Banks’ commitment to net-zero emissions has created a pessimistic view for energy companies in the market. This commitment is relatively slow which is why companies like Hess Corporation (HES) are still securing funding from banks. In today’s FA Alpha, we’ll discuss how Hess Corporation is still growing even though the market’s outlook for this industry is overly negative which in turn presents an upside opportunity for investors.

FA Alpha Daily:

Thursday Uniform Accounting Analysis

Powered by Valens Research

We have seen many industries commit to net-zero emissions goals in the last couple of years.

Many industrial companies are transforming their facilities to be more Environmental, Social, and Governance (ESG) friendly and trying to find ways of making their supply chains greener as well.

It is not only manufacturers that have these goals. One big example of this is banks.

Many banks signed up for the Net-Zero Banking Alliance (“NZBA”) and committed to achieving net-zero emissions by 2050.

This may sound interesting to some people. However, banks do not operate production facilities or transport huge amounts of goods like many industrial names.

One could expect them to be close to net-zero emissions already.

However, that is not the case. Even If they do not own the facilities, they are the ones providing funding to all those companies through lending and direct investment.

Now, they stated that they want to align these funding channels, so they encourage the usage of low-carbon energy and discourage planet-warming fossil fuels.

Everyone thinks this is the end of an industry. As those energy companies are starved for credit, they cannot invest and grow.

That would be the case if banks actually stop working with them completely, but that is not what we are seeing.

Banks continue to make credit available for those who want it and are investing in growth, even as many are focused on returning capital to shareholders.

Banks are nowhere near their 2050 goals. That means those that want to invest to grow still can.

Let’s look at Hess Corporation (HES). The company explores, produces, and transports crude oil, natural gas liquids, and natural gas. So, it is one of the names the market expects to be left without funding.

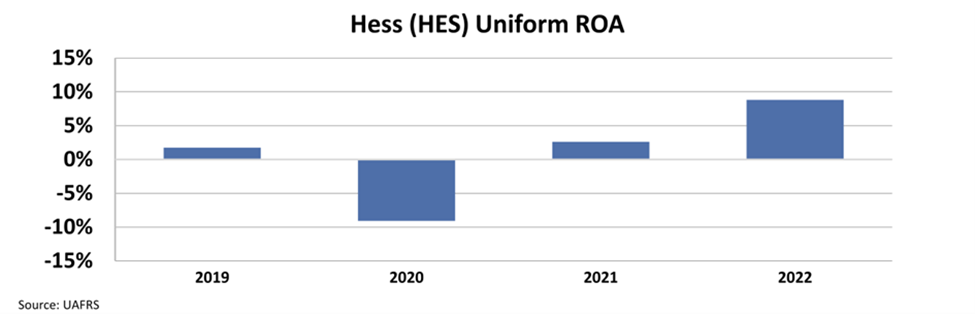

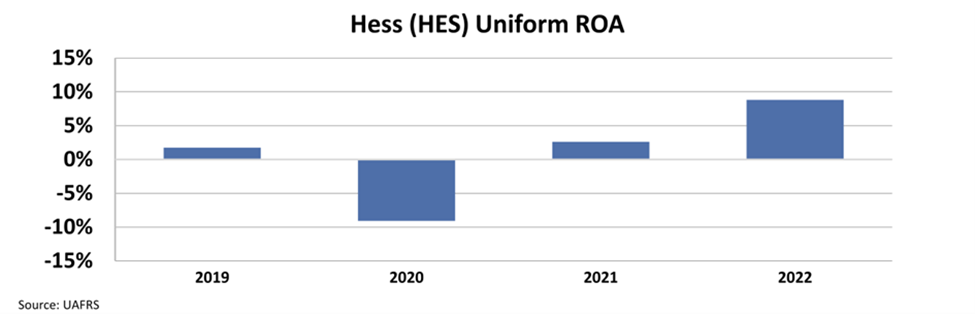

Hess had a quick recovery after the pandemic, as the Uniform return on assets (“ROA”) jumped from -9% in 2020 to just below 3% in 2021, even higher than in 2019.

With favorable market conditions and continued growth, the company reached an ROA of 9% in 2022.

However, the market’s misjudgment about banks’ net-zero emissions transition clouds their view about Hess.

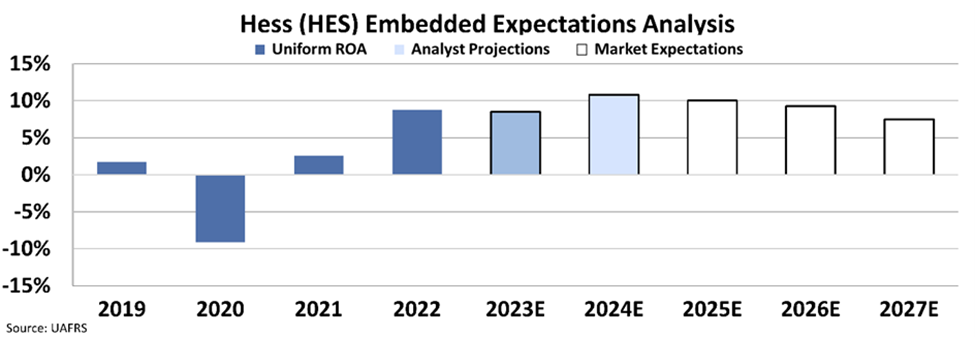

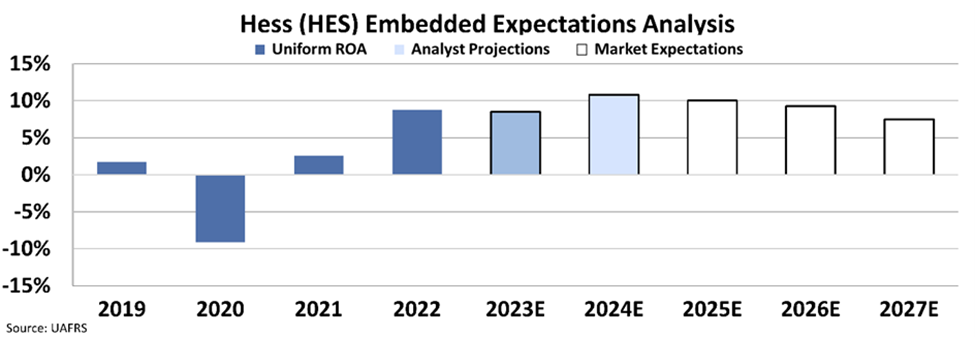

We can see this through our Embedded Expectations Analysis (“EEA”) framework.

The EEA starts by looking at a company’s current stock price. From there, we can calculate what the market expects from the company’s future cash flows. We then compare that with our own cash-flow projections.

In short, it tells us how well a company has to perform in the future to be worth what the market is paying for it today.

At around $118 per share, the market expects the company’s ROA to fall to below 8% with subdued growth.

What the market gets wrong is that Hess still has access to financial support from banks, and it will continue to invest and grow.

The market is too pessimistic because of the Net-Zero Banking Alliance, and overreacts to news about banks reducing their lending.

This causes the mispricing of Hess stock. If the company continues to grow and unlock higher profitability, there can be an upside opportunity.

SUMMARY and Hess Corporation Tearsheet

As the Uniform Accounting tearsheet for Hess Corporation (HES:USA) highlights, the Uniform P/E trades at 20.8x, which is above the corporate average of 18.4x but below its historical P/E of 25.7x.

High P/Es require high EPS growth to sustain them. In the case of Hess Corporation, the company has recently shown a 978% shrinkage in Uniform EPS.

Wall Street analysts provide stock and valuation recommendations that in general provide very poor guidance or insight. However, Wall Street analysts’ near-term earnings forecasts tend to have relevant information.

We take Wall Street forecasts for GAAP earnings and convert them to Uniform earnings forecasts. When we do this, Hess Corporation’s Wall Street analyst-driven forecast is a 1% and 55% EPS growth in 2023 and 2024, respectively.

Based on the current stock market valuations, we can use earnings growth valuation metrics to back into the required growth rate to justify Hess Corporation’s $130 stock price. These are often referred to as market embedded expectations.

The company is currently being valued as if Uniform earnings were to grow by 1% annually over the next three years. What Wall Street analysts expect for Hess Corporation’s earnings growth is above what the current stock market valuation requires through 2024.

Furthermore, the company’s earning power is 1x its long-run corporate average. Moreover, cash flows and cash on hand are 2x its total obligations—including debt maturities, capex maintenance, and dividends. Also, the company’s intrinsic credit risk is 70bps above the risk-free rate.

All in all, this signals low dividend risk.

Lastly, Hess Corporation’s Uniform earnings growth is above its peer averages and in line with its average peer valuations.

Best regards,

Joel Litman & Rob Spivey

Chief Investment Strategist &

Director of Research

at Valens Research

The Uniform Accounting insights in today’s issue are the same ones that power some of our best stock picks and macro research, which can be found in our FA Alpha Daily newsletters.