Narendra Modi’s historic third term as Indian prime minister underscores broad support for his economic strategies. As global manufacturing shifts from China to India, foreign investors face a landscape ripe with both opportunities and risks. In today’s FA Alpha Daily, we explore the driving forces behind India’s economic surge, and the potential risks and rewards influencing investment decisions.

FA Alpha Daily:

Monday Macro

Powered by Valens Research

While most Indian prime ministers serve a maximum of two terms, Narendra Modi became the second ever to reach a third term.

Indian citizens are clearly happy with how the last decade has gone. Modi has done a lot to help India’s economy become one of the fastest growing in the world, including welcoming a lot of new foreign investors over the last few years.

Since the pandemic, the world of outsourcing has shifted away from China.

A lot of Chinese factories were shut down for long periods during the pandemic, which led to severe supply chain shortages worldwide. Plus, relations between the U.S. and China have deteriorated.

The two countries have escalated a tariff war started under President Trump.

All of this led corporations to rethink where they’re manufacturing goods… leading many of them to start moving to India.

The value of India’s stock market has surged to roughly $5 trillion… putting it in line with the likes of Hong Kong’s.

International pension managers and wealth funds that like investing in emerging markets have started preferring India to China because India has a lot of the qualities China used to have.

Its economy grew 9% in 2021 and 7% in 2022… ahead of China’s alleged growth. And the country is set on keeping growth high through foreign direct investment.

India’s commerce ministry has a joint venture called Invest India that is trying to attract $100 billion in foreign investments in a single year.

And while foreign investment was only $28 billion last year… companies are still in the process of setting up shop in India. Reportedly, 200 American companies are in the process of moving their international manufacturing from China to India.

Over the past five years, India’s Nifty 50 index, which tracks its 50 largest public companies, has doubled.

While India’s economy has been doing well, foreign investors may be getting a bit ahead of themselves.

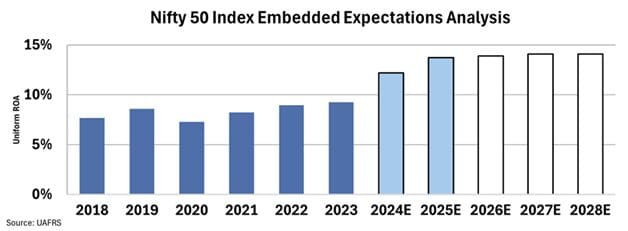

We can see this through our aggregate Embedded Expectations Analysis (“EEA”) framework.

Our aggregate EEA starts with the average stock price of all Nifty 50 companies. From there, we can calculate what the market expects from future cash flows. We then compare that with our own cash-flow projections.

In short, it tells us how well India’s largest companies must perform in the future to be worth what the market is paying for them today.

As you can see, profitability has been rising since 2018. Uniform ROA was only about 8%, and it rose to 9% last year. Wall Street analysts expect a big inflection in the next two years… they’re predicting Uniform ROA will rise to 14%.

And yet, investors have already priced in that entire rise in profitability.

Take a look…

For context, the U.S. economy returned 11% last year, and investors expect it to return about 12%.

With so much investment surging into the Indian economy, it’s entirely possible that its biggest companies could become more profitable. However, investors getting in today may be disappointed if they’re looking for massive gains.

Best regards,

Joel Litman & Rob Spivey

Chief Investment Strategist &

Director of Research

at Valens Research

To see our best macro insights, become an FA Alpha and get access to FA Alpha Pulse.