In February, Northwestern Mutual Wealth Management CIO Brent Schutte observed that the market’s current optimism stems from investors having factored in recession risks, as he believes that widespread expectations of a recession often align with its avoidance. This sentiment is intertwined with the notion that artificial intelligence (AI) mania has played a significant role in driving the stock market this year. Furthermore, Investor sentiment shifted in late May and early June as inflation showed signs of calming and investors became more confident in the Fed’s ability to achieve a soft landing. In today’s FA Alpha Daily, let’s discuss how some believe recession fears are subsiding and why it is important to remember that it is not a foregone conclusion.

FA Alpha Daily:

Monday Macro

Powered by Valens Research

It wasn’t just the “Big Six” AI firms rallying. The Russell 2000 small-cap index rose 14% from the end of May to the end of July.

The market was laughing in the face of the most well-telegraphed recession ever. It looked like this time was finally different

Any investor worth their salt should know not to fall into that trap.

That’s why, just a week before the recent market peak, we laughed when we saw a tweet highlighting this January 2008 Wall Street Journal quote:

“It is hard to imagine any time in history when such rampant pessimism about the economy has existed with so little evidence of serious trouble.”

When you read headlines like that from right before the Great Recession, warning bells should sound in your head.

Maybe this time isn’t that different after all.

That’s exactly what the credit markets – and specifically the Fed Funds futures market – are warning us.

The Fed Funds futures market is where big-money investors go to hedge their credit risk. These are highly liquid markets where more than $500 billion in notional value trades in any given day.

Said another way, this isn’t a place where casual punters can push the market around. So when we see extreme signals from them, it’s a surefire sign that deep-pocketed investors are telling the market something.

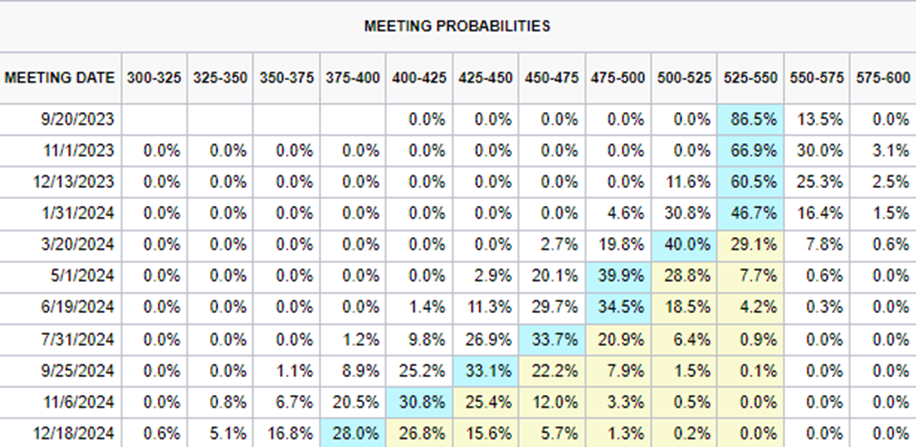

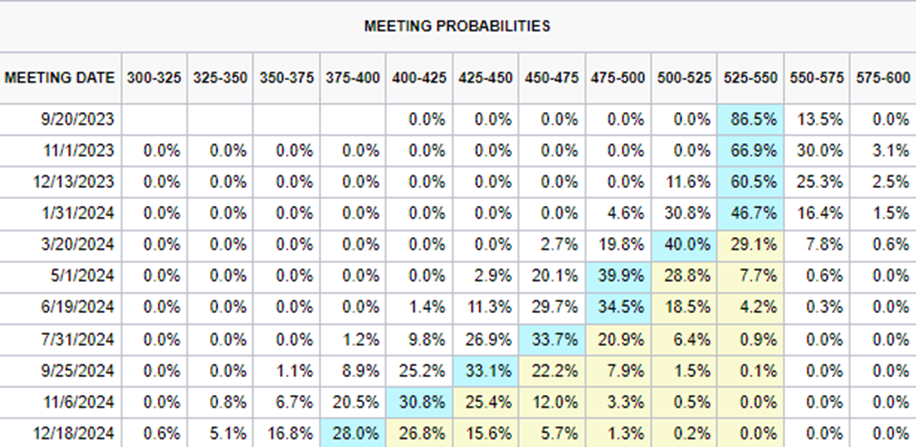

Right now, the market is predicting that the Fed will have to cut interest rates by 150 basis points (“bps”) by 2024. That’s six cuts over eight meetings.

Take a look below.

The market is betting the Fed’s target rate will drop from a range of 525bps to 550bps, down to a range of 375bps to 400bps.

The Fed lowers interest rates when it needs to stimulate the economy. If the economy has a soft landing, the central bank is going to be much slower to lower rates.

Fed regional presidents and Chair Jerome Powell keep repeating the phrase “higher for longer” when discussing interest rates. They’re saying if the economy is doing well, they’ll keep rates high to make sure inflation is stamped out.

We usually only get significant cuts during recessions when the economy desperately needs the Fed to step in and encourage spending.

As this year’s rally shows, equity investors are pretending this won’t be the case. But if we want a reliable recession signal, the last place we’d look is the equity markets.

The credit markets are always better at forecasting risk.

Over the next few quarters, credit markets will remain tight and companies will continue struggling to refinance. Signals like this confirm our view.

And that’s why we keep reminding investors to be cautious and patient when investing in the current environment.

Best regards,

Joel Litman & Rob Spivey

Chief Investment Strategist &

Director of Research

at Valens Research

To see our best macro insights, become an FA Alpha and get access to FA Alpha Pulse.