Winter has come and all eyes are on Europe and how they deal with the energy crisis. Another issue is on the horizon as diesel and heating oil supplies in the US have begun to dry up. This gives an opportunity for refiner companies like Valero Energy (VLO) to capitalize during this energy crisis. In today’s FA Alpha, we’ll discover the company’s true potential through the lens of Uniform Accounting.

FA Alpha Daily:

Thursday Uniform Accounting Analysis

Powered by Valens Research

Everyone is very concerned right now about energy prices and what is happening in Europe.

The European countries led by Germany are looking for alternative energy sources after the natural gas line deals with Russia fell. Germany is signing long-term deals with the likes of Qatar, while many countries are shipping natural gas from the U.S.

Even though these countries are determined to follow sustainability goals, they are now considering finite and dirtier sources like coal and fossil fuels.

While people focus on these developments, we have another big issue in the U.S.

We have been seeing surges in the price of diesel, and like many other things, that is tied to supply and demand.

People are back on the roads post-pandemic, and we don’t have enough diesel supply for everybody.

Additionally, people are complaining about heating prices as winter is here. That is also because of the low supply of heating oil.

Our deficit of diesel refining capacity hurts consumers’ wallets and discourages private transport.

While it is a loss for consumers and transportation, there is one industry that is great for and that is refining.

We need these refiner companies to produce refined products such as gasoline and diesel. The demand is much more than the supply for these products right now, driving the prices and the profitability of these companies upward.

One of these big winners is Valero Energy Corporation (VLO). The petrochemical products it manufactures are used in areas like transportation and the company has the ability to produce 3.2 million barrels of refined petroleum.

The pandemic had a big impact on its sales. However, the company managed to recover from the pandemic lows and is on track to reach triple the earnings it had in 2020.

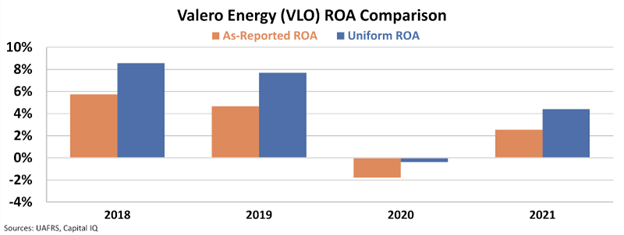

Looking at the as-reported accounting numbers, it seems like the company never makes money, even in good times for the refinery business. The as-reported return on assets (“ROA”) recovered to only above 2% in 2021 after the pandemic lows of -2% in 2020.

However, this picture of the company’s profitability is inaccurate. This is because of the distortions in as-reported accounting and can be fixed by making the over 130 adjustments needed under the Uniform accounting.

When we look at Uniform accounting numbers, we can clearly see the company’s ability to generate higher returns in good times.

After falling from around 8% in 2019 to below 0% in 2020, the Uniform ROA recovered to above 4% in 2021.

The profitability drivers don’t seem to be short-term effects either. Analysts expect this ROA surge to continue and surpass pre-pandemic levels this year and sustain this high profitability in 2023.

If the market is not recognizing the booming earnings Valero Energy is going to see due to the lack of new investments in refining capacity and sustained demand, there may be huge upside potential.

Uniform accounting shows the true profitability of the company and helps investors recognize this potential, which would go unseen with as-reported numbers.

SUMMARY and Valero Energy Corporation Tearsheet

As the Uniform Accounting tearsheet for Valero Energy Corporation (VLO:USA) highlights, the Uniform P/E trades at 12.2x, which is below the corporate average of 18.4x but above its historical P/E of -74.7x.

Low P/E require low EPS growth to sustain them. In the case of Valero Energy, the company has recently shown a 239% shrinkage in Uniform EPS.

Wall Street analysts provide stock and valuation recommendations that in general provide very poor guidance or insight. However, Wall Street analysts’ near-term earnings forecasts tend to have relevant information.

We take Wall Street forecasts for GAAP earnings and convert them to Uniform earnings forecasts. When we do this, Valero Energy’s Wall Street analyst-driven forecast is a 495% growth and 48% EPS shrinkage in 2022 and 2023, respectively.

Based on the current stock market valuations, we can use earnings growth valuation metrics to back into the required growth rate to justify Valero Energy’s $119 stock price. These are often referred to as market embedded expectations.

The company is currently being valued as if Uniform earnings were to grow by 6% annually over the next three years. What Wall Street analysts expect for Valero Energy’s earnings growth is above what the current stock market valuation requires in 2022 but below its requirement in 2023.

Furthermore, the company’s earning power in 2021 is 0.04x the long-run corporate average. Moreover, cash flows and cash on hand are 2.45x its total obligations—including debt maturities, capex maintenance, and dividends. Also, the company’s intrinsic credit risk is 70bps above the risk-free rate.

All in all, this signals low dividend risk.

Lastly, Valero Energy’s Uniform earnings growth is above its peer averages and in line with its average peer valuations.

Best regards,

Joel Litman & Rob Spivey

Chief Investment Strategist &

Director of Research

at Valens Research

The Uniform Accounting insights in today’s issue are the same ones that power some of our best stock picks and macro research, which can be found in our FA Alpha Daily newsletters.