Credit agencies give the infamous meme stock GameStop (GME) a credit rating of B, despite its numerous and lucrative equity issuances in the past year. Today’s FA Alpha Daily will examine its actual risk with the Credit Cash Flow Prime.

FA Alpha Daily:

Wednesday Credit

Powered by Valens Research

We’re starting to see some of the meme stocks that popped up in early 2021 come full circle and put their money where their mouth is, for better or for worse.

AMC Entertainment Holdings (AMC) is an example of the dark side of meme stocks. This movie-theater chain’s stock was up almost 2,500% at one point, and the firm took advantage by raising a lot of additional equity at these elevated prices.

With all that cash on hand, some investors thought AMC’s management would make investments to genuinely improve the business and justify higher prices, but almost the exact opposite has happened.

AMC signaled that it didn’t have any worthwhile investments to make in its legacy business and instead started investing in unrelated businesses like Hycroft (HYMC), a gold and silver miner.

Luckily, the same may not be true for the meme stock that started them all, GameStop (GME). GameStop stock rose more than 1,000% and was able to raise more than $1 billion in equity last year. Now it appears to have real reasons to deploy all that capital.

Ryan Cohen, founder of e-commerce platform Chewy (CHWY), was brought on as the chairman of GameStop to help the company transition to digital.

Hopefully, with Cohen at the helm, GameStop will spend its money on real transformation.

Yet, the credit rating agencies are still rating GameStop as a real credit risk. S&P grades GameStop a B, implying a 25% chance of default.

However, we can figure out if there is a real risk for this cash-rich company by examining it through the lens of the Credit Cash Flow Prime.

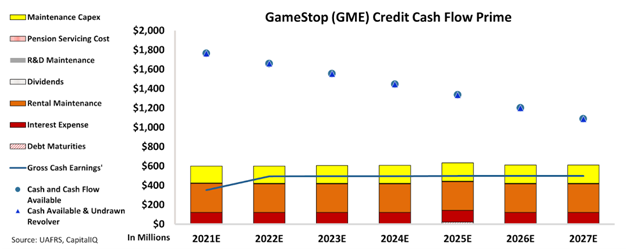

In the chart below, the stacked bars represent the firm’s obligations each year for the next seven years. These obligations are then compared to the firm’s cash flow (blue line) as well as the cash on hand available at the beginning of each period (blue dots) and available cash and undrawn revolver (blue triangles).

After raising capital, GameStop has a solid war chest of cash it can use to service obligations and invest in profitable ventures for years to come.

This is why we rate GameStop as a much safer IG4+ investment-grade credit.

It is our goal to bring forward the real creditworthiness of companies, built on the back of better Uniform Accounting.

To see Credit Cash Flow Prime ratings for thousands of companies, click here to learn more about the various subscription options now available for the full Valens Database.

SUMMARY and GameStop Corp. Tearsheet

As the Uniform Accounting tearsheet for GameStop Corp. (GME:USA) highlights, the Uniform P/E trades at 181.9x, which is above the global corporate average of 24.0x and its historical P/E of 147.1x.

High P/Es require high EPS growth to sustain them. That said, in the case of GameStop, the company has recently shown a 274% Uniform EPS decline.

Wall Street analysts provide stock and valuation recommendations that in general provide very poor guidance or insight. However, Wall Street analysts’ near-term earnings forecasts tend to have relevant information.

We take Wall Street forecasts for GAAP earnings and convert them to Uniform earnings forecasts. When we do this, GameStop’s Wall Street analyst-driven forecast is for a 57% and 192% decline in 2022 and 2023, respectively.

Meanwhile, the company’s earning power in 2021 is below the long-run corporate average. However, cash flows and cash on hand are more than twice its total obligations—including debt maturities and capex maintenance. All in all, this signals a low credit risk.

Lastly, GameStop’s Uniform earnings growth is well below its peer averages, but the company is trading above its average peer valuations.

Best regards,

Joel Litman & Rob Spivey

Chief Investment Strategist &

Director of Research

at Valens Research

This analysis of GameStop (GME) credit outlook is the same type of analysis that powers our macro research detailed in the FA Alpha Pulse.