of Ukraine caused a spike in demand for non-Russian LNG and has prompted U.S. companies to ship out greater amounts of gas to Europe.

U.S. domestic consumers found themselves competing with overseas customers, pushing up LNG prices from $8 per thousand cubic feet in August 2021 to $16 in August 2022.

Since the LNG price peak in August of 2022, prices have eased, especially over the past eight months.

A warmer-than-normal winter in the EU and shrinking long-term supply concerns from Russia have catalyzed an imbalance between market prices and the costs borne by drilling companies.

Yet, declining prices do not mean the industry is dying.

U.S. LNG production remains strong. In fact, LNG storage in the country is 21% higher than normal at this time of year, implying that inventories will be at a record high moving into the heating season.

While the inventory backlog continues to develop for the producers, and weak prices have brought activity to an arrest; prices are bound to recover in the long run.

Structurally, the U.S. already has the capacity to produce the most LNG in the world and still leads in supply additions through 2030.

We are still building more export terminals to help deliver gas to the rest of the world, and we have more excess capacity than any other nation.

When prices rebound, U.S. producers are going to be ready – producers such as Comstock Resources (CRK).

Comstock is the largest gas producer in the Haynesville Shale, a region known for its proximity to the Gulf of Mexico.

This is important to note, as its access to export facilities in the Gulf will allow it to meet rebounding European demand in the coming years.

The company has 470,000 net acres within the Haynesville region, an incumbent in the location where most LNG shippers are currently attempting to build new export facilities.

Comstock’s cost structure also provides them with a competitive advantage. Positioning in Haynesville has given the company cheaper drilling sites than that available in the Permian Basin. Furthermore, lower transportation costs due to their proximity to export terminals have allowed Comstock to continue immense drilling levels even at current natural gas prices.

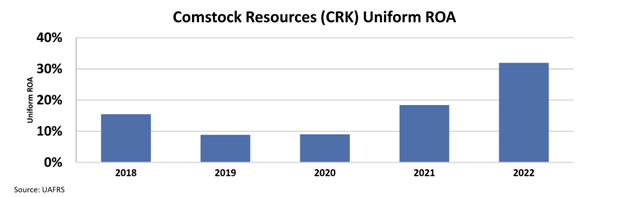

These huge competitive advantages showed themselves as the industry prospered after the pandemic. Comstock’s return on assets (“ROA”) jumped from 9% in 2020 to a massive 32% in 2022.

The company is continuing to demonstrate strong operational performance and is likely to do so as prices remain high.

And yet, the market fails to see the story.

Comstock’s stock is currently trading at a Uniform Price to Book (“P/B”) value of 1.0x, the cheapest it has traded in the last six years. The market is overly pessimistic about the future of natural gas and Comstock’s role in it.

With improvements in scale and positioning, the company deserves to be traded at higher valuations. Combined with its proven ability to ramp up returns in a high-price environment, Comstock is a great FA Alpha 50 name.

Throughout financial market history, many of the world’s most successful investors have been candid in their belief that Generally Accepted Accounting Principles (“GAAP”) distort economic reality.

Warren Buffett, for example, once said investors should “concentrate on the world of companies, not arcane accounting mathematics.”

Investors who neglect the very real issues with as-reported accounting can find themselves caught up in investing with the crowd, blindly following hot “themes” without a thorough grasp of how to understand the businesses in question.

The only true way to focus on the “world of companies,” as Buffett suggests investors do, is to present a clear picture of how a business operates, something that can only be done by adjusting financial statements to reflect the arbitrary nature of certain accounting rules that leave much to discretion.

The world’s best investors understand the need to make these adjustments, which allows them to focus not on picking out the most popular companies but rather on looking for great names in sleepy areas that the market isn’t paying much attention to. From there, the goal is to then identify quality companies with significant growth potential at reasonable prices.

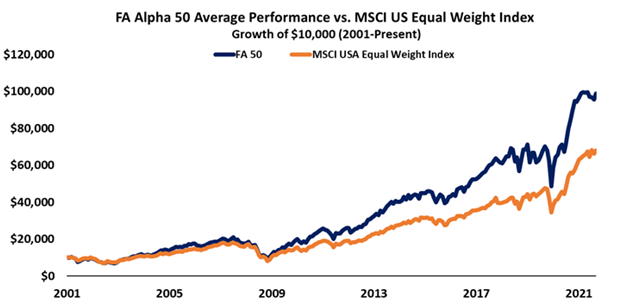

That’s exactly what we’ve set out to do with the FA Alpha, our monthly list of 50 companies that rank at the top for quality, high growth, and low valuations.

This list has outperformed the market by 300 basis points per year for over 20 years now, effectively doubling the performance of the market by focusing on the real fundamentals and valuations of companies with our proprietary Uniform Accounting framework.

See for yourself below.

To see the other 49 names on the list, click here.

Best regards,

Joel Litman & Rob Spivey

Chief Investment Strategist &

Director of Research

at Valens Research

Today’s highlight, Comstock Resources (CRK) is one of the top stock picks from FA Alpha 50 this month. To see more stock picks like this, become an FA Alpha get access to FA Alpha 50.