The credit market is facing challenges as rising interest rates and tightening credit conditions make it more difficult for businesses to access financing, especially in the junk bond market. The rising interest rates have made junk bonds less attractive to investors, putting pressure on companies that have issued them as they face higher borrowing costs. In today’s FA Alpha Daily, let’s discuss how junk bond-dependent companies will experience more problems amidst the current market conditions.

FA Alpha Daily:

The Monday Macro Report

Powered by Valens Research

In these conditions, it’s not just bond markets that are closed to borrowers. Banks are not rushing to hand out loans either.

John McClain, a portfolio manager at Brandywine Global Investors even went on to say that “the credit quality of the loan space is poorer than the bond space.”

Overall, the future of borrowing is not currently positioned well.

As we discussed earlier, less access to credit is putting companies at higher risk of defaults since they can’t refinance.

For example, companies that have previously defaulted, including Envision Healthcare and Serta Simmons, have defaulted again this year.

Banks are tightening lending rates at rapid rates and it’s beginning to show.

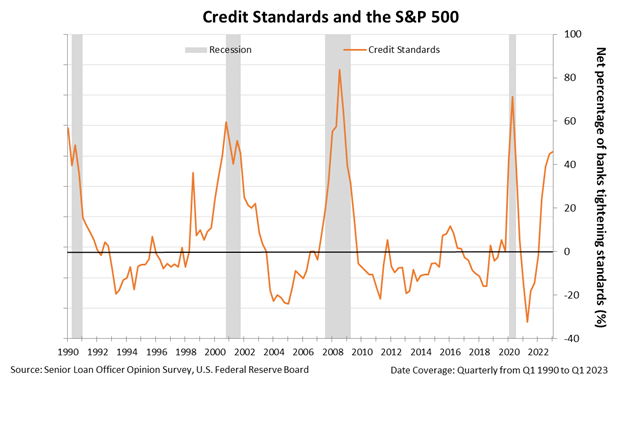

We can see this through the Senior Loan Officer Opinion Survey (“SLOOS”).

The SLOOS is a quarterly survey performed by the Federal Reserve. It asks loan officers if their lending rules have tightened, eased, or remained unchanged in the last three months.

In other words, it indicates how eager banks are to provide loans, and how simple or difficult it is for firms and individuals to access credit.

The chart below shows the percentage of domestic banks that tightened standards for consumer and industrial (“C&I”) loans to large- and middle-market firms. As you can see, rates are tightening faster than in other periods besides 2020.

Loan standards tightening shows that the banks understand the financial strain consumers and corporations are currently dealing with and they’re choosing to not hand out money to them as a result.

Understanding credit is the underlying strategy for maneuvering the equity market.

Companies are built on the backbone of loans and debt. If a company’s loans are worthless, its equity will be worthless too. Therefore, it’s essential to understand where these companies are positioned at all times.

That’s why we’re watching out for companies with a large exposure to debt that they can’t refinance. Some have variable rate debt that gets more expensive as interest rates rise.

And they can’t refinance since banks’ lending standards have tightened.

Therefore, if companies or consumers cannot come up with the money, they are going to default.

That’s why bankruptcies and defaults are on the rise, and it makes sense why banks want no involvement.

Banks are clearly being very strategic with capital deployment and investments. Given the current market conditions, this may be the smartest move.

We still think we’re looking at a more or less sideways market for the rest of the year. If credit starts looking worse, our forecast could become even more bearish.

Best regards,

Joel Litman & Rob Spivey

Chief Investment Strategist &

Director of Research

at Valens Research

To see our best macro insights, become an FA Alpha and get access to FA Alpha Pulse.