Banks have tightened their lending standards for the sixth consecutive quarter, making it hard for companies to borrow money. With a significant amount of junk bonds maturing in the next 36 months, we could expect more defaults and bankruptcies in the near future. This could cause the credit market to seize up.

FA Alpha Daily:

Monday Macro

Powered by Valens Research

Neither investors nor banks want junk bonds, and companies still need them.

With interest rates rising above 5%, investors have more opportunities to get a good yield than in years past.

It used to be that if investors wanted a high yield, they needed to turn to junk bonds. U.S. Treasury bonds and investment-grade bonds could barely keep up with inflation, while junk bonds could offer investors yields above 7%.

That gap is narrowing. Some investors are fine taking a 5% yield for U.S. Treasurys, considering how much safer that is than a junk bond yielding just a few percentage points more.

So demand for new junk bonds is falling.

Companies recognize this, but there’s not much they can do about it. It’s just not feasible for companies to raise yields as fast as interest rates are rising.

And worse yet, some companies don’t even have a choice. This quarter, banks once again tightened their lending standards.

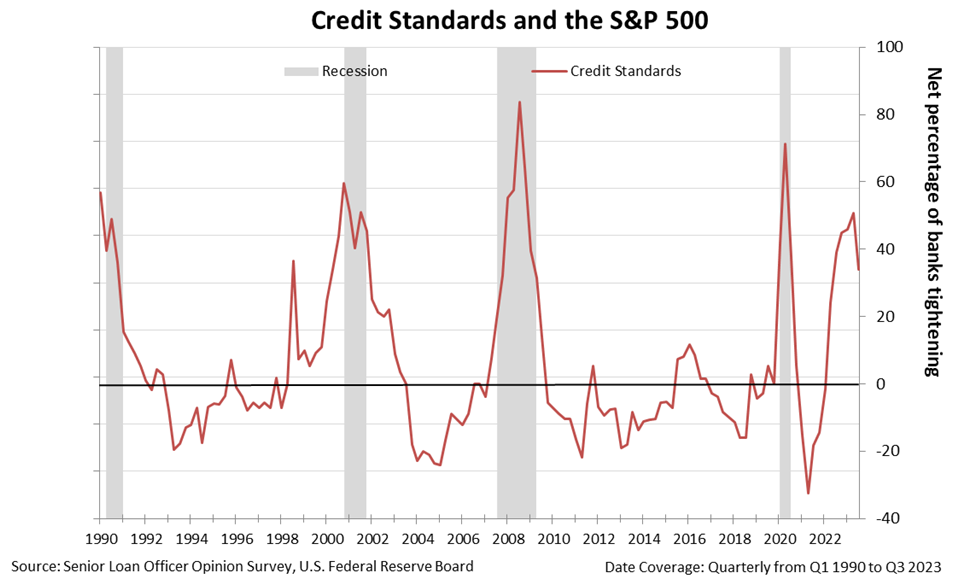

We can see this via the Senior Loan Officer Opinion Survey (“SLOOS”). It’s one of our favorite ways to track credit standards.

The SLOOS is a quarterly survey from the Federal Reserve. In short, it gathers information about lending practices in the U.S… by asking loan officers if their lending rules have tightened, eased, or remained unchanged in the past three months.

During the second quarter, 51% of banks indicated they’ve made their lending standards stricter. And in the third quarter, 34% of banks tightened their standards even more.

That’s the sixth consecutive quarter of tightening lending standards.

Remember that this has compounding effects. Even though the number of banks that tightened was lower this quarter, overall lending was already much tighter.

So it’s going to keep getting harder for companies to borrow money.

This is the biggest reason junk bonds aren’t flowing like they used to… banks aren’t willing to underwrite them.

And this is coming at a bad time. Today, the amount of junk bonds coming due within the next 36 months is as high as it was in 2007, right before the Great Recession.

Companies are going to need to figure something out soon. And if the banks aren’t willing to lend, that’s likely to mean more defaults and bankruptcies.

Unless lending standards ease drastically in the coming quarter, we’re on the verge of the credit market completely seizing up.

Remember, defaults and bankruptcies force banks to be more prudent with their lending. We’ve already started to see some high-profile bankruptcies announced… and by the looks of it, more junk bond issuers could be joining in soon.

Best regards,

Joel Litman & Rob Spivey

Chief Investment Strategist &

Director of Research

at Valens Research

To see our best macro insights, become an FA Alpha and get access to FA Alpha Pulse.