If not managed properly, legal safeguards like intellectual properties and patents can spell doom for a company. However, when utilized correctly and managed effectively, they play a crucial role in constraining competition, enabling companies to achieve higher returns. In today’s FA Alpha Daily, we explore the impact of intellectual properties on two companies, shedding light on both their benefits and limitations.

FA Alpha Daily:

Friday Portfolio Analysis

Powered by Valens Research

The last five years have marked the emergence of two critical technological advancements, Artificial intelligence (“AI”) and cryptocurrencies. Notably, these two industries have stimulated explosive growth in demand for graphics processing units (“GPUs”).

Competition runs high in this market, but one firm has continued to outperform all its counterparts—NVIDIA (NVDA). While many factors may contribute to the company’s success, recent performance has been facilitated by its exclusive programming platform, CUDA.

CUDA enables programmers to create systems that communicate with GPUs directly. And these GPUs have roles in crypto and AI-related systems.

As it stands, CUDA is the best platform out there for building out AI software. Moreover, because CUDA is designed by NVIDIA, it can only be utilized on NVIDIA GPUs.

This provides NVIDIA a major competitive advantage, at least until better open-source software that is compatible with all GPUs is developed. CUDA is an example of exclusivity and the idea of intellectual property comes in.

For customers to use CUDA, they need NVIDIA GPUs. So, they are forced to purchase the products. Plain and simple.

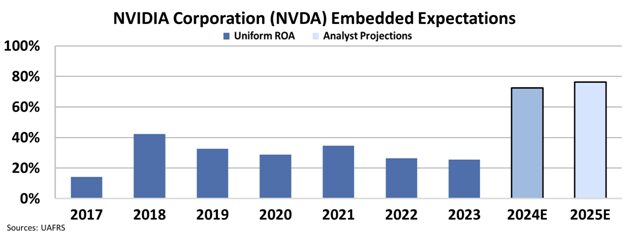

This is the reason NVIDIA has done so well this year and its returns are so high. Its chips are the only ones that are allowed to run its programming language.

But this doesn’t last forever.

Patents eventually run out, in which case IP becomes less valuable.

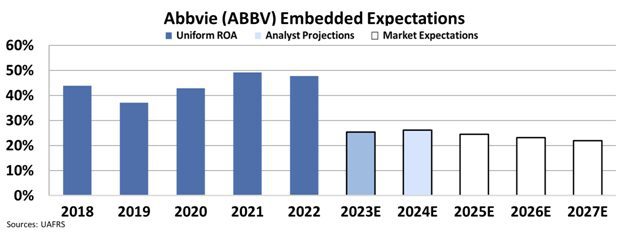

Look at AbbVie (ABBV) as an example. AbbVie’s flagship drug Humira helped the company earn nearly 50% returns for years.

Since 2002, Humira has been the company’s cash cow.

Other pharmaceutical competitors were unable to introduce generic copies of the medicine since it was covered by hundreds of patents. The capital requirements were intensive to create alternatives, so competitors just had to sit back and allow Humira to become the first drug ever to surpass $20 billion in annual revenue.

However, it can always be sunny. Even with exploitative tricks and loopholes used historically, AbbVie could not manage to extend the patents or exclusivity to the drug anymore.

The patent runs out this year, so generics can take away pricing power and market share.

That’s why Uniform ROA is expected to crater this year.

IP is a powerful competition if you catch it early. But it must be managed properly. Patents and copyrights can buy time and allow for growth, though it must be noted that it won’t last forever.

You can bet that NVIDIA is not just sitting around as CUDA dominates the market. Others will create alternatives in the future, and protection will be no more.

This can be a hard reality to face, and the market will make sure to punish you for it.

Just look at AbbVie. After 20 years of dominance, it’s back to square one.

So while IP can be a powerful competitive advantage, it doesn’t last forever. And investors are usually wise when a company is losing its IP advantage. When investing in companies that rely on IP, it’s important to get in early or to have some assurance that the market under-appreciates how long the advantage will last.

Best regards,

Joel Litman & Rob Spivey

Chief Investment Strategist &

Director of Research

at Valens Research

This portfolio analysis highlights the same insights we share with our FA Alpha Members. To find out more, visit our website.