Artificial intelligence is transforming how creative content is made, generating images, videos, and designs faster than ever. Many fear this could replace the need for professional creative software, but the real impact may be different. In today’s FA Alpha Daily, we explore how Adobe (ADBE) is using AI to strengthen its business and why the market may be misjudging its future potential.

FA Alpha Daily

Powered by Valens Research

Decades ago, paper was supposed to give way to the “paperless office” as experts warned that this new technology would destroy demand for it.

This sentiment reached fever pitch when Adobe (ADBE) introduced the portable document format (“PDF”) in 1993. However, instead of killing paper, businesses started printing more as soon as PDFs hit the market and achieved widespread adoption.

Meanwhile, email was made out to be another paper killer when it hit widespread adoption. However, just like PDFs, it supercharged paper consumption by an average of 40%. And today, roughly 12 trillion sheets are printed annually.

These stories illustrate the truth about disruptive technologies: They can supercharge old standards, not kill them.

Fast forward to today, investors have set their sights on another disruptive force: artificial intelligence (“AI”).

And just like back then, many are worried that this technology could wipe out jobs and upend industries altogether.

This time around, investors are worried that the proliferation of AI in the creative industry could eliminate the need for software like Adobe’s Photoshop or Illustrator as tools like ChatGPT, Gemini, and Midjourney can generate images, templates, and logos without the need for professional software.

On the surface, it might seem these AI tools could validate those fears. However, this ignores what’s more likely to happen.

Just like PDFs and emails led to more printing, AI is flooding the world with more content. Social media feeds and advertising are filled with AI-generated images, videos, and designs.

While AI tools are great at creating content at scale, creative professionals will still need software to refine outputs.

The software company has dominated the graphic design market for decades. Its flagship tools—all under the banner of Creative Cloud—like Acrobat, Photoshop, and Illustrator are all major names in the digital world and are used by over 22,000 enterprises.

Adobe has spent the past few years integrating AI into its business through Firefly, a generative AI platform tailor-made for creative professionals. This offering is designed to work with the company’s creative tools, making it attractive to both existing and new customers.

Unlike ChatGPT and other similar generative AI tools, Firefly is designed to generate content without violating copyright as it’s made specifically for publishing content commercially. This is especially appealing for companies that create ads, videos, and social media content.

According to Adobe, 90% of paid users generate content with Firefly each week. And since its launch last year, this offering and other AI-first products have taken off, reaching $125 million in annual recurring revenue (“ARR”) at the end of the first quarter. The company expects this number to grow to $250 million by the end of this year.

Adobe isn’t just using AI to create new offerings, it’s also leveraging it to improve its existing business segments such as Creative Cloud, Experience Cloud, and Document Cloud.

AI agents help Experience Cloud subscribers recognize consumer patterns, automate content creation and delivery, and predict consumer reaction to marketing campaigns. Meanwhile, AI assistants help Document Cloud users to summarize documents, identify key points, and even suggest edits when creating PDFs through Adobe Acrobat.

The company’s recent results show that its AI integration has paid off so far.

During the third quarter of fiscal year 2025, the company announced that ARR for AI applications has eclipsed $5 billion.

Revenue rose 11% year over year to $5.99 billion and remaining performance obligations (“RPO”) jumped to $20.44 billion, with both results beating consensus estimates. Management also raised guidance to range from $23.65 billion to $23.7 billion from the prior outlook of $23.5 billion to $23.6 billion.

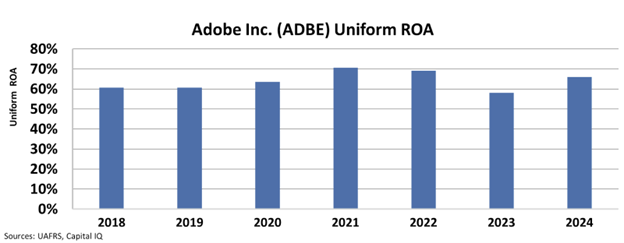

Adobe has maintained its return on assets (ROA) above 60% over the past few years. And rather than diminishing performance, AI has helped sustain it.

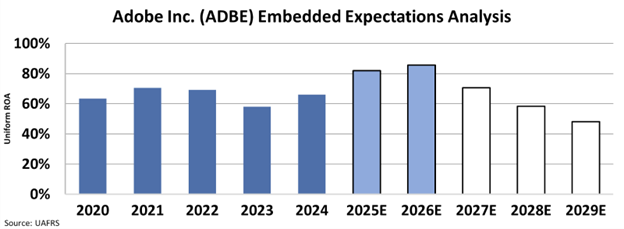

However, despite Adobe’s strong results and demonstrated ability to shield its business from AI disruption, the market still expects the company’s profitability to decline.

We can see what the market thinks through our Embedded Expectations Analysis (“EEA”) framework.

The EEA starts by looking at a company’s current stock price. From there, we can calculate what the market expects from the company’s future cash flows. We then compare that with our own cash-flow projections.

In short, it tells us how well a company has to perform in the future to be worth what the market is paying for it today.

Wall Street analysts expect Adobe’s returns to rise to 86% over the next two years, recognizing the company’s growth opportunity. However, the rest of the market anticipates profitability will drop to 49% by 2029—the lowest level in almost a decade.

Investors are too fixated on AI as a perceived threat rather than recognizing the opportunity it presents.

As AI continues to flood the world with content in the coming years, businesses and creative professionals will need tools to refine and manage this output—positioning Adobe to benefit immensely from this game-changing technology.

Best regards,

Joel Litman & Rob Spivey

Chief Investment Officer &

Director of Research

at Valens Research

Today’s analysis highlights the same insights we share with our FA Alpha Members. If you want to an get in-depth analysis of market trends and uncover undervalued stocks, become an FA Alpha Member today.