As the U.S. undergoes massive infrastructure expansion, companies like Arch Resources (ARCH) step into the spotlight. Positioned as a crucial supplier of metallurgical coal for steel production, ARCH is primed to seize the imminent demand surge. In today’s FA Alpha Daily, we’ll explore how ARCH is set to capitalize on this surge and fulfill the growing need for essential materials.

FA Alpha Daily:

Tuesday Company Specific

Powered by Valens Research

The U.S. is increasing infrastructure spending to address the aging and deteriorating condition of its roads, bridges, public transportation, and other critical infrastructure. Many of these structures were built decades ago and are now in need of repair or replacement to ensure safety and efficiency.

Increasing infrastructure spending in the U.S. will lead to a surge in construction and development projects, such as building bridges, highways, and public transportation systems.

These projects require significant amounts of steel for their structural components, support beams, and other construction elements.

As a result, as more infrastructure projects are initiated and underway, the demand for steel will rise to meet the needs of these projects.

Ultimately, the growth in infrastructure initiatives directly correlates with a heightened need for steel, driving up its demand in the market.

However, steel needs a combination of certain materials to be created. This is where companies like Arch Resources (ARCH) come in.

Arch Resources is a prominent U.S. company primarily involved in the production of coal. They specialize in mining metallurgical coal, which is used in the steel-making process, as well as thermal coal, which is used for electricity generation.

The company operates large, efficient mining complexes in various regions and is committed to safe and sustainable mining practices. Arch plays a critical role in supplying essential raw materials for the energy and steel industries.

The company stands to gain significantly from an increase in steel demand. Metallurgical coal is a crucial ingredient in steel production, as it is transformed into coke, which is then used to extract iron from ore and produce steel.

Therefore, when there is a surge in steel production to support infrastructure projects, the demand for metallurgical coal also rises. This increased demand can lead to higher prices and potentially more contracts for Arch Resources, boosting their sales and profitability.

In essence, as infrastructure initiatives drive up steel production, companies like Arch Resources experience a positive impact on their business, contributing to their overall success and growth.

And we’re already seeing this growth from the recent increase in infrastructure spending.

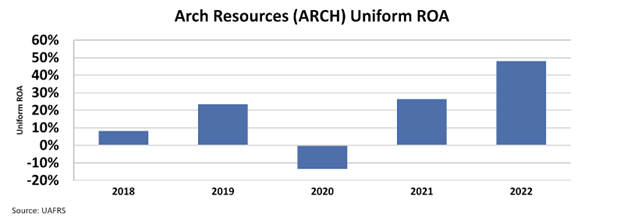

Arch’s return on assets (“ROA”) jumped from -13% in 2020 to 26% in 2021 and then to 48% in 2022.

The chart shows that the company has been performing incredibly well with the recent growth in infrastructure. Clearly, as this infrastructure spending continues, Arch should continue performing well.

And yet, the market fails to recognize this opportunity.

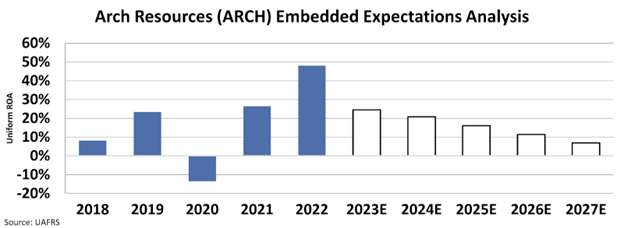

We can see this through our Embedded Expectations Analysis (“EEA”) framework.

The EEA starts by looking at a company’s current stock price. From there, we can calculate what the market expects from the company’s future cash flows. We then compare that with our own cash-flow projections.

In short, it tells us how well a company has to perform in the future to be worth what the market is paying for it today.

At the current stock price, the market expects the company’s ROA to fall below 10%, assuming the demand will collapse.

Given increasing infrastructure initiatives and the company’s essential position in its growth, these expectations seem overly pessimistic.

Arch has substantial potential to scale its operations and continue benefiting from the growth in infrastructure.

That is why Arch Resources showed up on our screen. The company makes a great FA Alpha 50 name due to its potential for high returns and low expectations from the market.

Throughout financial market history, many of the world’s most successful investors have been candid in their belief that Generally Accepted Accounting Principles (“GAAP”) distort economic reality.

Warren Buffett, for example, once said investors should “concentrate on the world of companies, not arcane accounting mathematics.”

Investors who neglect the very real issues with as-reported accounting can find themselves caught up in investing with the crowd, blindly following hot “themes” without a thorough grasp of how to understand the businesses in question.

The only true way to focus on the “world of companies,” as Buffett suggests investors do, is to present a clear picture of how a business operates, something that can only be done by adjusting financial statements to reflect the arbitrary nature of certain accounting rules that leave much to discretion.

The world’s best investors understand the need to make these adjustments, which allows them to focus not on picking out the most popular companies but rather on looking for great names in sleepy areas that the market isn’t paying much attention to. From there, the goal is to then identify quality companies with significant growth potential at reasonable prices.

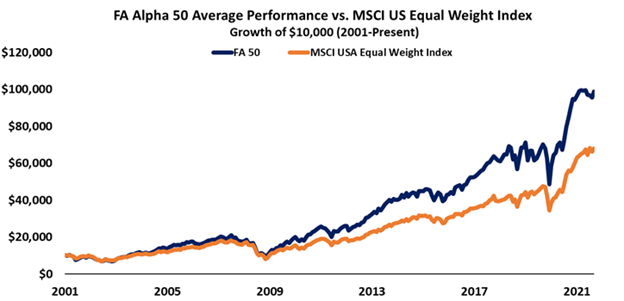

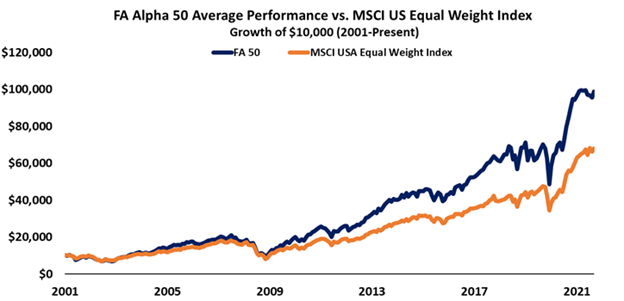

That’s exactly what we’ve set out to do with the FA Alpha, our monthly list of 50 companies that rank at the top for quality, high growth, and low valuations.

This list has outperformed the market by 300 basis points per year for over 20 years now, effectively doubling the performance of the market by focusing on the real fundamentals and valuations of companies with our proprietary Uniform Accounting framework.

See for yourself below.

To see the other 49 names on the list, click here.

Best regards,

Joel Litman & Rob Spivey

Chief Investment Strategist &

Director of Research

at Valens Research

Today’s highlight, Arch Resources, Inc. (ARCH) is one of the top stock picks from FA Alpha 50 this month. To see more stock picks like this, become an FA Alpha and get access to FA Alpha 50.