Consumer discretionary companies often face challenges during economic downturns as consumers prioritize spending on essentials and cut back on non-essential items. However, companies like Malibu Boats stand out in this sector due to several factors. In today’s FA Alpha Daily, let us visit how their sales remained strong making them less susceptible to the typical downturn patterns of the broader sector.

FA Alpha Daily:

Tuesday Company Specific

Powered by Valens Research

Consumer discretionary companies typically experience a downturn during recessions because their products and services are considered non-essential.

In times of economic hardship, consumers prioritize spending on necessities like food, housing, and healthcare, and reduce or delay purchases of discretionary items such as luxury goods, travel, and dining out.

As household budgets tighten, the demand for the discretionary sector’s offerings declines, often leading to reduced sales and profits for these companies.

Moreover, consumer confidence tends to wane during such periods, further exacerbating the cutback on spending in non-essential categories.

Yet, not all consumer discretionary companies are painted with the same brush during economic downturns. This is where entities like Malibu Boats (MBUU) stand apart, carving a niche that defies the typical downturn patterns of the broader sector.

Malibu Boats is a leading designer, manufacturer, and marketer of performance sport boats primarily used for water sports, such as water skiing, wakeboarding, and wake surfing.

The company has the potential to weather a recession due to several resilient factors in its business model and market positioning.

First, its customer base predominantly consists of affluent individuals who are less likely to be significantly impacted by economic downturns, sustaining demand for luxury leisure items like high-end sport boats.

Additionally, the company’s strong brand reputation and loyalty could lead to continued sales through repeat customers and referrals. Malibu’s diverse product line allows for flexibility in pricing and features, appealing to a wider range of budgets during tighter economic conditions.

Furthermore, the company’s lean operational structure and strong balance sheet with adequate liquidity can provide the financial stability needed to navigate through periods of reduced consumer spending.

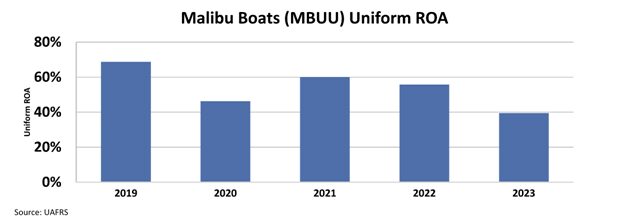

Malibu Boats has shown strong profitability during economic downturns in the past as well. Looking at 2020, during the pandemic, Malibu Boats had a Uniform return on assets (“ROA”) of 46%, shrinking from 69% in 2019.

The chart shows that the company performed well during a very difficult economic climate for discretionary spending. Clearly, if another economic downturn were to happen Malibu Boats should fare well again.

And yet, the market fails to recognize this opportunity.

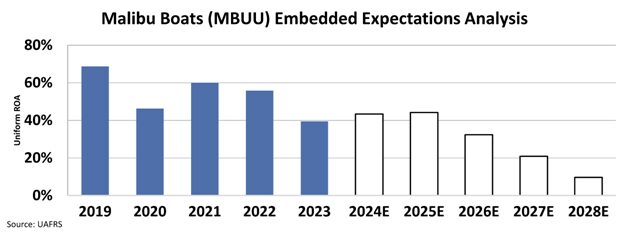

We can see this through our Embedded Expectations Analysis (“EEA”) framework.

The EEA starts by looking at a company’s current stock price. From there, we can calculate what the market expects from the company’s future cash flows. We then compare that with our own cash-flow projections.

In short, it tells us how well a company has to perform in the future to be worth what the market is paying for it today.

At the current stock price, the market expects the company’s ROA to fall below 10%, assuming the demand will collapse.

The company’s second-lowest Uniform ROA was seen in 2020 but didn’t even fall below the 40% mark. Yet, the market thinks Malibu Boats will hit Uniform ROA figures never seen in its history.

Given the company’s strong niche in the consumer discretionary sector, these expectations seem overly pessimistic.

Yes, Malibu Boats can be hurt by economic downturns but the market is pricing in an overly dramatic fall from grace for the company.

Malibu Boats knows how to deal with economic downturns so these harsh market expectations give the company serious potential for upside.

That is why Malibu Boats showed up on our screen. The company makes a great FA Alpha 50 name due to its potential for high returns and low expectations from the market.

Throughout financial market history, many of the world’s most successful investors have been candid in their belief that Generally Accepted Accounting Principles (“GAAP”) distort economic reality.

Warren Buffett, for example, once said investors should “concentrate on the world of companies, not arcane accounting mathematics.”

Investors who neglect the very real issues with as-reported accounting can find themselves caught up in investing with the crowd, blindly following hot “themes” without a thorough grasp of how to understand the businesses in question.

The only true way to focus on the “world of companies,” as Buffett suggests investors do, is to present a clear picture of how a business operates, something that can only be done by adjusting financial statements to reflect the arbitrary nature of certain accounting rules that leave much to discretion.

The world’s best investors understand the need to make these adjustments, which allows them to focus not on picking out the most popular companies but rather on looking for great names in sleepy areas that the market isn’t paying much attention to. From there, the goal is to then identify quality companies with significant growth potential at reasonable prices.

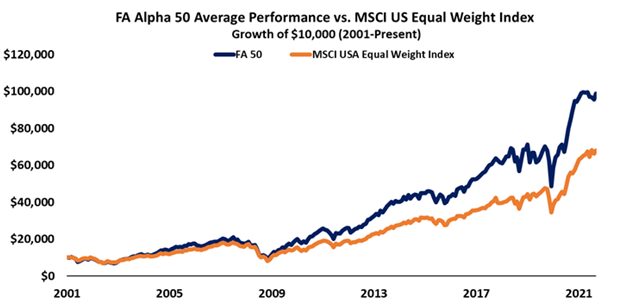

That’s exactly what we’ve set out to do with the FA Alpha, our monthly list of 50 companies that rank at the top for quality, high growth, and low valuations.

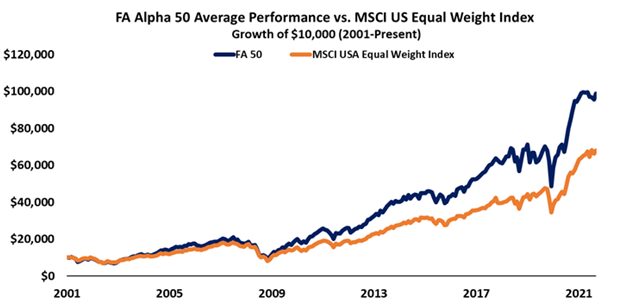

This list has outperformed the market by 300 basis points per year for over 20 years now, effectively doubling the performance of the market by focusing on the real fundamentals and valuations of companies with our proprietary Uniform Accounting framework.

See for yourself below.

To see the other 49 names on the list, click here.

Best regards,

Joel Litman & Rob Spivey

Chief Investment Strategist &

Director of Research

at Valens Research

Today’s highlight, Malibu Boats (MBUU) is one of the top stock picks from FA Alpha 50 this month. To see more stock picks like this, become an FA Alpha and get access to FA Alpha 50.