The immense demand for online communication tool has made people more conscious in showing their faces even in meeting face-to-face, people started to care about their physical bodies as well. Presenting their facial features and bodies made people spend more on elective dermatology procedures. In today’s FA Alpha, we’ll look into invasive aesthetic medical products for various procedures offered by InMode’s (INMD) technologies.

FA Alpha Daily:

Tuesday Company Specific

Powered by Valens Research

The pandemic shaped the way we live and work in the past two years, and we started using tools and software products we had never heard of before.

The biggest one of them was definitely Zoom. As remote work took the place of offices, we had no other choice but to hold all our meetings online. Zoom answered all our needs.

Even though some companies found alternative solutions, Zoom stock surged from $70 at the beginning of 2020 to an incredible $560 in October 2020—all in just 10 months. This reflected the immense demand for an online communication tool.

One result of this increasing demand was that people started to show their faces more and in HD resolution. Each time they clicked the link to attend the morning call, they would see themselves, making them more conscious of their appearance.

As an outcome, people became impelled to spend more on elective dermatology procedures like face contouring and skin generation.

Now that people are starting to return to the real world and meet other people face-to-face, they have to care not only for their facial features but their bodies as well. However, everyone wants a less invasive way to do it.

That is where InMode’s (INMD) technologies come into play. The company develops and markets minimally invasive aesthetic medical products for various procedures, such as liposuction, body and face contouring, and skin rejuvenation treatments.

Thanks to the company’s ability to innovate better than its peers, it dominated its market last year.

Its Uniform return on assets (“ROA”) has dropped from 362% in 2019 to 227% in 2020 because of the pandemic. However, it recovered to 310% in 2021, showing the increasing demand for its products.

InMode has captured the growing market and has the opportunity to do it further. Its dominance in the market means this jump is sustainable.

However, the market does not recognize this. The price-to-earnings (“P/E”) and price-to-book value (“P/B”) ratios are currently much lower than where they were in 2021.

Both of these ratios nearly halved as the stock crashed 70% in the first six months of 2022. It has risen 75% since, showing the recovery the business had.

This indicates that the market is still overly pessimistic about the future of the business. This leads to unrealistic valuations and creates opportunities for investors.

In fact, the impressively high ROA, high demand, and low valuation mean that InMode is a great candidate to be an FA Alpha name.

Throughout financial market history, many of the world’s most successful investors have been candid in their belief that Generally Accepted Accounting Principles (“GAAP”) distort economic reality.

Warren Buffett, for example, once said investors should “concentrate on the world of companies, not arcane accounting mathematics.”

Investors who neglect the very real issues with as-reported accounting can find themselves caught up in investing with the crowd, blindly following hot “themes” without a thorough grasp of how to understand the businesses in question.

The only true way to focus on the “world of companies,” as Buffett suggests investors do, is to present a clear picture of how a business operates, something that can only be done by adjusting financial statements to reflect the arbitrary nature of certain accounting rules that leave much to discretion.

The world’s best investors understand the need to make these adjustments, which allows them to focus not on picking out the most popular companies but rather on looking for great names in sleepy areas that the market isn’t paying much attention to. From there, the goal is to then identify quality companies with significant growth potential at reasonable prices.

That’s exactly what we’ve set out to do with the FA Alpha, our monthly list of 50 companies that rank at the top for quality, high growth, and low valuations.

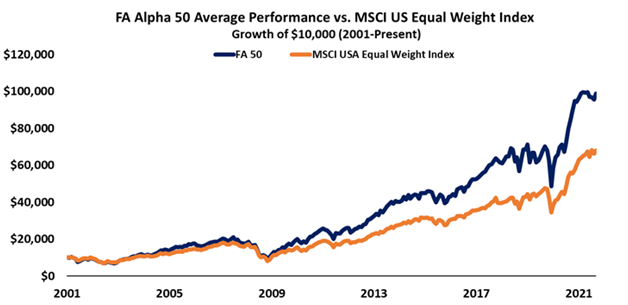

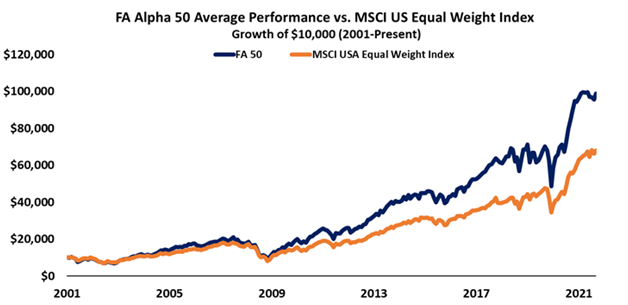

This list has outperformed the market by 300 basis points per year for over 20 years now, effectively doubling the performance of the market by focusing on the real fundamentals and valuations of companies with our proprietary Uniform Accounting framework.

See for yourself below.

To see the other 49 names on the list, click here.

Best regards,

Joel Litman & Rob Spivey

Chief Investment Strategist &

Director of Research

at Valens Research

Today’s highlight, InMode Ltd. (INMD) is one of the top stock picks from FA Alpha 50 this month. To see more stock picks like this, become an FA Alpha and get access to FA Alpha 50.