In a world where artificial intelligence is reshaping industries, Ziff Davis dances to a different tune in the media landscape. While many saw AI as the villain for siphoning away copyrighted content, Ziff Davis spotted an ally. By investing in AI firm Xyla, amidst economic headwinds and skeptical credit ratings, they’re betting on a futuristic content evolution that just might revolutionize digital advertising.

FA Alpha Daily:

Wednesday Credit

Powered by Valens Research

Artificial intelligence (“AI”) was one of the stock market’s biggest influences this year.

In light of this, the future of a company is becoming increasingly tied to its ability to leverage AI.

For the media industry, the increased adoption of AI has had a mixed impact. While some businesses that worked with AI saw an increase in profits, others were concerned about its potential implications.

The primary assets of media organizations became at risk because AI tools can be used for free to obtain copyrighted data that media companies charge for.

Although some businesses argued that they need to sue AI models for profiting off their property, not all of them went in this direction.

These media companies cooperated with AI firms because they recognized an opportunity rather than danger. Ziff Davis (ZD) is a great example for this proactive side in the media industry.

The company offers digital media products such as websites and publications with a major focus in technology and gaming. It generates revenue through numerous ways such as content marketing, subscriptions, and advertising spaces.

Unfortunately, recent macro headwinds like the looming recession and declined spending on marketing has adversely affected the business. Even with this macroeconomic uncertainty however, Ziff Davis found a way to thrive.

The company recently acquired a minority stake in an AI firm called Xyla. With this move, it aims to improve its content using generative AI models to be able to sell more advertising.

However, credit rating agencies seem to be negative about this investment and cannot see how this AI investment would affect the business in the near future. They also seem to be highly worried about a further decline in demand for advertising.

Thus, the company received a “BB” credit rating from S&P, which denotes a high risk of default at around 11% in the next five years. This rating also places the company in the risky high-yield basket.

Oppositely, we think that Ziff Davis should have a higher credit rating considering its investments to grow and improve the business and its current financial strength.

We can figure out if there is a real risk for this company by leveraging the Credit Cash Flow Prime (“CCFP”) to understand how the company’s obligations match against its cash and cash flows.

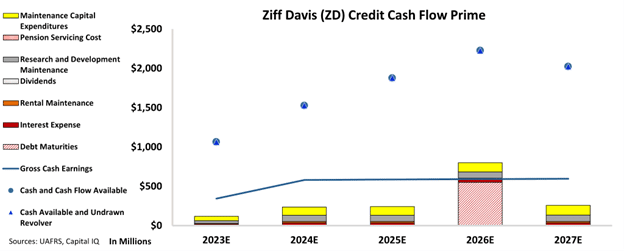

In the chart below, the stacked bars represent the firm’s obligations each year for the next five years. These obligations are then compared to the firm’s cash flow (blue line) as well as the cash on hand available at the beginning of each period (blue dots) and available cash and undrawn revolver (blue triangles).

The CCFP chart indicates that Ziff Davis’ cash flows are more than sufficient to meet all of its financial obligations in the future.

The chart implies that the company has a solid financial foundation and should be able to meet its obligations without difficulty in the next five years.

Given its significant cash flows, the lone debt maturity in 2026 does not seem alarming at all. Moreover, the firm could see an improvement in its profitability as a result of its new investments into generative AI technologies.

Our analysis of Ziff Davis’ financial position reveals that the company does not currently face a significant probability of default, in contrast to the rating agencies’ assessment.

As a result, we give Ziff Davis an “IG4+” rating and place it in the safer investment-grade category. This rating suggests that the company’s risk of default is only about 2%, as opposed to S&P’s 11%.

It is our goal to bring forward the real creditworthiness of companies, built on the back of better Uniform Accounting.

To see Credit Cash Flow Prime ratings for thousands of companies, click here to learn more about the various subscription options now available for the full Valens Database.

SUMMARY and Ziff Davis (ZD:USA) Tearsheet

As the Uniform Accounting tearsheet for Ziff Davis (ZD:USA) highlights, the Uniform P/E trades at 10.7x, which is below the global corporate average of 18.4x and its historical P/E of 14.6x.

Low P/Es require low EPS growth to sustain them. In the case of Ziff Davis, the company has recently shown a 14% Uniform EPS shrinkage.

Wall Street analysts provide stock and valuation recommendations, that in general, provide very poor guidance or insight. However, Wall Street analysts’ near-term earnings forecasts tend to have relevant information.

We take Wall Street forecasts for GAAP earnings and convert them to Uniform earnings forecasts. When we do this, Ziff Davis’ Wall Street analyst-driven forecast is for a -0% and 22% EPS growth in 2023 and 2024, respectively.

Based on the current stock market valuations, we can use earnings growth valuation metrics to back into the required growth rate to justify Ziff Davis’ $65 stock price. These are often referred to as market-embedded expectations.

Furthermore, the company’s earning power in 2022 was 6x the long-run corporate average. Moreover, cash flows and cash on hand are 3x its total obligations—including debt maturities and capex maintenance. The company also has an intrinsic credit risk that is 240bps above the risk-free rate.

Overall, this signals a moderate credit risk.

Lastly, Ziff Davis’ Uniform earnings growth is in line with its peer averages and is trading below its average peer valuations.

Best regards,

Joel Litman & Rob Spivey

Chief Investment Strategist &

Director of Research

at Valens Research

This analysis of Ziff Davis (ZD)’s credit outlook is the same type of analysis that powers our macro research detailed in the member-exclusive FA Alpha Pulse.