With rising prices due to inflation, U.S. corporations have been able to pass the rising costs to consumers. Today’s FA Alpha Daily will unfold the impressive profitability of corporate America.

FA Alpha Daily:

Monday Macro

Powered by Valens Research

As inflation has risen over the past year, everything seems to have gotten more expensive, including food, hotels, car rentals, and tires.

As prices increase, many have expected companies, particularly those in consumer products or restaurant brands, to see margin compression due to increased input costs.

Only what they’ve found instead is that these companies have had zero issues passing these costs along to customers. Some companies have seen margins increase because they still see plenty of customers even as they are forced to raise prices.

Whether it’s food titans like McDonald’s (MCD) increasing menu prices or niche companies like Atkore (ATKR) raising the price of its tubing, customers still want these goods and are willing to pay for them.

Krispy Kreme’s chief operating officer highlighted that they’ve been able to push through double-digit price increases for their donuts and coffee in the U.S. without customers pushing back at all. As inflation continues to rise, prices will only continue to go up.

One of our most powerful metrics to look at when analyzing a company is Uniform return on assets (ROA).

We can also do this for the economy as a whole to get an idea of how inflation is affecting the entirety of corporate America.

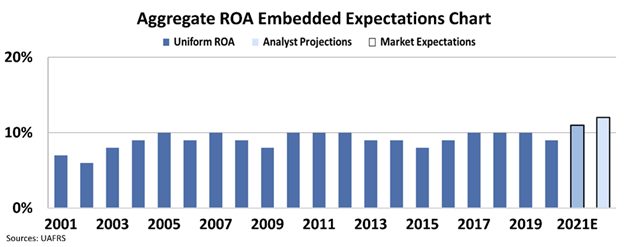

When we look at Uniform ROA for the entire U.S. public market, we see an impressively profitable corporate environment. Returns have mostly been rising in the past 20 years, as with each economic cycle, businesses have been able to get more efficient.

As Uniform ROA shows, U.S. corporate profitability has been staggeringly impressive in the face of inflation and the coronavirus pandemic. It’s expected to rise to historically high levels of 11% in 2021. Going into 2022, these levels are forecast to rise even higher to 12%.

This type of earnings growth, even in the face of inflation, gives us optimism for continued upside for the market because it points to the resiliency of U.S. corporations.

Despite everything costing more coming out of the pandemic, consumers are still willing to spend their money on the goods they want, which means stronger profitability for companies.

However, costs can only be pushed onto consumers for so long.

If companies keep easily passing on inflationary pressures to customers and even padding their margins as they currently are, they could potentially fuel an inflationary spiral. Higher prices could lead to wage hikes to offset inflation, leading to more price hikes and creating a vicious cycle.

But there is a data point we know to be on the lookout for. We can watch for if worker expectations for wage hikes in perpetuity start to show up, as that can indicate more price increases could be on the horizon.

Over the next few months, we will continue to monitor inflationary signals to ensure it will taper off as supply chains normalize. In the meantime, keep an eye on the Monday issue of the FA Alpha Daily for our forecast of strong 2022 shifts.

Best regards,

Joel Litman & Rob Spivey

Chief Investment Strategist &

Director of Research

at Valens Research

To see our best macro insights, get access to FA Alpha Pulse.