Howard Marks is a highly respected investment professional whose insights are valued by many, including Warren Buffett. Marks’ investment philosophy is focused on high-yield and distressed debt securities, which he believes offer attractive risk-adjusted returns. After his time at Citibank and at Trust Company of the West (TCW), Marks decided to start his own boat and lunch Oaktree Capital Management. In today’s FA Alpha Daily, we’ll look into Oaktree’s top holdings and evaluate their performance using Uniform Accounting.

FA Alpha Daily:

Friday Portfolio Analysis

Powered by Valens Research

Investing in high-yield and distressed debt securities carries inherent risks due to the nature of the underlying companies.

These types of companies often have financial instability and various management issues. Leading to a higher likelihood of default in exchange for a higher return.

Howard Marks and his fund Oaktree Capital Management is one of the leading firms in these strategies. Let’s remember how they became so successful in this challenging space and the strategies they employ from the original article we wrote back in June 2020.

High praise from one of the greatest, if not the greatest investors we’ve ever seen. There are few people that the Oracle of Omaha himself would listen to with bated breath, and Howard Marks, one of the founders of Oaktree Capital Management, can consider himself one of those people.

Marks has commanded this level of respect, not just from Buffett, for decades.

In 1995, after success at Citibank, and then at Trust Company of the West (TCW), Marks decided it was time to strike out on his own.

He and his group at TCW were frustrated, feeling as if they were subsidizing poor performers at TCW, and not being compensated for the massive returns they were bringing to the firm. When he finally decided to leave and start Oaktree, the respect he commanded allowed him to bring along some of the most distinguished members of the then-TCW team, including multiple managing directors.

This “brain drain” at TCW was just the beginning.

Almost immediately after Oaktree was formed, a number of major TCW clients moved over $1.5 billion from TCW to Oaktree. These clients were investing in the team, not the brand, and Marks and his team were who investors wanted to be with.

To mitigate their losses, TCW eventually came back to Marks with its tail between its legs, and worked out a deal with Marks and Oaktree. The latter would manage roughly $2.6 billion that had been managed by TCW’s former managing directors.

With assets under management, a quality team, and a reputation that preceded them, Oaktree immediately became a success. It has only built on that over the last twenty-five years.

Today, Oaktree runs over $100 billion.

Yet, while some equity investors know of Marks’ memos, and read them for their general outlook, most knew very little about his stock-picking ability.

That is because he isn’t a stock-picker.

Today, $7 billion of Oaktree’s assets under management (AUM) is in equities, which makes up around 4% of its total AUM.

It’s a tiny exposure in the fund’s portfolio but Oaktree’s niche is in credit. The firm is focused on high yields, convertible debt, and distressed securities.

Its strategy relies on finding cheap, generally senior, safer credit, in which they have a “knowledge advantage.”

That being said, we can still take a look at Oaktree’s equity portfolio, using its most recent 13-F, to provide a window into the firm’s overall philosophy.

To find companies that can deliver alpha beyond the market, just finding companies where as-reported metrics misrepresent a company’s real profitability is insufficient.

To really generate alpha, any investor also needs to identify where the market is significantly undervaluing the company’s potential.

These dislocations demonstrate that most of these firms are in a different financial position than GAAP may make their books appear. But there is another crucial step in the search for alpha. Investors need to also find companies that are performing better than their valuations imply.

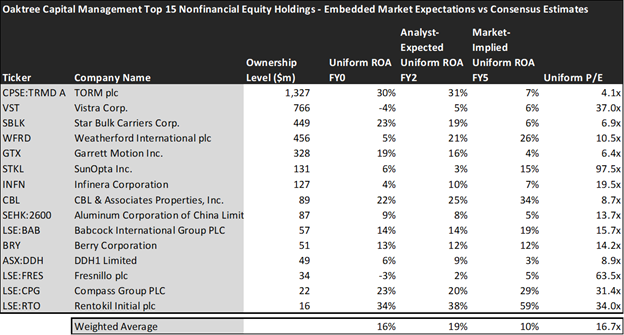

Valens has built a systematic process called Embedded Expectations Analysis to help investors get a sense of the future performance already baked into a company’s current stock price. Take a look:

This chart shows four interesting data points:

- The average Uniform ROA among Oaktree Capital Management’s top 15 holdings is actually 6% which is worse than the corporate average in the United States.

- The analyst-expected Uniform ROA represents what ROA is forecasted to do over the next two years. To get the ROA value, we take consensus Wall Street estimates and convert them to the Uniform Accounting framework.

- The market-implied Uniform ROA is what the market thinks Uniform ROA is going to be in the three years following the analyst expectations, which for most companies here are 2023, 2024, and 2025. Here, we show the sort of economic productivity a company needs to achieve to justify its current stock price.

- The Uniform P/E is our measure of how expensive a company is relative to its Uniform earnings. For reference, the average Uniform P/E across the investing universe is roughly 20x.

Embedded Expectations Analysis of Oaktree Capital Management paints a clear picture. Over the next few years, Wall Street analysts expect the companies in the fund to improve their profitability substantially. The market agrees with analysts but has slightly lower expectations.

Analysts forecast the portfolio holdings on average to see Uniform ROA increase to 19% over the next two years. At current valuations, the market’s expectations are lower than analysts and it expects a 10% Uniform ROA for the companies in the portfolio.

For instance, Infinera Corporation (INFN) returned 4% this year. Analysts think its returns will significantly increase to 10%. And at a 19.5x Uniform P/E, the market expects a slight improvement in profitability and is pricing Uniform ROA to be around 7%.

Similarly, TORM (CPSE:TRMD A) has stayed profitable this year with a 30% Uniform ROA. Analysts expect its returns will increase to 31%, but the market is more cautious about the name and pricing its returns to be around 7%.

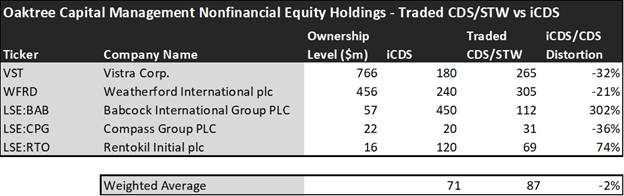

As Oaktree Capital Management’s niche is in credit, let’s take a look at its top holdings from the credit perspective.

While this may not be a full representation of their credit portfolio, it can serve as a showcase of the fund’s investment strategy for debt securities.

Using traded CDS or bond spreads (STW) as a proxy for balance sheet security, investors would think Oaktree is investing in unsafe debt securities, which would be surprising for a legend in debt investments.

The firm invests in high-risk securities but carefully analyzes using its “knowledge advantage” to make sure they are not unsafe investments.

For instance, high-quality companies like Vistra (VST) and Weatherford International (WFRD) have much lower credit risk underlying than the market is pricing in. Meaning that they may be risky high-yield companies but not unsafe ones.

Their intrinsic credit risk (iCDS) is lower than it appears looking at traded spreads. This is the “knowledge advantage” Oaktree talks about.

Overall, we can see that Oaktree Capital Management has risky but promising names in its portfolio from both the equity and the credit perspectives.

Being an expert in risk management, Oaktree has been able to handle that pressure historically. However, the market’s high expectations from these names might limit the upside potential for investors.

That is why investors should be highly careful before investing in these companies and these types of securities. A detailed valuation analysis is required for these high-risk and high-return investments, just like Oaktree does.

This just goes to show the importance of valuation in the investing process. Finding a company with strong profitability and growth is only half of the process. The other, just as important part, is attaching reasonable valuations to the companies and understanding which have upside which has not been fully priced into their current prices.

To see a list of companies that have great performance and stability also at attractive valuations, the Valens Conviction Long Idea List is the place to look. The conviction list is powered by the Valens database, which offers access to full Uniform Accounting metrics for thousands of companies.

Click here to get access.

Read on to see a detailed tearsheet of one of Oaktree Capital Management’s largest holdings.

SUMMARY and TORM plc Tearsheet

As one of Oaktree Capital Management’s largest individual stock holdings, we’re highlighting TORM plc (TRMD A:DNK) tearsheet today.

As the Uniform Accounting tearsheet for TORM plc highlights, its Uniform P/E trades at 4.1x, which is below the global corporate average of 18.4x, but above its historical average of -115.3x.

Low P/Es require low EPS growth to sustain them. In the case of TORM plc, the company has recently shown 100% Uniform EPS shrinkage.

Wall Street analysts provide stock and valuation recommendations that, in general, provide very poor guidance or insight. However, Wall Street analysts’ near-term earnings forecasts tend to have relevant information.

We take Wall Street forecasts for GAAP earnings and convert them to Uniform earnings forecasts. When we do this, TORM plc’s Wall Street analyst-driven forecast is for EPS to be immaterial in 2023 and to shrink by 12% in 2024.

Furthermore, the company’s return on assets was 30% in 2022, which is 5x the long-run corporate averages. Also, cash flows and cash on hand consistently exceed its total obligations—including debt maturities and CAPEX maintenance. Moreover, its intrinsic credit risk is 240bps above the risk-free rate. These signal low dividend risk and moderate credit risk.

Lastly, TORM plc’s Uniform earnings growth is above peer averages, and its P/E is above peer valuations.

Best regards,

Joel Litman & Rob Spivey

Chief Investment Strategist &

Director of Research

at Valens Research

This portfolio analysis highlights the same insights we share with our FA Alpha Members. To find out more, visit our website.