Rising interest rates have negatively impacted fixed-income securities held by insurance companies. On a positive note, these potential losses are realized only when securities are sold before maturity. Prudential Financial stands out for its strong balance sheet and its ability to hold debt to maturity, making these paper losses insignificant. In today’s FA Alpha Daily, let’s examine the company using Uniforming Accounting and determine the market’s embedded expectations for the firm.

FA Alpha Daily:

Thursday Uniform Accounting Analysis

Powered by Valens Research

The insurance space has undoubtedly faced significant challenges over the past couple of years.

Many insurance companies are heavily invested in fixed-income securities, a strategic move necessary to align the duration of their liabilities with that of their assets.

However, these sizable investments haven’t fared well recently, primarily due to the surge in interest rates.

It’s crucial to recognize that these losses are essentially actuarial in nature, which means they are not realized as actual cash flow losses.

The key here is that as long as insurance companies refrain from selling these fixed-income securities and hold onto them until maturity, these losses are merely on paper.

The real trouble arises when they decide to sell, or more commonly, have to sell… Then they realize losses, which has unfortunately led to the downfall of some regional banks earlier this year.

Banks like Silicon Valley Bank and First Republic (FRCB) collapsed because they had to sell their investments at a loss to fulfill withdrawal requests. As those losses mounted, more customers ran to take out their funds.

Insurance companies typically always hold debt to maturity. That means interest rate risk is not a real risk for them, especially if they have a solid balance sheet.

Interestingly, higher interest rates actually present an opportunity for these insurance companies.

They can reinvest their funds at these higher rates, resulting in more substantial returns on their long-term investments.

This is precisely why now is an opportune time to consider investing in stable insurance companies.

Prudential Financial (PRU) stands out as a reliable option in insurance.

Their financial health, as reflected in their solid balance sheet, makes them one of the less risky players in insurance.

The actuarial losses they’ve recorded should not cause alarm, as the intention is to hold onto these investments until maturity, where any paper losses would be nullified.

Furthermore, the prospect of investing at higher interest rates promises to enhance Prudential Financial’s return on equity (“ROE”).

However, the market’s sentiment has been somewhat negative.

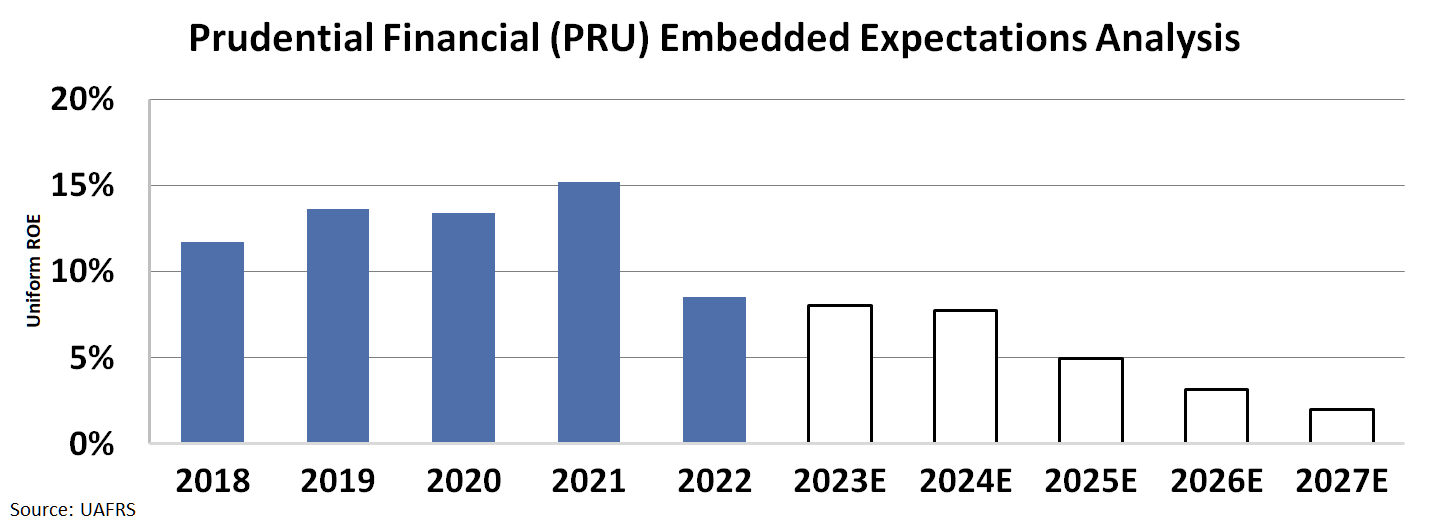

We can see this through our Embedded Expectations Analysis (“EEA”) framework.

The EEA starts by looking at a company’s current stock price. From there, we can calculate what the market expects from the company’s future cash flows. We then compare that with our own cash-flow projections.

In short, it tells us how well a company has to perform in the future to be worth what the market is paying for it today.

At the current stock price, the market expects the company’s ROE, which has historically been moving around 12%, to fall to 2% levels.

This pessimistic expectation is caused by the market perceiving increasing interest rates as detrimental to insurance companies due to the headlines highlighting these actuarial losses.

This presents an opportunity for those who can see beyond the surface. Prudential Financial appears to be undervalued, representing a potentially lucrative opportunity within the insurance sector.

The company’s robust fundamentals and the prospect of capitalizing on higher rates make it a compelling choice for investors looking to tap into the insurance space.

Best regards,

Joel Litman & Rob Spivey

Chief Investment Strategist &

Director of Research

at Valens Research

The Uniform Accounting insights in today’s issue are the same ones that power some of our best stock picks and macro research, which can be found in our FA Alpha Daily newsletters.