The Capex Supercycle has led to increased investments in supply chains and infrastructure, resulting in a higher demand for steel and metallurgical coal. This greatly benefits Warrior Met Coal, a company that mines and sells metallurgical coal to steel manufacturers. In today’s FA Alpha, we discuss how the market misunderstands Warrior Met Coal’s growth potential and the sustainability of its high returns.

FA Alpha Daily:

Tuesday Company Specific

Powered by Valens Research

We have been talking about how big the Capex Supercycle is going to be, and each day we see more proof that that’s the case.

The pandemic showed what ignoring your infrastructure and supply chain causes: extended lead times, canceled orders, supply shocks, and many more…

Now, the U.S. has finally recognized its problems and is investing in the correct areas.

We are making our supply chains more efficient and resilient by renewing our infrastructure. Lots of companies have already started plans to bring their manufacturing facilities home to be closer to the customer.

However, this is only the start of a decade of increasing Capex spending.

In order to discover investment opportunities, we should be looking at where the money flows as investments ramp up.

All the arrows lead in one direction. All these companies need materials to build new facilities and infrastructure, especially steel.

That means we need more products that go into steel, like metallurgical coal. Metallurgical coal is used in basic oxygen furnaces (“BOF”) to make steel initially.

This is great news for Warrior Met Coal (HCC). The company operates mines to produce coal and sells it to steel manufacturers all around the world.

It also sells natural gas, which is extracted as a byproduct of coal production.

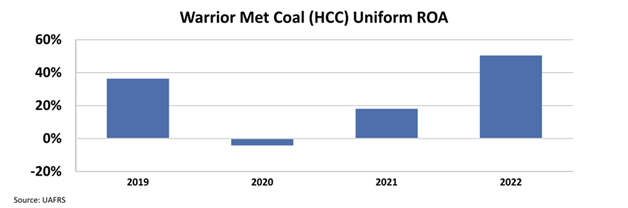

Warrior Met Coal is a fairly new company that was incorporated in 2015, but it turned profitable very quickly. After years of high profitability, it closed 2020 with a loss, as steel production halted during the pandemic.

However, its return on assets (“ROA”) bounced back pretty quickly from -4% in 2020 to 50% in 2022, thanks to the reopening of the economy and increasing coal prices.

As Capex Supercycle plays out in the next decade, we will see more demand for steel and, therefore, for metallurgical coal. Warrior Met Coal is in a strong position to benefit from this trend.

However, the market doesn’t seem to think these levels of returns are sustainable. The stock trades at only 6.4x price-to-earnings (“P/E”), which might be very low for a company that expects increasing demand in the upcoming years.

The market is not recognizing how long these investments will continue, leading to this mispricing.

That is why we think Warrior Met Coal is a great FA Alpha name. It has a high ROA, high growth, and a bright future with sustainable margins.

Throughout financial market history, many of the world’s most successful investors have been candid in their belief that Generally Accepted Accounting Principles (“GAAP”) distort economic reality.

Warren Buffett, for example, once said investors should “concentrate on the world of companies, not arcane accounting mathematics.”

Investors who neglect the very real issues with as-reported accounting can find themselves caught up in investing with the crowd, blindly following hot “themes” without a thorough grasp of how to understand the businesses in question.

The only true way to focus on the “world of companies,” as Buffett suggests investors do, is to present a clear picture of how a business operates, something that can only be done by adjusting financial statements to reflect the arbitrary nature of certain accounting rules that leave much to discretion.

The world’s best investors understand the need to make these adjustments, which allows them to focus not on picking out the most popular companies but rather on looking for great names in sleepy areas that the market isn’t paying much attention to. From there, the goal is to then identify quality companies with significant growth potential at reasonable prices.

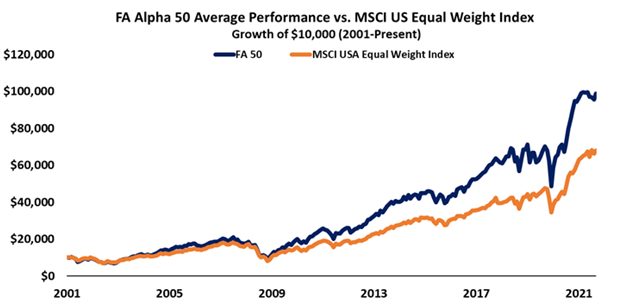

That’s exactly what we’ve set out to do with the FA Alpha, our monthly list of 50 companies that rank at the top for quality, high growth, and low valuations.

This list has outperformed the market by 300 basis points per year for over 20 years now, effectively doubling the performance of the market by focusing on the real fundamentals and valuations of companies with our proprietary Uniform Accounting framework.

See for yourself below.

To see the other 49 names on the list, click here.

Best regards,

Joel Litman & Rob Spivey

Chief Investment Strategist &

Director of Research

at Valens Research

Today’s highlight, Warrior Met Coal, Inc. (HCC) is one of the top stock picks from FA Alpha 50 this month. To see more stock picks like this, become an FA Alpha get access to FA Alpha 50.