As the world reopens, consumers become more eager to spend on trips rather than their homes, quickly affecting those stocks that have benefitted from the “At-Home Revolution” despite their strong competitive moats. So while as-reported metrics may discount RH (RH), an upscale furniture company, today’s FA Alpha Daily will unravel the company’s actual performance.

FA Alpha Daily:

Tuesday Company Specific

Powered by Valens Research

The “At-Home Revolution” (AHR) has quickly turned into the “Revenge Vacation Rebellion” in the last 12 months, with 71% of Americans intending to travel in 2021. Pretty much companies that benefitted from the At-Home Revolution have now been left in the dust as folks look to spend time out of the home.

World travelers have been making up for lost time as the world reopens. This coupled with durable goods companies suffering delays from supply chain issues has created the perfect storm for a decline.

With this decline, there are two categories of AHR companies that have fallen victim. In the first, many names have been rightly punished, as they were selling promises that they could not keep.

But many great companies that were successful long before the pandemic are the second victims being looped in with those losers.

A great example of that is RH, which is an upscale furniture company with expansive showrooms in unique and distinguished galleries across major cities.

Their ROA seemed doomed in 2017. But the company bounced back with some strategic brand management and business transformation.

Its move to a subscription business was a key component that led to a steady income stream and loyal customer base. By becoming an RH Member, customers pay a fee for discounts, making them loyal customers and ensuring RH takes home consistent subscription fees.

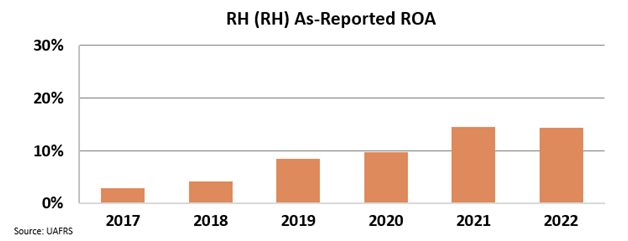

When looking at as-reported ROA, this post-2017 transformation is evident, but projected to plateau. 2021 and 2022 as reported returns hover at 14%, just above the corporate average.

These GAAP metrics coupled with the puttering At Home Revolution paint RH as another average offering. However, it has the small problem of being totally untrue.

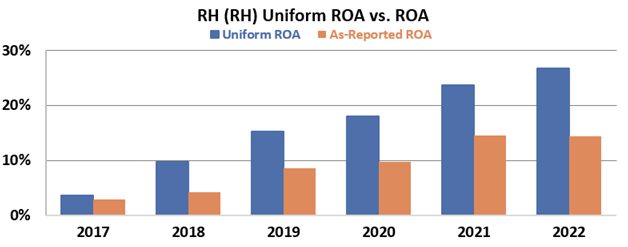

When Uniform Accounting cleans up this distorted picture, it is shown that RH’s ROA has been steadily climbing without any plateauing of returns. Furthermore, since the pandemic, returns have soared well above the corporate average of 12%.

Uniform ROA is almost two times what as-reported reflect, at 27% last year. It’s forecasted to remain above 23% this year and next.

On top of that, the company grew by 40% in 2022. This shows the pandemic did unlock significant growth even while the company has maintained strong returns.

And yet the market has unfortunately priced it at a lowly 12x P/E. By lumping RH in with other AHR names, even though RH’s returns were due to factors other than the pandemic, investors are missing out on the name.

RH is a high return and strong moat business. Combined with high growth and low P/E it is a great FA Alpha name.

Throughout financial market history, many of the world’s most successful investors have been candid in their belief that Generally Accepted Accounting Principles (“GAAP”) distort economic reality.

Warren Buffett, for example, once said investors should “concentrate on the world of companies, not arcane accounting mathematics.”

Investors who neglect the very real issues with as-reported accounting can find themselves caught up investing with the crowd, blindly following hot “themes” without a thorough grasp of how to understand the businesses in question.

The only true way to focus on the “world of companies,” as Buffett suggests investors do, is to present a clear picture of how a business operates, something that can only be done by adjusting financial statements to reflect the arbitrary nature of certain accounting rules that leave much to discretion.

The world’s best investors understand the need to make these adjustments, which allows them to focus not on picking out the most popular companies, but rather on looking for great names in sleepy areas that the market isn’t paying much attention to. From there, the goal is to then identify quality companies with significant growth potential at reasonable prices.

That’s exactly what we’ve set out to do with the FA Alpha, our monthly list of 50 companies that rank at the top for quality, high growth, and low valuations.

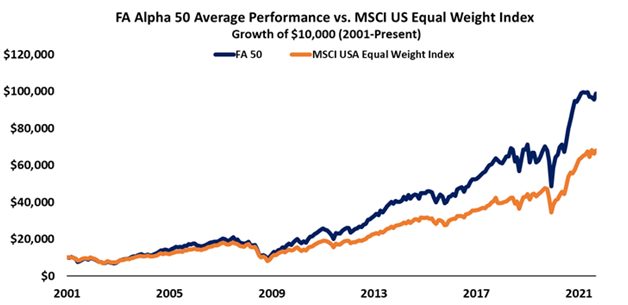

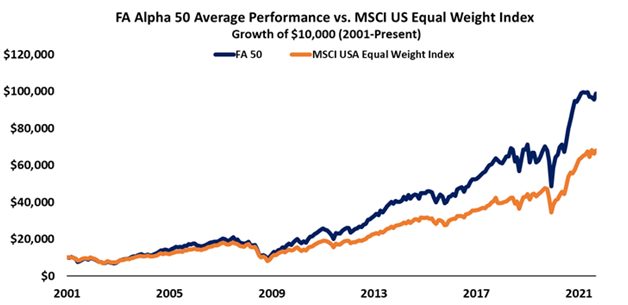

This list has outperformed the market by 300 basis points per year for over 20 years now, effectively doubling the performance of the market by focusing on the real fundamentals and valuations of companies with our proprietary Uniform Accounting framework.

See for yourself below.

To see the other 49 names on the list, click here.

Best regards,

Rob Spivey

Director of Research

at Valens Research

Today’s highlight, RH (RH), is one of the top stock picks from FA Alpha 50 this month. To see more stock picks like this, get access to FA Alpha 50.