FA Alpha Daily:

Thursday Uniform accounting analysis

Powered by Valens Research

Russia’s invasion of Ukraine created huge supply shocks in many industries.

The most major impacts have been seen in the agricultural and energy space though.

Prices soared and companies saw problems with their supply chains as a big part of the world’s wheat, oil, and natural gas supply became suddenly unavailable.

As bad as it seems for the consumers, this gave rise to new opportunities for the corporate world.

The U.S., sitting on an incredible amount of shale, now has a huge chance to emerge as the main supplier for Europe.

Whether it is companies that extract natural gas or transport it, they have already started to recognize surging profitability this year thanks to rising prices.

One big winner was Golar LNG (GLNG). The company engages in the operation and chartering of liquified natural gas (“LNG”) carriers.

Naturally, it is a cyclical business that is highly exposed to commodity prices. The more valuable LNG is, the better the business.

Golar has seen its profitability jump immensely in the modern era of high demand and high LNG prices.

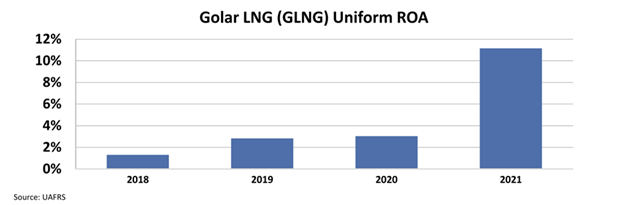

Its Uniform return on assets (“ROA”) has jumped from as low as 3% in 2020 to 11% in 2021.

However, the market is looking out for the developments and ringing the alarm bells.

Chinese shipyards are booming with new LNG tanker orders after builders in South Korea are full up. The order book for new ships jumped 95% in only a year.

This means that the global tanker fleet will grow by around 50%, and more competition for Golar might mean less profitability.

The market seems to be recognizing this and thinking prices are going to crash on the open market in 2023 and beyond.

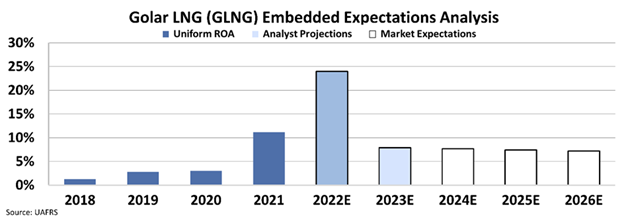

We can see this by utilizing our Embedded Expectations Analysis (“EEA”) framework and seeing what investors expect these companies to do at the current stock price.

Stock valuations are typically determined using a discounted cash flow (“DCF”) model, which makes assumptions about the future and produces the “intrinsic value” of the stock.

We know models with garbage-in assumptions based on distorted GAAP metrics only come out as garbage. Therefore, we use the current stock price with our Embedded Expectations Analysis to determine what returns the market expects.

At $22 per share, the market is expecting ROA to crash together with prices and go back to 7% with an immense drop.

However, the market misses one crucial point.

Limited LNG capacity means we are going to see huge lines for tankers to import. This will probably slow down the pace of LNG moving on the ocean.

We are not going to see these soaring prices go away just because we have more tankers.

On the contrary, we could see higher rates for longer, unfortunate for consumers.

Considering these facts, the market expectations seem overly pessimistic for Golar, which might mean upside potential.

SUMMARY and Golar LNG Limited CorporationTearsheet

As the Uniform Accounting tearsheet for Golar LNG Limited (GLNG:USA) highlights, the Uniform P/E trades at 9.7x, which is below the corporate average of 18.4x and its historical P/E of 20.7x.

High P/Es require high EPS growth to sustain them. In the case of Golar, the company has recently shown a 222% shrinkage in Uniform EPS.

Wall Street analysts provide stock and valuation recommendations that in general provide very poor guidance or insight. However, Wall Street analysts’ near-term earnings forecasts tend to have relevant information.

We take Wall Street forecasts for GAAP earnings and convert them to Uniform earnings forecasts. When we do this, Golar’s Wall Street analyst-driven forecast is a 260% EPS growth in 2022 and an 83% shrinkage in 2023.

Based on the current stock market valuations, we can use earnings growth valuation metrics to back into the required growth rate to justify Golar’s $23 stock price. These are often referred to as market embedded expectations.

The company is currently being valued as if Uniform earnings were to shrink by 8% annually over the next three years. What Wall Street analysts expect for Golar’s earnings growth is above what the current stock market valuation requires in 2022 but below its requirement in 2023.

Furthermore, the company’s earning power is 2x its long-run corporate average. Moreover, cash flows and cash on hand are below its total obligations—including debt maturities, capex maintenance, and dividends. Also, the company’s intrinsic credit risk is 430bps above the risk-free rate.

All in all, this signals average credit risk.

Lastly, Golar’s Uniform earnings growth is above its peer averages but below its average peer valuations.

Best regards,

Joel Litman & Rob Spivey

Chief Investment Strategist &

Director of Research

at Valens Research

The Uniform Accounting insights in today’s issue are the same ones that power some of our best stock picks and macro research, which can be found in our FA Alpha Daily newsletters.