Warm winters and summers have prompted stockpiling of natural gas in anticipation of Russian supply shortage. Warm winters led to excess supply for U.S. shale producers, but a heat wave is increasing demand for air conditioning and refrigeration. Despite the market’s overly pessimistic view of the energy sector, a surge in natural gas demand for electricity generation has increased prices for companies like Earthstone (ESTE). In today’s FA Alpha Daily, let’s look at Earthstone and how the market’s pessimism about the company can be a great opportunity for investors.

FA Alpha Daily:

Tuesday Company Specific

Powered by Valens Research

The last two years have been volatile for energy companies.

A dramatic rise in oil and gas prices, falling debt levels, and the critical drop in Russian supplies to Europe drove oil and gas companies to record profits in 2022.

Russia’s invasion of Ukraine reshaped global energy markets and sent big oil skyrocketing to profits that doubled 2021’s figures.

However, these companies have had a shaky start to 2023.

Inflation, supply chain issues, and political pressures have resulted in investment capital declines for oil and gas.

Not only that, but the thing natural gas companies feared the most happened; We had one of the warmest winters this year.

That means there was less natural gas needed for heating, which drove prices lower.

Yet now, record heat waves in the U.S. are increasing energy demand and driving the price of oil upwards once again.

Higher temperatures lead to increased use of air conditioning and refrigeration. This raises electricity consumption and demand for oil, especially in regions where oil plays a significant role in electricity generation. Higher demand drives up oil prices.

Energy companies such as Earthstone Energy (ESTE) stand to benefit from this increasing demand.

The company operates as an independent oil and gas company in the U.S., acquiring and developing oil and gas reserves.

It has specifically targeted the biggest basins in the country, such as the Midland Basin and the Delaware Basin. This put the company in a very competitive position to prosper during the good times in the economy.

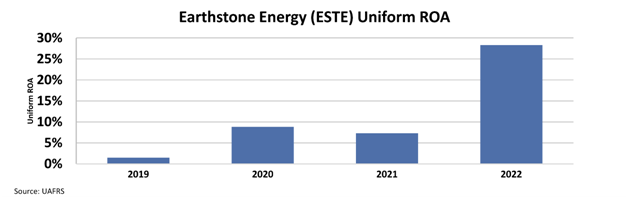

The company’s return on assets (“ROA”) was lower than 10% in the last three years and was affected by the drop in demand during the pandemic.

Earthstone used its competitive position to benefit massively from the boost in demand for natural gas, driving its ROA from 7% in 2021 to 28% in 2022.

This clearly shows what the company can achieve in good economic conditions.

Yet, the market sees the woes oil and gas have faced so far in 2023 and automatically lumps Earthstone in with them.

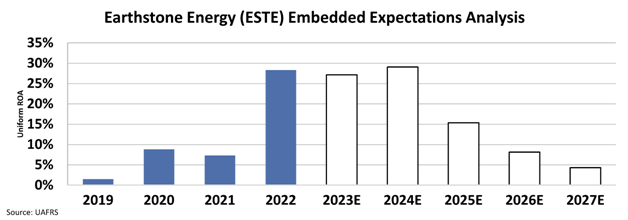

We can see this through our Embedded Expectations Analysis (“EEA”) framework.

The EEA starts by looking at a company’s current stock price. From there, we can calculate what the market expects from the company’s future cash flows. We then compare that with our own cash-flow projections.

In short, it tells us how well a company has to perform in the future to be worth what the market is paying for it today.

At today’s price, the market is expecting the company’s ROA to tank to 4%, a level not seen since 2019.

Take a look…

Expectations are that the oil and gas industry will continue to falter. But that is quite far from the truth.

With natural gas prices remaining strong, Earthstone has a big chance to relive one of its best years so far.

Earthstone’s cheap valuation, high returns, and high growth make Earthstone a great FA Alpha 50 name.

Throughout financial market history, many of the world’s most successful investors have been candid in their belief that Generally Accepted Accounting Principles (“GAAP”) distort economic reality.

Warren Buffett, for example, once said investors should “concentrate on the world of companies, not arcane accounting mathematics.”

Investors who neglect the very real issues with as-reported accounting can find themselves caught up in investing with the crowd, blindly following hot “themes” without a thorough grasp of how to understand the businesses in question.

The only true way to focus on the “world of companies,” as Buffett suggests investors do, is to present a clear picture of how a business operates, something that can only be done by adjusting financial statements to reflect the arbitrary nature of certain accounting rules that leave much to discretion.

The world’s best investors understand the need to make these adjustments, which allows them to focus not on picking out the most popular companies but rather on looking for great names in sleepy areas that the market isn’t paying much attention to. From there, the goal is to then identify quality companies with significant growth potential at reasonable prices.

That’s exactly what we’ve set out to do with the FA Alpha, our monthly list of 50 companies that rank at the top for quality, high growth, and low valuations.

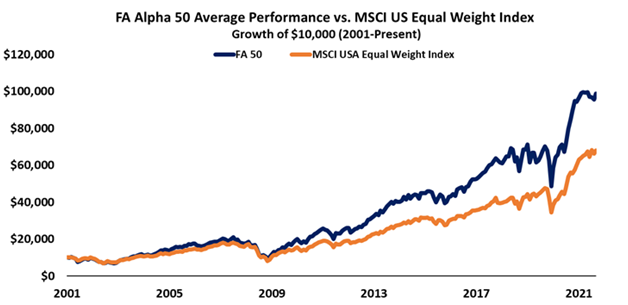

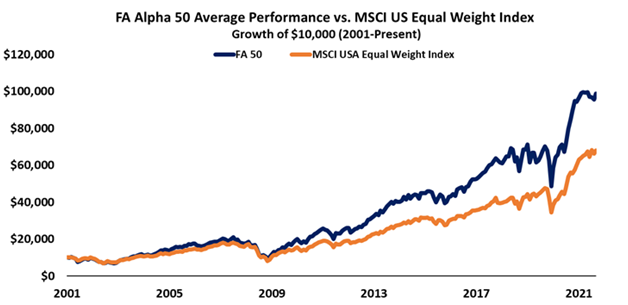

This list has outperformed the market by 300 basis points per year for over 20 years now, effectively doubling the performance of the market by focusing on the real fundamentals and valuations of companies with our proprietary Uniform Accounting framework.

See for yourself below.

To see the other 49 names on the list, click here.

Best regards,

Joel Litman & Rob Spivey

Chief Investment Strategist &

Director of Research

at Valens Research

Today’s highlight, Earthstone (ESTE) is one of the top stock picks from FA Alpha 50 this month. To see more stock picks like this, become an FA Alpha get access to FA Alpha 50.