Economic slowdowns often lead to an increased unemployment rate. While this could pose challenges for staffing agencies, it might also present opportunities for HR professionals and employment firms, like Korn Ferry. With its wide network and good reputation, Korn Ferry stands resilient to economic downturns. In today’s FA Alpha Daily, let us examine Korn Ferry’s credit profile through Credit Cash Flow Prime™ and determine its capacity to meet its obligations.

FA Alpha Daily:

Wednesday Credit

Powered by Valens Research

The U.S. economy is facing the looming threat of a recession, which could have a significant impact on the job market.

In the most basic terms, recession means a slowdown in economic activity. Employers typically reduce hiring and may even lay off workers. This can lead to increased unemployment and competition for jobs.

Thus, employment firms are very likely to be affected by a recession. As employers reduce hiring, there will be less demand for the services of employment firms. This could lead to layoffs and closures of employment firms.

In fact, the effect of the looming recession has already started to be seen. A recent survey found that the number of temporary and contract workers in the U.S. fell by 4.6% in the second quarter of 2023, compared to the first quarter. This is unusual, as staffing employment and sales typically grow in the second quarter.

However, despite the challenges, there are also some opportunities for HR professionals and employment firms.

For example, HR professionals can play a critical role in helping organizations manage their workforce effectively during a recession. Employment firms can also position themselves to help companies hire the best talent during a recession, when many companies are struggling to find qualified workers.

That’s why it is crucial for these firms to have a large customer base and work with top companies that are less likely to lay off workers and are in search of qualified ones.

Korn Ferry (KFY) is one such company. It is one of the most respected global human resources consulting firms that provides a range of services to help clients with their talent needs.

When it comes to HR firms, it is important to have a wide network and a good reputation. Having said that, Korn Ferry was ranked as the US’ best executive recruiter by Forbes this year.

The company works with 79% of the world’s top performing companies. This partnership helps it to stay strong and overcome challenges.

By working with top companies, Korn Ferry is better equipped to weather economic downturns, as these companies tend to perform well even during recessions and are less likely to lay off workers.

And in fact, the company’s performance remained robust even amidst periods characterized by significant macroeconomic and geopolitical volatility and uncertainty, particularly within the job market.

During these challenging times, they achieved an impressive 8% growth in their fee revenues.

Yet, owing to their cautious outlook on the impending recession and its potential impact on the job market, rating agencies are hesitant in assigning favorable credit ratings to human resources and unemployment firms.

Therefore, S&P has assigned Korn Ferry a “BB” rating, indicative of a substantial default risk estimated at approximately 11% over the next five years. This classification also categorizes the company within the high-risk, high-yield bracket.

Nevertheless, we believe that the company deserves a safer credit rating, given its robust financial prospects for the next five years.

We can figure out if there is a real risk for this company by leveraging the Credit Cash Flow Prime (“CCFP”) to understand how the company’s obligations match against its cash and cash flows.

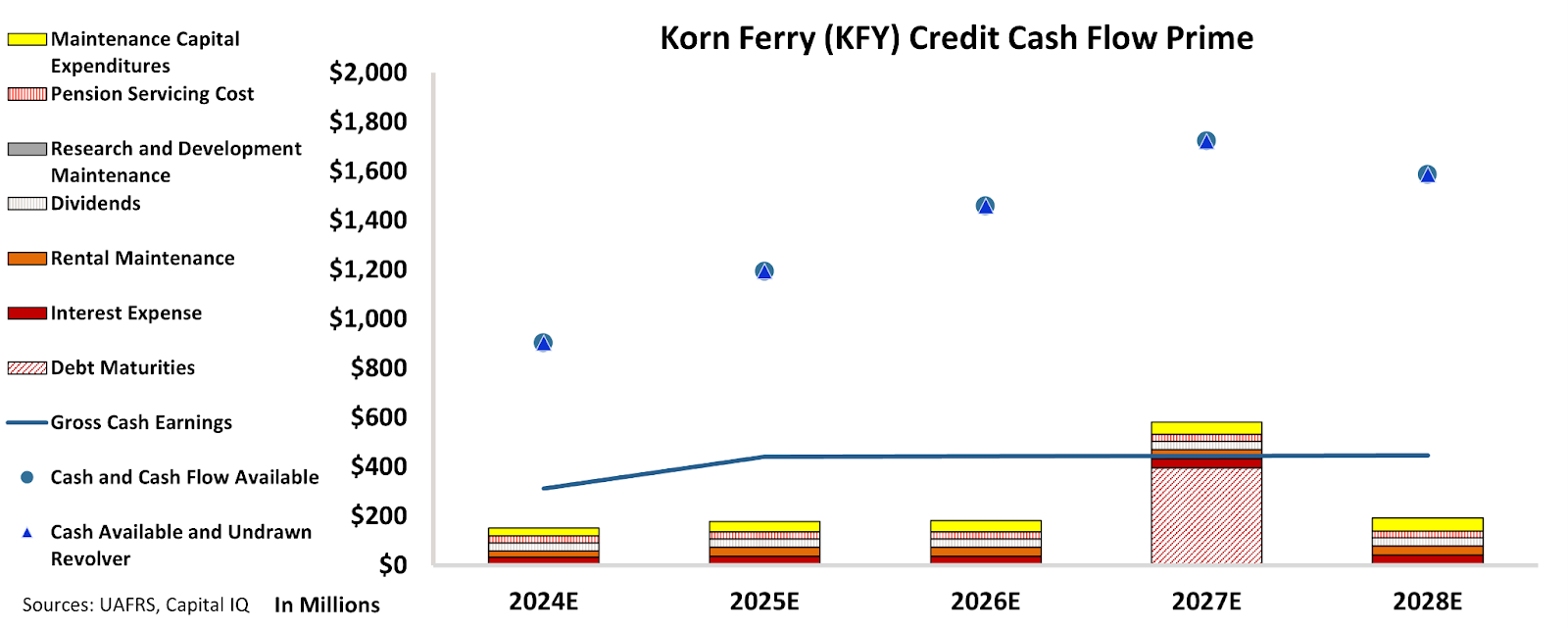

In the chart below, the stacked bars represent the firm’s obligations each year for the next five years. These obligations are then compared to the firm’s cash flow (blue line) as well as the cash on hand available at the beginning of each period (blue dots) and available cash and undrawn revolver (blue triangles).

The CCFP chart shows that Korn Ferry’s cash flows are more than enough to serve all its obligations going forward.

The chart implies that the company has a solid financial foundation and should be able to meet its obligations without difficulty in the next five years.

Also, the debt maturities coming in 2027 seems insignificant compared to its massive cash flows.

Hence, our belief is that Korn Ferry is not exposed to a substantial default risk, contrary to rating agencies’ evaluation.

Thus, we are giving an “IG4” rating to the company. This rating ensures it is in the safer investment-grade basket and implies a risk of default of around 2%.

It is our goal to bring forward the real creditworthiness of companies, built on the back of better Uniform Accounting.

To see Credit Cash Flow Prime ratings for thousands of companies, click here to learn more about the various subscription options now available for the full Valens Database.

SUMMARY and Korn Ferry (KFY:USA) Tearsheet

As the Uniform Accounting tearsheet for Korn Ferry (KFY:USA) highlights, the Uniform P/E trades at 13.4x, which is below the global corporate average of 18.4x and above its historical P/E of 12.1x.

Low P/Es require low EPS growth to sustain them. In the case of Korn Ferry, the company has recently shown a 12% Uniform EPS shrinkage.

Wall Street analysts provide stock and valuation recommendations, that in general, provide very poor guidance or insight. However, Wall Street analysts’ near-term earnings forecasts tend to have relevant information.

We take Wall Street forecasts for GAAP earnings and convert them to Uniform earnings forecasts. When we do this, Korn Ferry’s Wall Street analyst-driven forecast is for a 18% EPS shrinkage and a 12% EPS growth in 2024 and 2025, respectively.

Based on the current stock market valuations, we can use earnings growth valuation metrics to back into the required growth rate to justify Korn Ferry’s $47 stock price. These are often referred to as market-embedded expectations.

Furthermore, the company’s earning power in 2023 was 3x the long-run corporate average. Moreover, cash flows and cash on hand are 4x its total obligations—including debt maturities and capex maintenance. The company also has an intrinsic credit risk that is 110bps above the risk-free rate.

Overall, this signals a moderate credit risk and a low dividend risk.

Lastly, Korn Ferry’s Uniform earnings growth is below its peer averages and is trading below its average peer valuations.

Best regards,

Joel Litman & Rob Spivey

Chief Investment Strategist &

Director of Research

at Valens Research

This analysis of Korn Ferry (KFY)’s credit outlook is the same type of analysis that powers our macro research detailed in the member-exclusive FA Alpha Pulse.