The current financial landscape is challenging, with limited financing and high-interest rates putting pressure on consumer spending. Demand for big purchases like housing may drop, but homebuilder demand remains strong, particularly for companies like D.R. Horton. In today’s FA Alpha, we’ll discuss how D.R. Horton maintained its high profitability and why the market is mispricing them.

FA Alpha Daily:

Tuesday Company Specific

Powered by Valens Research

The past decade will be remembered with easy access to capital for retail customers and companies alike.

It is difficult to fail in that environment.

Companies could easily finance their projects and have a big margin of safety because if the project fails and they cannot pay their debt, they can easily refinance with another low-interest one.

The U.S. consumption trended higher, investments into equities ramped up, and a lot of companies found a great opportunity to grow.

However, we are not in the same environment right now. To battle rising inflation, the Federal Reserve (“FED”) increased rates by another 25 basis points from 4.5% to 4.75% after their last meeting in February.

The idea behind rising interest rates is that it slows down the economy. It becomes costlier for companies and individuals to borrow, so they don’t do it as much as before.

This is bad news for a lot of people. Companies directly facing end customers see lower demand for their products as consumption falls.

Also, they don’t have the same opportunity to grow and invest in risky projects as they did during the past decade.

In particular, we would expect to see the demand for big purchases drop, like housing. People usually use credit when they want to buy a house, and it gets harder with increasing interest and mortgage rates.

However, the demand for homebuilders is still strong. No one wants to sell their existing homes with low mortgage payments and move to a new one in this high-cost environment.

On top of that, people still have to buy homes. They may be getting married, moving across the country, or trying to have a different life. With a big portion of the market unavailable, they go to homebuilders.

This is unlikely to change with the interest rates where they are, and that is great news for homebuilders like D.R. Horton (DHI).

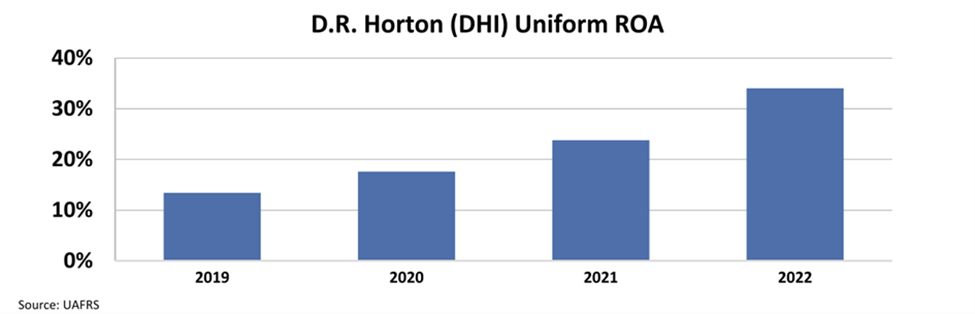

The company already has a very high and increasing profitability. Its return on assets (“ROA”) surged from 13% to a massive 35% in 2022.

However, the market doesn’t seem to get the business and the narrative.

The stock is being traded at only an 11.3x price-to-earnings (“P/E”) multiple, meaning that the market is not paying attention to it fully.

They make the same mistake we explained and expect rising interest rates to crash this company. As the availability in the housing market mostly comes from homebuilders, the market’s thesis doesn’t seem like it will hold.

D.R. Horton has high profitability and high growth, and the market doesn’t recognize the potential we see. That makes it a great FA Alpha 50 name.

Throughout financial market history, many of the world’s most successful investors have been candid in their belief that Generally Accepted Accounting Principles (“GAAP”) distort economic reality.

Warren Buffett, for example, once said investors should “concentrate on the world of companies, not arcane accounting mathematics.”

Investors who neglect the very real issues with as-reported accounting can find themselves caught up in investing with the crowd, blindly following hot “themes” without a thorough grasp of how to understand the businesses in question.

The only true way to focus on the “world of companies,” as Buffett suggests investors do, is to present a clear picture of how a business operates, something that can only be done by adjusting financial statements to reflect the arbitrary nature of certain accounting rules that leave much to discretion.

The world’s best investors understand the need to make these adjustments, which allows them to focus not on picking out the most popular companies but rather on looking for great names in sleepy areas that the market isn’t paying much attention to. From there, the goal is to then identify quality companies with significant growth potential at reasonable prices.

That’s exactly what we’ve set out to do with the FA Alpha, our monthly list of 50 companies that rank at the top for quality, high growth, and low valuations.

This list has outperformed the market by 300 basis points per year for over 20 years now, effectively doubling the performance of the market by focusing on the real fundamentals and valuations of companies with our proprietary Uniform Accounting framework.

See for yourself below.

To see the other 49 names on the list, click here.

Best regards,

Joel Litman & Rob Spivey

Chief Investment Strategist &

Director of Research

at Valens Research

Today’s highlight, D.R. Horton, Inc. (DHI) is one of the top stock picks from FA Alpha 50 this month. To see more stock picks like this, become an FA Alpha and get access to FA Alpha 50.