Today’s FA Alpha Daily will zero in on KKR & Co. Inc. (KKR),, one of the most prominent private equity firms, and how it was able to amass wealth with the carried interest loophole.

FA Alpha Daily:

Tuesday Company Specific

Powered by Valens Research

Huge deals and controversial buyouts put private equity firms and their managers at the forefront of the discussion in the financial industry for many years.

The subject of numerous magazines, books, and movies, private equity firms were on the headlines, especially when they couldn’t succeed.

A particularly public failure was when KKR, one of the largest private equity firms completed the historical leveraged buyout deal of RJR Nabisco for a then-record $25 billion in 1989. However, the combined private business failed to add any value for those involved. The conglomerate split again in 1999.

The fallout from the buyout continued for many years, and led to immense debt loads for the company and thousands of employees losing their jobs.

Nearly all of the major private equity players became involved in the deal and the famous book “Barbarians at the Gate” was written and then turned into a film covering the turmoil that ensued. However, these kinds of spectacular deals aren’t the only thing putting private equity in the spotlight.

Every time there is a discussion about reforming the U.S. tax code, one of the biggest debates is around the carried interest loophole.

This loophole lets private equity managers take a significant amount of their annual income in the form of capital gains, allowing them to lower their tax bills significantly.

Many view it as a total mis-alignment, driving private equity firms to make wild deals like RJR Nabisco. Meanwhile, others looking at the income statements of the private equity firms themselves might wonder if it’s that big of a deal.

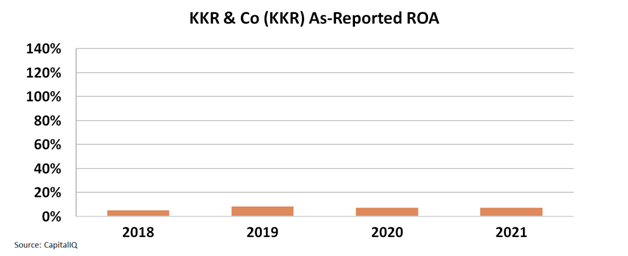

After all, on an as-reported basis, private equity firms aren’t that profitable.

Looking at KKR itself, it only generated a modest 7% as-reported return-on-asset (ROA) in 2020, not exactly the kind of profitability that leads to massive payouts.

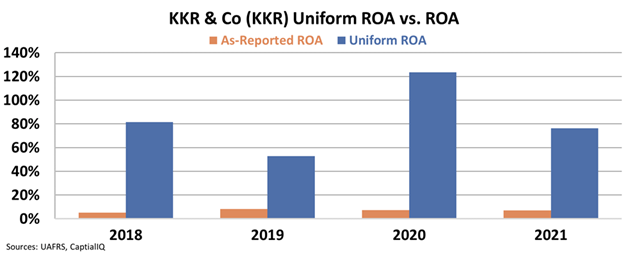

But a closer look, using Uniform Accounting, shows why people are outraged. In reality, these are amazingly profitable firms, enriching those who work there.

Using Uniform Accounting we can see that KKR generated a 76% ROA in 2020, and that isn’t even its highest ROA in the past several years, as in 2019 it generated a staggering 124% ROA.

Furthermore, tax reformers are likely to be even more frustrated at how these barons are growing their firms at the same time. Last year KKR alone grew by 70%, showing not only that it could generate massive gains, but redeploy those gains into growing its business.

And yet, as Uniform metrics show, the company trades at a modest 9x Uniform P/E, well below the as-reported 14x levels and the market average of around 20x. Even in face of these outsized returns, the market is failing to recognize how underpriced the firm is.

While those who think taxation should be fairer may not like it, as Uniform Accounting shows, this is a truly great company for investors to be involved in, with high ROA, high growth, and low P/Es. This is why it’s included in the FA Alpha 50.

Throughout financial market history, many of the world’s most successful investors have been candid in their belief that Generally Accepted Accounting Principles (“GAAP”) distort economic reality.

Warren Buffett, for example, once said investors should “concentrate on the world of companies, not arcane accounting mathematics.”

Investors who neglect the very real issues with as-reported accounting can find themselves caught up investing with the crowd, blindly following hot “themes” without a thorough grasp of how to understand the businesses in question.

The only true way to focus on the “world of companies,” as Buffett suggests investors do, is to present a clear picture of how a business operates, something that can only be done by adjusting financial statements to reflect the arbitrary nature of certain accounting rules that leave much to discretion.

The world’s best investors understand the need to make these adjustments, which allows them to focus not on picking out the most popular companies, but rather on looking for great names in sleepy areas that the market isn’t paying much attention to. From there, the goal is to then identify quality companies with significant growth potential at reasonable prices.

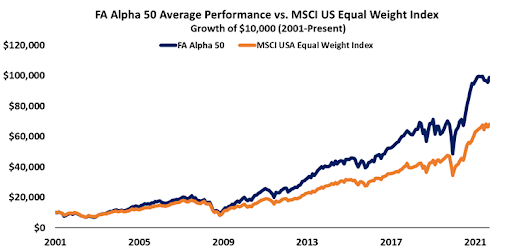

That’s exactly what we’ve set out to do with the FA Alpha, our monthly list of 50 companies that rank at the top for quality, high growth, and low valuations.

This list has outperformed the market by 300 basis points per year for over 20 years now, effectively doubling the performance of the market by focusing on the real fundamentals and valuations of companies with our proprietary Uniform Accounting framework.

See for yourself below.

If you’re interested in seeing the other 49 names on this month’s FA Alpha, click here to learn more.

Best regards,

Joel Litman & Rob Spivey

Chief Investment Strategist &

Director of Research

at Valens Research

Today’s highlight, KKR & Co. Inc. (KKR) is one of the top stock picks from FA Alpha 50 this month. To see more stock picks like this, get access to FA Alpha 50.