Consumers are feeling the strain as inflation, rising debt, and new tariffs cut into spending power. Yet some companies are weathering the turbulence better than expected. In today’s FA Alpha Daily, we explore how Campbell’s (CPB) has stayed resilient and why it may remain a defensive choice for investors.

FA Alpha Daily

Powered by Valens Research

America’s consumer-driven economy has faced increasing pressure thus far this year, as inflation, high levels of debt, unfavorable interest rates, and tariff-induced volatility has either raised prices or shrunk spending power.

The U.S. is currently sitting at an enormous amount of consumer debt totaling $18.4 trillion as of the second quarter of this year. Lower-income households aren’t the only ones fueling this rise.

Higher income earners are being squeezed as well, as it’s been reported that Americans who make over $150,000 annually are falling behind on their credit card and auto loan payments, resulting in their delinquency rates surging nearly 20% over the past couple of years.

Meanwhile, high inflation continues to persist, sitting at 3% as of September, above the Fed’s target of 2%.

Tariffs have added more volatility to the consumer as well, raising the prices of goods ranging from steel and aluminum to even food products.

With consumers facing pressure from multiple directions, firms like The Campbell’s Company (CPB) have had to navigate a volatile business environment.

Campbell’s is a consumer staples firm primarily known for its canned soup, sauces, and snacks.

This year, the company navigated the impacts of tariffs on the different aspects of its business, which includes the imported steel and aluminum used for its packaging and even the tariffs applied to its pasta sauce offering imported from Italy.

Campbell’s managed rising costs through a combination of price increases and close coordination with suppliers.

As a result, the firm has managed to remain stable amid wider economic turbulence. During the first quarter of fiscal year 2026, the company generated revenues of $2.7 billion, beating analyst estimates by $40 million.

Campbell’s also announced its acquisition of a 49% stake in La Regina, an Italy-based tomato processor known for making Rao’s pasta sauce with a manufacturing facility in Alma, Georgia. According to reports, this acquisition is expected to spur product development.

While there’s no denying consumers are under mounting pressure, Campbell’s has historically done well regardless of economic cycles, making it a defensive option for investors.

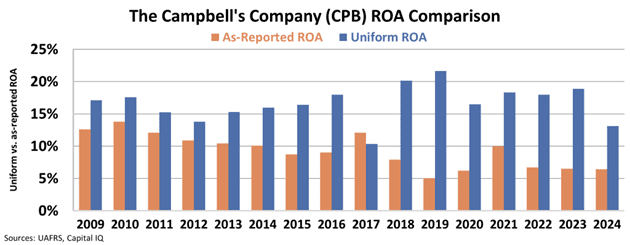

Since 2009, the company has consistently delivered stable returns, far outpacing as-reported numbers. As a result, investors who rely on the latter have underestimated just how profitable the company is.

The same observation still holds. With prices rising and consumers looking for affordable products, Campbell’s could be a defensive option for investors averse to volatility.

Best regards,

Joel Litman & Rob Spivey

Chief Investment Officer &

Director of Research

at Valens Research

Today’s analysis highlights the same insights we share with our FA Alpha Members. If you want to an get in-depth analysis of market trends and uncover undervalued stocks, become an FA Alpha Member today.