At a time when demand for healthcare workers reaches unprecedented levels, AMN Healthcare Services, Inc. (AMN), the largest U.S. healthcare staffing company, seems to not be riding with the momentum based on as-reported metrics. Today’s FA Alpha Daily will scope the FA Alpha 50 name’s profitability and growth prospects even as the pandemic wanes.

FA Alpha Daily:

Tuesday Company Specific

Powered by Valens Research

At the start of the pandemic, healthcare capacity was squeezed, and hospitals reached their limits. This caused a surge in demand for health care professionals.

However, even as the pandemic wanes, that demand has not gone away. The pandemic revealed a startling lack of capacity in healthcare due to a shortage of trained healthcare professionals. Furthermore, high turnover rates in the healthcare industry mean hospitals and healthcare facilities are still just as desperate for more employees.

That’s great news for a company like AMN Healthcare Services (AMN).

AMN Healthcare is the largest US healthcare staffing company and provides temporary and permanent employee solutions in the healthcare industry.

Travel nurses, physician staffing, leadership solutions, and even telehealth services are all a part of the company’s portfolio. This means AMN Healthcare has a full spectrum of employees to meet the needs of healthcare facilities that are facing labor shortages.

Yet even at a time when demand for healthcare workers is heightened, AMN Healthcare doesn’t look to be anything extraordinary.

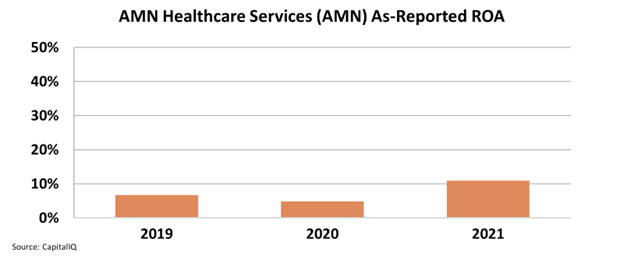

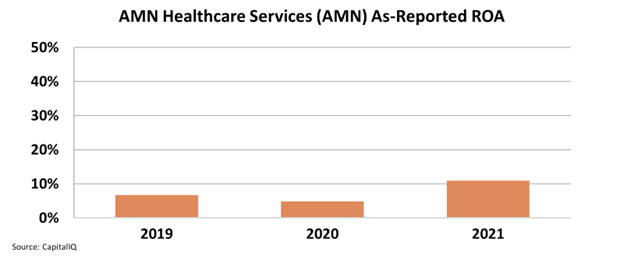

As-reported metrics make it appear the firm’s return on assets (“ROA”) has risen from near cost-of-capital levels to just 10% in 2021.

Over the past few years where labor shortages were compounded with the fallout of COVID having increased demand, AMN Healthcare’s ROA is still disappointing in how little it improved.

However, Uniform metrics show a little different picture.

In reality, AMN Healthcare has had a fairly high return on assets for a while now, bolstered by chronic labor shortages in the industry.

However, thanks to this surging demand amidst labor shortages, it’s gotten even higher, rising from 24% in 2019 to 43% in 2021.

This impressive performance shows us the strong tailwinds AMN Healthcare is seeing and taking advantage of. Uniform Accounting makes it clear that as-reported metrics greatly understate AMN Healthcare’s strong positioning in an essential field.

Yet even with this robust profitability, it is still growing.

In 2021, its asset growth was an explosive 52%, thanks to investments in digital experiences to create a stronger firm that can keep up with an increasing demand for integrated healthcare services.

But the market doesn’t seem to understand that the demand for AMN Healthcare will continue, even in a more normal environment, as it is priced at a bargain 12.4x Uniform P/E.

This low valuation, combined with strong growth and profitability, makes it a compelling company and an interesting FA Alpha 50 name.

Throughout financial market history, many of the world’s most successful investors have been candid in their belief that Generally Accepted Accounting Principles (“GAAP”) distort economic reality.

Warren Buffett, for example, once said investors should “concentrate on the world of companies, not arcane accounting mathematics.”

Investors who neglect the very real issues with as-reported accounting can find themselves caught up investing with the crowd, blindly following hot “themes” without a thorough grasp of how to understand the businesses in question.

The only true way to focus on the “world of companies,” as Buffett suggests investors do, is to present a clear picture of how a business operates, something that can only be done by adjusting financial statements to reflect the arbitrary nature of certain accounting rules that leave much to discretion.

The world’s best investors understand the need to make these adjustments, which allows them to focus not on picking out the most popular companies, but rather on looking for great names in sleepy areas that the market isn’t paying much attention to. From there, the goal is to then identify quality companies with significant growth potential at reasonable prices.

That’s exactly what we’ve set out to do with the FA Alpha, our monthly list of 50 companies that rank at the top for quality, high growth, and low valuations.

This list has outperformed the market by 300 basis points per year for over 20 years now, effectively doubling the performance of the market by focusing on the real fundamentals and valuations of companies with our proprietary Uniform Accounting framework.

See for yourself below.

To see the other 49 names on the list, click here

Best regards,

Joel Litman & Rob Spivey

Chief Investment Strategist &

Director of Research

at Valens Research

Today’s highlight, AMN Healthcare Services, Inc. (AMN) is one of the top stock picks from FA Alpha 50 this month. To see more stock picks like this, get access to FA Alpha 50.