During recessions, businesses often cut their marketing budget, impacting the demand for advertising services. However, not all marketing companies should be painted with the same brush. Particularly, AppLovin, a key player in the mobile application advertising sector, primarily generates revenue by using its machine learning algorithm for personalized ads. In today’s FA Alpha Daily, we will discuss how AppLovin’s ad-matching algorithm is essential in the mobile app industry.

FA Alpha Daily:

Thursday Uniform accounting analysis

Powered by Valens Research

Economic fluctuations often dictate the flow of resources.

As the recession looms, businesses across various industries are forced to reassess their priorities. Marketing budgets tend to be one of the first areas that get hit.

While this belt-tightening approach is a necessary response to economic uncertainty, it is important not to paint all marketing companies with the same brush.

AppLovin (APP), an essential player in the mobile application advertising sector, stands as an exception.

Directing ads for television and helping mobile applications earn money are two completely different businesses. Television is just a channel to make your brand known while showing ads is the main revenue stream of mobile applications.

And this is what AppLovin does. It utilizes its machine learning algorithm to give users a personalized ad experience. This is a win for everybody. Users are happy they are not seeing unrelated ads, and advertisers and ad publishers are happy as click rates are rising. More clicks on ads means more revenue.

While advertisers may want to publish ads on huge social media platforms, when they want to use targeted ads, AppLovin is the place to go. Its machine learning model is mentioned as the best ad-matching algorithm out there.

Additionally, this is a very stable industry…

Mobile apps have become integral to modern life, supporting communication, entertainment, productivity, and more. This pervasive demand for mobile apps remains steadfast, making the industry less susceptible to economic downturns.

While the industry is strong, AppLovin’s services will be in high demand.

However, the market is having trouble differentiating AppLovin from other marketing businesses.

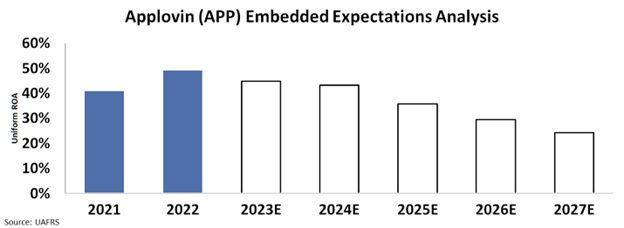

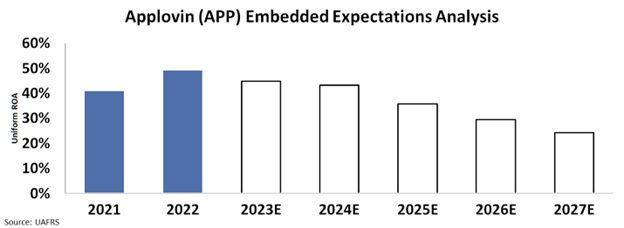

We can see what the market thinks through our Embedded Expectations Analysis (“EEA”) framework.

The EEA starts by looking at a company’s current stock price. From there, we can calculate what the market expects from the company’s future cash flows. We then compare that with our own cash-flow projections.

In short, it tells us how well a company has to perform in the future to be worth what the market is paying for it today.

At the current stock price, the market expects the company’s Uniform return on assets (“ROA”) to fall around 24%, the lowest since the IPO.

While the broader marketing industry may indeed face challenges during economic downturns, it would be unwise to apply a blanket assessment to all marketing companies.

The market thinks marketing will collapse, it may not be wrong about the broader industry, but it is for this name.

AppLovin has an essential space in the mobile app industry. So essential that the mobile app industry has to collapse entirely for it not to operate.

The market’s inability to differentiate AppLovin from the pack is raising an opportunity for investors.

SUMMARY and Applovin Corp. Tearsheet

As the Uniform Accounting tearsheet for Applovin Corp. (APP:USA) highlights, the Uniform P/E trades at 14.2x, which is below its global corporate average of 18.4x and its historical P/E of 15.7x.

Low P/Es require low EPS growth to sustain them. In the case of Applovin, the company has recently shown a 4% shrinkage in Uniform EPS.

Wall Street analysts provide stock and valuation recommendations that in general provide very poor guidance or insight. However, Wall Street analysts’ near-term earnings forecasts tend to have relevant information.

We take Wall Street forecasts for GAAP earnings and convert them to Uniform earnings forecasts. When we do this, Applovin’s Wall Street analyst-driven forecast is a 35% and 16% EPS growth in 2023 and 2024, respectively.

Based on the current stock market valuations, we can use earnings growth valuation metrics to back into the required growth rate to justify Applovin’s $39.13 stock price. These are often referred to as market embedded expectations.

The company is currently being valued as if Uniform earnings were to shrink 6% annually over the next three years. What Wall Street analysts expect for Applovin’s earnings growth is above what the current stock market valuation requires through 2024.

Furthermore, the company’s earning power is 8x its long-run corporate average. Moreover, cash flows and cash on hand are 2x its total obligations—including debt maturities, capex maintenance, and dividends.

All in all, this signals low credit risk with no dividends.

Lastly, Applovin’s Uniform earnings growth is above its peer averages but below its average peer valuations.

Best regards,

Joel Litman & Rob Spivey

Chief Investment Strategist &

Director of Research

at Valens Research

The Uniform Accounting insights in today’s issue are the same ones that power some of our best stock picks and macro research, which can be found in our FA Alpha Daily newsletters.