C&I loan growth is a crucial economic health indicator for corporate investment, as it shows how companies fund capital projects instead of relying on cash flows. This provides insight into their investment and outlook. Today’s FA Alpha Daily takes a closer look at current C&I loan growth and its implications for investors.

FA Alpha Daily:

The Monday Macro Report

Powered by Valens Research

Corporate investment is one of the most important economic health indicators.

To track this metric, we look at something called commercial and industrial (C&I) loan growth. Companies use C&I loans to fund capital projects instead of relying on cash flows. So C&I loan growth can tell us a lot about investment and the corporate outlook.

At its heart, economic growth is powered by credit cycles.

When credit availability is improving and anyone who needs a loan can get one, it’s easy for companies to refinance and borrow for growth. That leads to strong gross domestic product (“GDP”) growth and a bull market.

On the other hand, when credit availability is tight and demand is declining, the economy contracts.

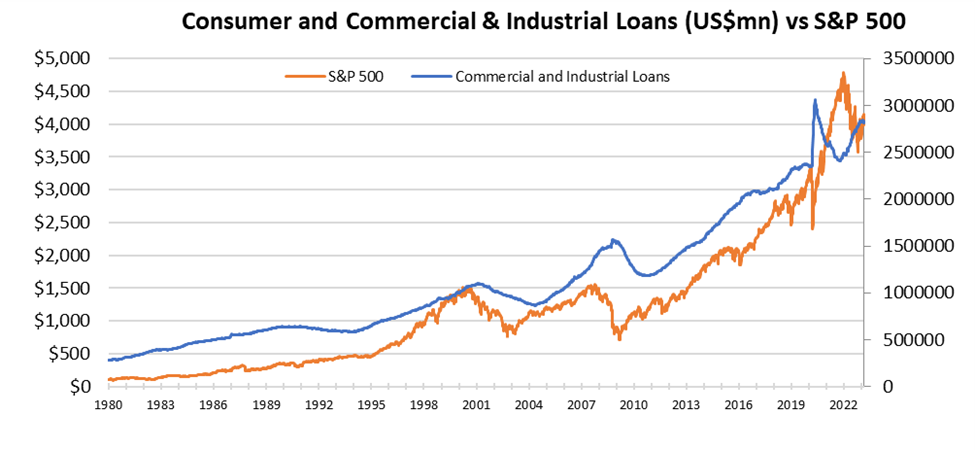

C&I loans can be a driver of economic activity. The market often tends to follow it closely. That’s what happened in every major bear market for the past 30 years.

In 1990, 2000, 2008, and 2020, C&I loans declined. And in each of those years, we saw recessions at the exact same time. Declining loans had ripple effects across the economy.

As you can see, the S&P 500 closely tracks C&I loan growth activity.

And it goes both ways… When C&I loan shrinkage bottoms out, it’s an equally important signal. That’s when the economy goes from a consolidating bear market back to a bull market. We saw this in 1994, 2003, 2010 to 2011, and in early 2021.

Currently, C&I loan growth is sending negative signals.

Right now, C&I loan growth is rolling over again for the first time since early 2020. In the last 3 months, C&I credit contracted a little less than 1%.

In the last 20 years, you’d only see loan shrinkage that bad or worse one out of every six years…about as frequently as you generally see a recession.

To put that into further context, in the middle of last year, loan growth reached 4% a quarter.

Companies are no longer able to get the credit to invest.

That’s why we don’t think the recent PMI data is a one-off. It’s part of a bigger story. Economic activity is slowing down.

Until credit availability improves, those PMI trends aren’t likely to rebound. Production levels will stay lower until corporates have more confidence, and banks make it easier to get access to credit again.

Inventories will continue to dwindle. Employment in sectors that rely on manufacturing may suffer. And that’s a good reason to remain cautious and tactical in this range-bound market.

Best regards,

Joel Litman & Rob Spivey

Chief Investment Strategist &

Director of Research

at Valens Research

To see our best macro insights, become an FA Alpha and get access to FA Alpha Pulse.