AI and data centers are fueling a semiconductor boom, but not all chipmakers are benefiting equally. Texas Instruments (TXN), which relies heavily on cyclical markets like automotive and industrial, is facing slowing demand. In today’s FA Alpha Daily, we explore why TXN’s growth challenges may limit its upside.

FA Alpha Daily

Powered by Valens Research

The semiconductor industry is growing fast. Companies supplying chips to data centers and AI applications are thriving, driven by surging demand for computing power.

However, not all semiconductor firms are benefiting from this shift. Some are heavily tied to industries that move with the economic cycle like automotive.

These markets have been slowing, weighed down by weaker demand, supply chain issues, and shifting investment priorities.

Unlike the AI boom, which is creating steady growth for certain chipmakers, these sectors experience ups and downs, making it harder for companies selling into them to maintain stable momentum.

This divide in the semiconductor market is becoming more apparent, with some companies surging ahead while others struggle to regain traction.

Texas Instruments (TXN) has been struggling…

Texas Instruments sells analog chips primarily to the automotive, industrial, and consumer electronics sectors.

These markets have been under pressure for some time, making the company more exposed to economic cycles than other semiconductor firms.

Texas Instruments’ latest earnings report showed a better-than-expected quarter, but weak guidance for the next period.

Despite its dominant position in analog semiconductors, the company’s exposure to cyclical industries is proving to be a challenge.

Automotive demand has been inconsistent, impacted by supply chain disruptions and shifting consumer spending.

The industrial sector, including automation, has seen slowing capital investments. Consumer electronics, a historically volatile market, continues to struggle as post-pandemic demand normalizes.

This dependence on cyclical markets is visible in Texas Instruments’ revenue breakdown. While analog revenue grew slightly by 1.7%, embedded processing revenue dropped sharply by 18%.

The company’s other revenue sources increased by 7.3%, but that was not enough to offset declines elsewhere.

Many of its customers are still working through excess inventory, reducing new orders. This inventory correction has affected several semiconductor companies, but Texas Instruments is feeling the impact more due to its industry exposure.

Shares fell 7% after the earnings announcement as investors reacted to the weak outlook.

While Texas Instruments is known for its strong profitability and reliable dividend, its growth prospects remain uncertain.

Furthermore, the company’s current valuation leaves little room for upside without a clear catalyst.

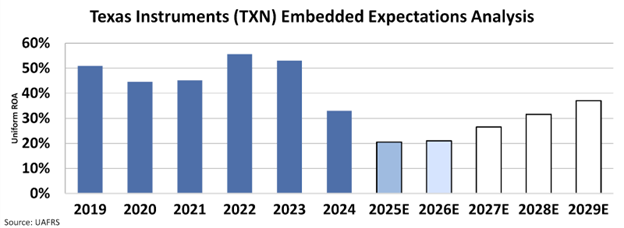

We can also see this through our Embedded Expectations Analysis (“EEA”) framework.

The EEA starts by looking at a company’s current stock price. From there, we can calculate what the market expects from the company’s future cash flows. We then compare that with our own cash-flow projections.

In short, it tells us how well a company has to perform in the future to be worth what the market is paying for it today.

At the current stock price, the market predicts that the company’s Uniform return on assets ”ROA” will increase to around 37% from 34% last year.

However, analyst expectations are much lower for the next two years with ROA falling around 20%.

The demand for Texas Instruments’ end market has been weak, and there is little indication of a near-term recovery.

While the company maintains strong profitability and returns cash to shareholders, its growth prospects remain limited compared to semiconductor firms benefiting from AI and data center demand.

The weak guidance supports the risks ahead, and with economic uncertainty persisting, investors should be cautious.

Without a clear catalyst for growth, the stock may continue to struggle, making it a less attractive option in a market where other semiconductor companies are better positioned for long-term gains.

Best regards,

Joel Litman & Rob Spivey

Chief Investment Officer &

Director of Research

at Valens Research

Today’s analysis highlights the same insights we share with our FA Alpha Members. If you want to an get in-depth analysis of market trends and uncover undervalued stocks, become an FA Alpha Member today.