Indian families are flocking to buy gold and demand in the country hit an all-time peak in 2021. Today’s FA Alpha Daily will dig in why gold should be avoided despite inflationary fears.

FA Alpha Daily:

Monday Macro

Powered by Valens Research

The pandemic hit India hard. Many people lost their jobs and struggled to make ends meet. But even through the worst of it all, demand for gold remained strong.

In fact, India has been a consistent buyer of gold, second only to China in terms of market size. On average, a typical Indian family holds 11% of their wealth in gold. It’s seen as a popular way to store undeclared wealth.

India has also rushed to renew its love for gold with the world’s reopening. Between festivals like Diwali and parties like weddings once again taking place, there have been more opportunities to wear elaborate jewelry and give gold as a traditional gift.

In 2021, Indian demand for gold hit an all-time peak. The country was in the market for 340 tons of precious metal. That beats out the levels reported in 2010 and 2012, the prior peaks of demand.

Indian families currently hold 22,500 tons of gold. At current prices, that’s worth about $1.4 trillion, roughly 5 times the amount held in the U.S.

Outside of Indian markets, gold often rises during times of inflationary concern.

Many called for gold prices to rocket higher throughout 2021 due to growing concerns around inflation.

Historically, people have turned to gold as a hedge in times of uncertainty. When you look at times of geopolitical concerns, there are short-term spikes in prices after global conflicts, such as 9/11 or the attack on Pearl Harbor. In short, when people are nervous about the state of the world or inflation, they buy gold.

But today, even after gold prices increased due to geopolitical concerns over Ukraine, it is barely higher than it was at the end of 2020, and it’s still far off from the high prices in August 2020.

While Indian families may be flocking to buy gold, this is not the traditional “currency debasing” inflation that ruins economies. In Germany during the 1930s or Zimbabwe in the 1990s, rampant inflation was caused by the government printing their currencies into oblivion.

The inflation we’re seeing right now is about supply and demand. There aren’t enough materials and services to feed people’s demand in the short term.

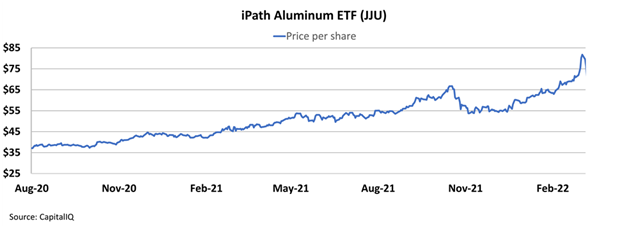

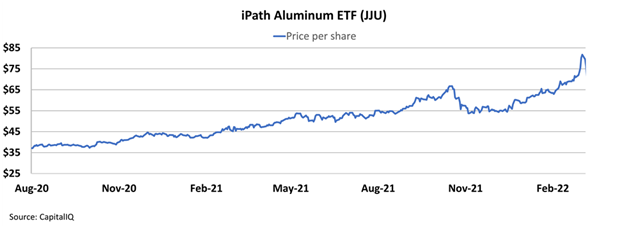

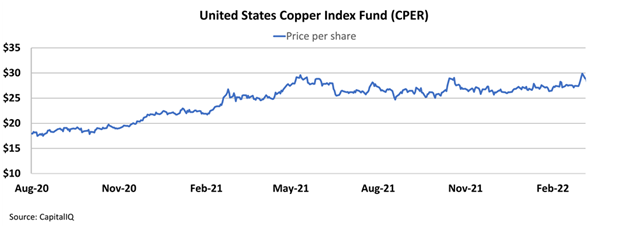

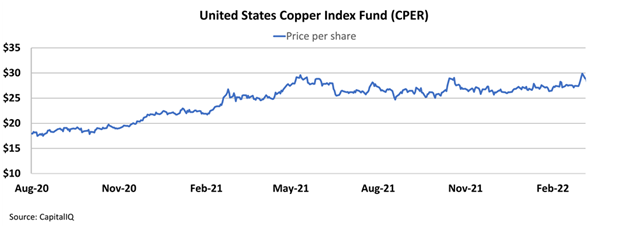

When you look at the chart of individual metals, like aluminum or copper, these metals sit at high levels. The economy is growing due to demand, and that’s responsible for driving this inflation.

As the world opens back up, there’s also been an increase in demand, and that’s why prices are going up.

Furthermore, as supply grows to match the heightened demand, prices will decrease. Barring more political issues, gold might continue to be a disappointing asset.

Take PepsiCo (PEP) as an example. If you bought the stock fifty years ago, not only are you entitled to the cash flows of Pepsi, but today you would also have its portfolio of well-known brands, like Frito-Lay, Quaker Oats, and Doritos. You would also have Taco Bell, Pizza Hut, and KFC from the Yum Brands (YUM) shares spun out from the company as well.

Meanwhile, If you bought a piece of gold fifty years ago, you would have still had the same piece today.

While gold may have been a good investment in the 1930s in Germany or Zimbabwe in the 1990s, when their currency was incredibly devalued, it’s better today to put your money into the stock market, which has consistently outperformed gold over the long term.

Best regards,

Joel Litman & Rob Spivey

Chief Investment Strategist &

Director of Research

at Valens Research

To see our best macro insights, get access to FA Alpha Pulse.